Weekly Newsletter: December 16 - December 20

Market Calendar: Key Events to Watch

Monday:

S&P Global U.S. Manufacturing and Services PMI (DEC): A critical measure of economic activity in both sectors. Watch for indications of economic expansion or contraction.

Tuesday:

Core Retail Sales (NOV): A key indicator of consumer spending, excluding autos. Markets will look for trends in holiday shopping impact.

Wednesday:

FOMC Press Conference and Interest Rate Decision: The Federal Reserve’s decisions will dominate headlines.

Thursday:

GDP QoQ (Q3): Final estimate for Q3 GDP; crucial for understanding the pace of economic growth.

Initial Jobless Claims: Labor market health is always a focus.

Friday:

Core PCE Price Index (MoM and YoY): The Fed's preferred inflation gauge. Markets will closely analyze this for clues on future monetary policy.

Earnings Calendar

Wednesday:

Micron Technology (MU): Semiconductor sector insights.

Lennar Corp (LEN): Key housing market data.

Thursday:

CarMax (KMX): Trends in used car sales.

Nike (NKE): Consumer demand and global retail trends.

FedEx (FDX): Supply chain and logistics health.

Friday:

Carnival Corp (CCL): Travel and leisure industry performance.

Trade Recap: Highlights from Last Week

Another stellar week with impressive gains! Here's how we capitalized on market opportunities:

YINN $33C DEC 20: Bought at $1.15, sold at $5.80 (+404%).

RIVN $12.5C JAN 2025: Bought at $1.38, sold at $2.23 (+61%).

BABA $100C MAR 21 2025: Bought at $2.52, sold at $5.55 (+120%).

BA $180C JAN 2025: Bought at $0.95, sold at $2.99 (+214%).

TSLA $435C DEC 20: Bought at $2.48, sold at $8.70 (+251%).

Key Focus This Week

FOMC Decision: Market sentiment will hinge on Wednesday’s interest rate announcement.

Economic Data: GDP and Core PCE numbers

Earnings: Pay close attention to forward guidance from companies like Nike and FedEx as they signal consumer and global economic health.

Stay disciplined, manage your risk, and let’s continue to make profitable moves!

