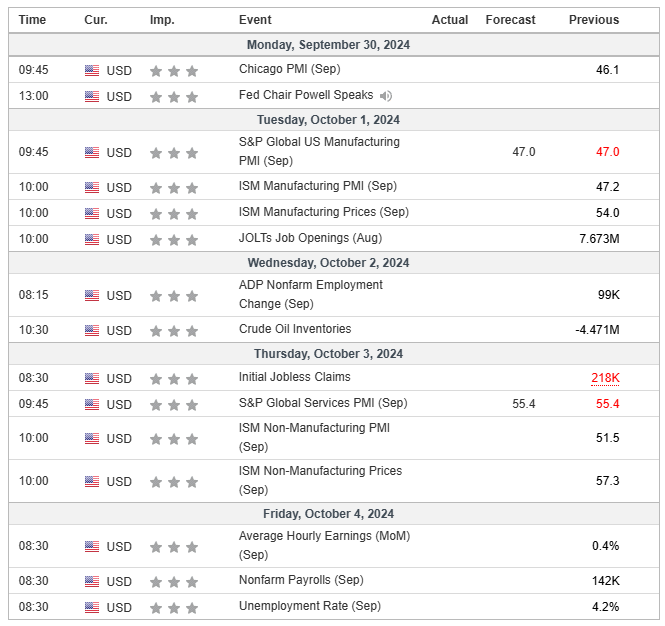

Hello Traders, welcome to this week's edition of JR28 Market Insights! With a new quarter beginning and a busy economic calendar ahead, expect volatility to pick up as investors digest the latest data and we head into election day. As we move into the first week of October, markets will focus on key economic reports, including the ISM Manufacturing Index and Non-Farm Payrolls.

Major Indices Performance MTD (September 2024):

S&P 500: +1.59%

NASDAQ: +2.22%

IWM: +0.11%

Sector Performance 1-month:

Top Performers: Consumer Discretionary (+7.94%), Utilities (+6.41%)

Laggards: Healthcare (-1.27%), Energy (-3.67%)

Key Themes for the Upcoming Week:

Economic Events:

The ISM Manufacturing PMI on Tuesday will give insights into the industrial sector's health, while the all-important Non-Farm Payrolls report on Friday will be a key indicator of the labor market’s strength.

Earnings Calendar:

