Hello Traders, welcome to this week's edition of JR28 Market Insights!

As we head into the final stretch of October, volatility continues to drive the market with global economic uncertainties and corporate earnings reports leading the way. Investors are carefully balancing concerns about inflation, central bank policies, and geopolitical tensions. The key question remains: can the market sustain its upward momentum, or will we see a pullback as earnings season heats up?

Key Themes for the Week

1. Corporate Earnings in Focus

This week is packed with earnings reports from several big names across various sectors. Look out for results from Enphase Energy (ENPH), 3M (MMM), Tesla (TSLA), Coca-Cola (KO), AT&T (T), and UPS (UPS), among others. The performance and forward guidance from these companies will provide crucial insights into how different sectors are handling inflationary pressures and potential macroeconomic slowdowns.

2. Federal Reserve Watch

Keep an eye on the bond market, as the 10-year Treasury yield has been moving higher and could pressure equities, particularly in the tech sector.

3. Geopolitical Risks

Ongoing geopolitical risks, especially in the Middle East and Europe, are likely to keep investors cautious. Oil prices may be particularly volatile this week as supply chain disruptions and potential production changes could impact the energy sector. Any developments in this area could influence overall market sentiment and sector performance.

4. Sector Spotlight: Energy

Given the instability in global oil markets, energy stocks may see significant movement this week. Companies with strong balance sheets and diverse operations, like Chevron and ExxonMobil, may fare better if oil prices stay elevated. Watch for potential buying opportunities if prices pull back on any temporary resolutions in geopolitical tensions.

JR28 Strategy Insights

For traders with smaller capital bases, this is the time to be selective and avoid overexposure. Look for opportunities in sectors that may outperform in volatile conditions, such as consumer staples and utilities. We continue to recommend keeping an eye on companies with strong fundamentals that can weather interest rate hikes and macroeconomic headwinds.

This Week's Key Earnings Reports:

Tuesday, October 22: Enphase Energy (ENPH), 3M (MMM)

Wednesday, October 23: Tesla (TSLA), Coca-Cola (KO), AT&T (T)

Thursday, October 24: UPS (UPS)

As of mid-October 2024, here is a summary of sector performance for the month so far:

1. Information Technology: The sector has been performing well, buoyed by continued investor interest in tech giants, especially those with strong cash positions. It saw significant strength during the first half of the month.

2. Financials: With the economy still resilient despite aggressive monetary tightening, financial stocks have shown solid performance. Rising interest rates have benefited banks and insurance companies, allowing them to profit from higher lending and premium returns.

3. Energy: The Energy sector has faced some challenges, with oil prices slipping due to weaker demand and increased supply. This has led to underperformance in comparison to other sectors, despite its traditionally strong performance in a high-rate environment.

4. Utilities: As of October, Utilities are seeing a resurgence after lagging earlier in the year. The sector has benefitted from investors seeking stability amid market volatility.

5. Consumer Staples: This sector has performed steadily, with companies that produce essential goods seeing stable demand despite the inflationary pressures weighing on profit margins.