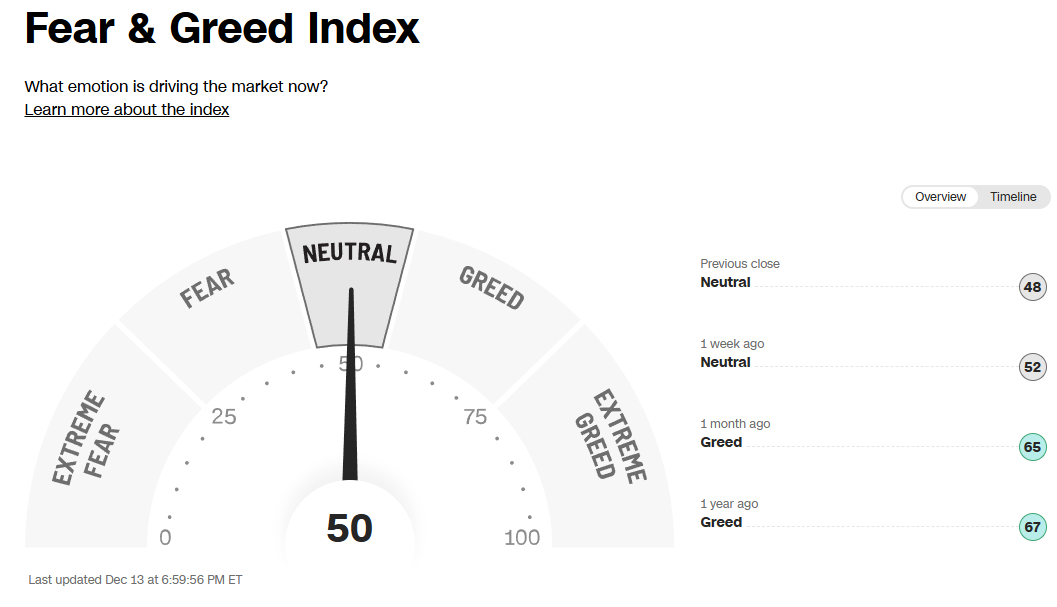

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

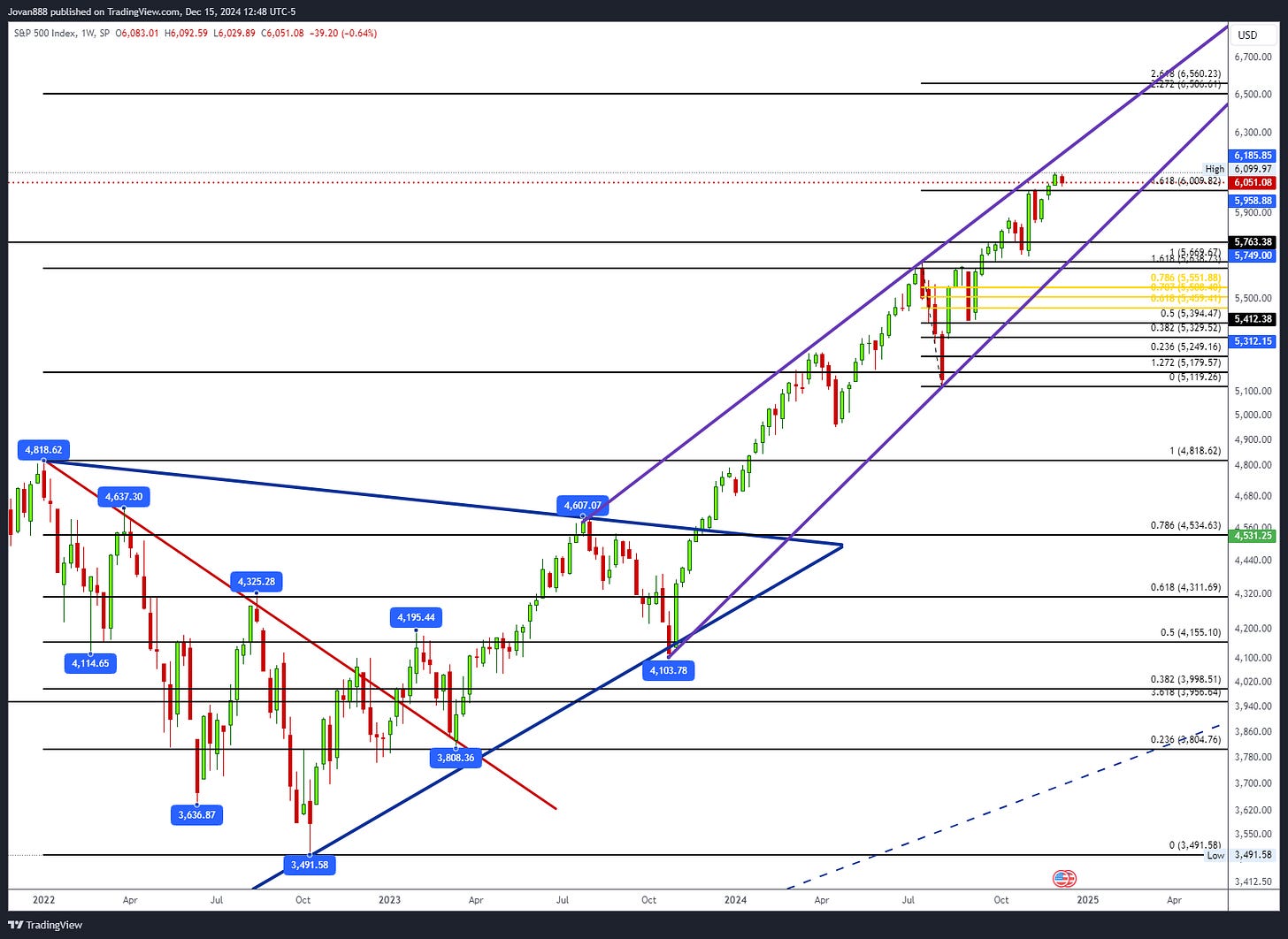

SPX Analysis:

Key Levels: 6009

Flagging price action above 6009 key level into FOMC.

Bullish Setups:

1. A failed breakdown of 6009 for a move higher into 6240.

2. Chase long on flag breakout above 6100 for a move into 6240

Bear Setups:

1. A failed breakout of 6009 for a short back to 5916 and 5782.

IWM 0.00%↑

Looking to buy dips as long as 226 holds for a move into new all time highs (LIS is 226)

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.