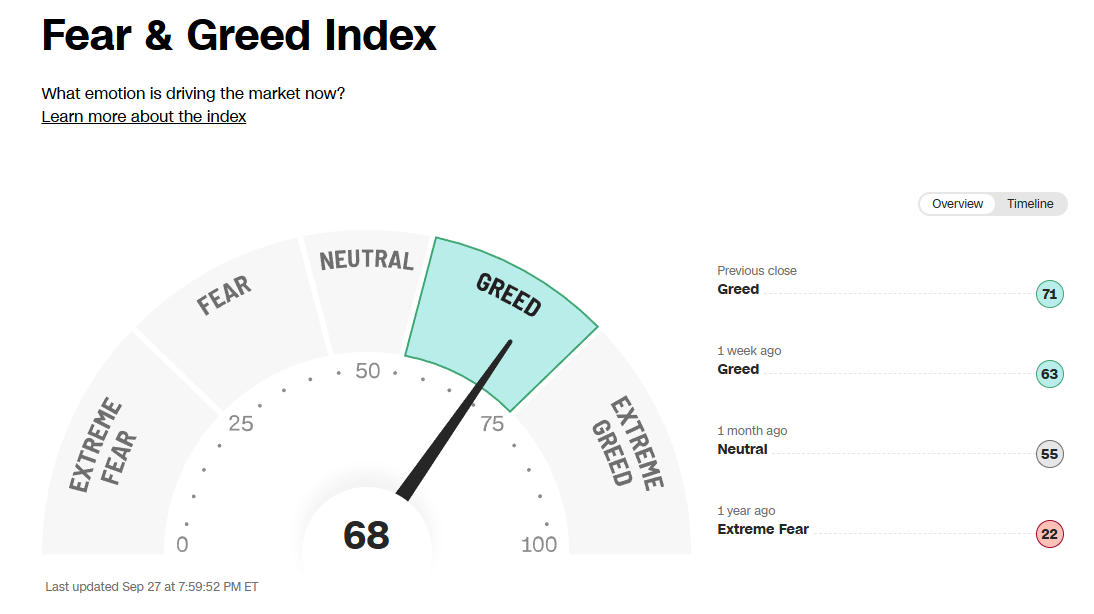

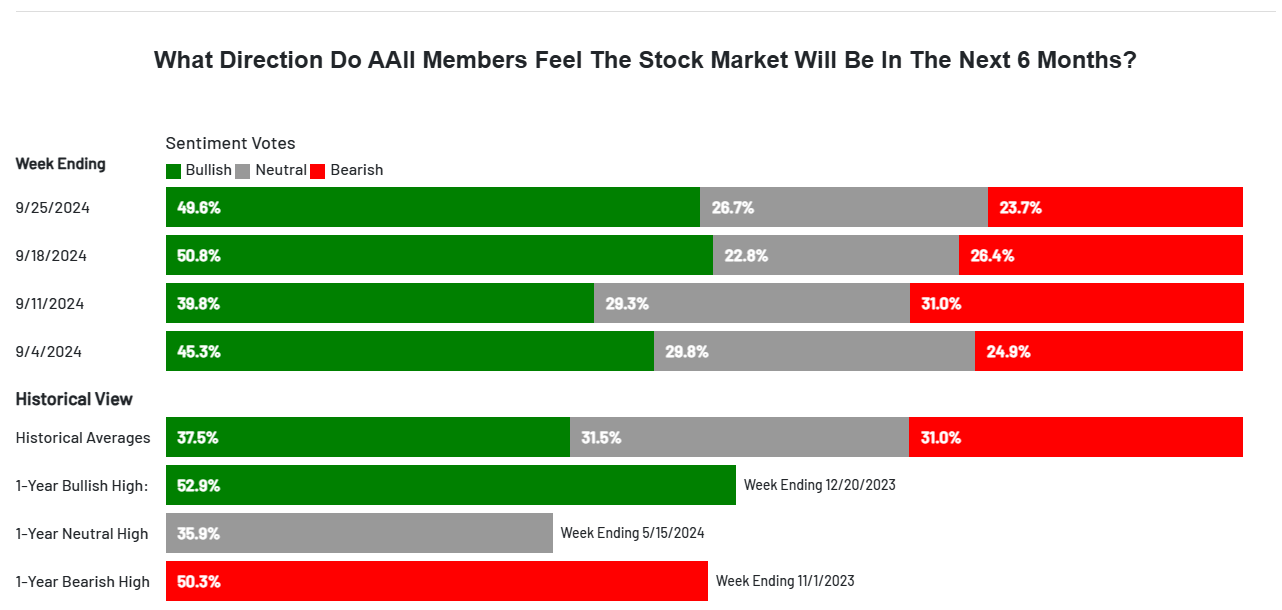

Market Sentiment:

I've mentioned this many times before, but the "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, which should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn. “The trend is your friend.”

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

TPT 50k account: Cost with code JR28 : $85 (refunded after you pass and take your first withdrawal) + $130 activation = total cost $130.

TPT 150K account: Cost with code JR28 : $180 (refunded after you pass and take your first withdrawal) + $130 activation = total cost $130.

jr28trader.com

Technical Analysis

SPX Analysis:

Key Levels: 5735 & 5638

Bullish Trajectory: Bulls are in control above 5638. A pullback to the 5584-5638 zone would be a good long entry if it holds. We might also see slow upward movement, but this tight range at the wedge’s apex isn’t ideal for new positions. If we drop below 5530 (50-day SMA), avoid buying the dip as it could signal a top with potential downside to 5179.

Bear Trajectory: There’s no major bear scenario right now, but a short trade could develop if 5735 breaks, targeting 5706 and 5638. A true bearish setup would come with a break below 5530, potentially sending us down to 5179.

Summary:

A retest of the 5584-5638 zone is likely. If this support breaks, expect a short opportunity with 300+ points of downside. If it holds, it flips to a long setup with 200-300+ points of upside. Watch how price reacts in this zone to gauge the next big move on SPX.

IWM 0.00%↑

SPY shows strength, but IWM hasn’t reached its July high, though it closed above 216.83, a key level to watch. Longs are favorable above 216.83 but not below. If bears reclaim this level, we could drop to 199.30. Bulls need to break 223-226 resistance to target 232.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.