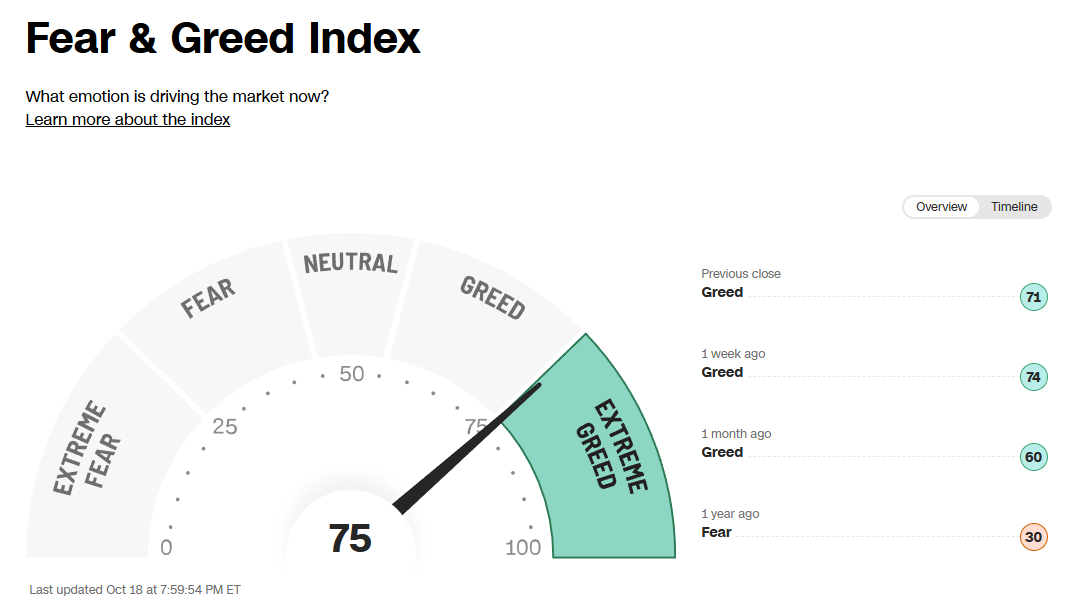

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

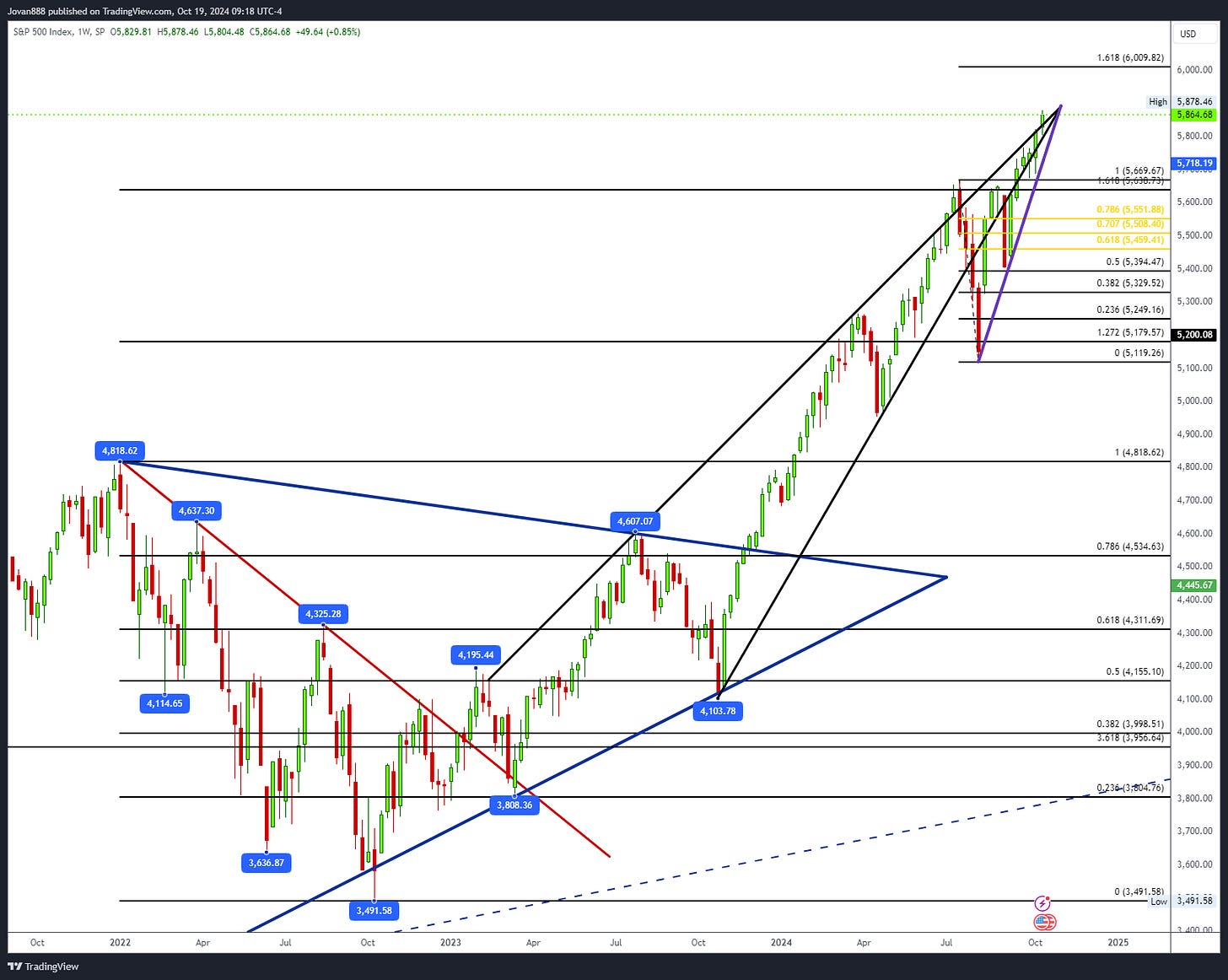

SPX Analysis:

Key Levels: 5763 & 5824

Rising wedge throwover.

Bullish Trajectory: Bulls are in control above 5824 in active breakout. Above 5824 has a path to 6009 the 1.618 extension. In an uptrend, continue to look for failed breakdowns as entry points instead of chasing long. Bulls do not want price to drop back below 5763 or else it turns into a failed breakout.

Bear Trajectory: There’s no major bear scenario right now, but a short trade could develop at any moment if 5763 were to fall. Bears being so close to ATH, should watch for failed breakouts (2b tops) to initiate a short trade with a tight stop. At this point any failure below 5820 could lead to a retest of 5763 and setup the short swing trade.

Summary:

Draw a line at 5824. Above this, bulls have the edge and failed breakdowns on dips are ideal. Below this, bears begin to take the edge and failed breakouts on rips are ideal.

IWM 0.00%↑

Longs are favorable above 216.83 but not below. IWM has stalled for months now at this long term trendline. If it can hold above this 224 area where it struggled earlier in the year, it could continue higher into new highs and ultimately 295. It is right at that line now so it either rejects or attempts breakout for new ATH imminently.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.