Weekly Newsletter: December 9 - December 13, 2024

Market Calendar Highlights

Tuesday, December 10:

Core CPI (MoM) for November: Key measure of inflation, excluding volatile food and energy prices. A critical indicator for Federal Reserve policy.

Wednesday, December 11:

CPI (YoY) & (MoM) for November: Tracks overall consumer inflation trends. High-impact data that could shift market sentiment.

Friday, December 13:

Initial Jobless Claims: Provides insights into labor market health.

PPI (MoM) for November: Reflects producer-level inflation trends, often a precursor to consumer inflation changes.

Earnings Calendar

Monday, December 9:

Oracle ($ORCL): Tech sector insights, particularly in cloud and software services.

Tuesday, December 10:

GameStop ($GME): Focus on retail and gaming trends.

AutoZone ($AZO): Key indicator for auto parts and services demand.

Wednesday, December 11:

Macy’s ($M): Updates on consumer spending trends.

Adobe ($ADBE): Key software and creative industry player.

Thursday, December 12:

Lovesac ($LOVE): Insights into the furniture retail segment.

Broadcom ($AVGO): Semi-conductor and tech sector updates.

Costco ($COST): Crucial read on consumer discretionary and bulk retail trends.

Trade Recap: Highlights from Last Week

Amazon ($AMZN): Reached our $224 target after the long from $190. This confirms strength in large-cap tech.

NVIDIA ($NVDA): Hit $145 after our relong from $133, supported by strong sector momentum.

Apple ($AAPL): Finally reached $240 levels since our relong at $224, continuing its bullish trajectory.

Coinbase ($COIN): Achieved our $350 target from the long at $170, capitalizing on renewed crypto optimism.

AMC Entertainment ($AMC): The bull flag we warned about started triggering this week, signaling potential upside continuation.

Key Market Moves

Fresh Highs:

SPY: Extended to new highs, supported by robust inflows and bullish sentiment.

QQQ: Continued to rally, with mega-cap tech stocks leading the charge.

TSLA: Achieved fresh highs, underscoring its resilience and investor confidence.

Big Reversal:

TLT (Treasury Bonds): Reversed sharply from $89 to $95, reflecting shifts in rate expectations and investor appetite for bonds.

Outlook for the Week Ahead

Inflation Data Focus: CPI and PPI reports will shape market expectations for future Federal Reserve moves, with potential ripple effects across equities, bonds, and commodities.

Earnings Watch: With key names like $ORCL, $ADBE, $COST, and $AVGO reporting, insights from these sectors could guide the next market rotation.

Key Levels to Watch:

SPY: 608 potential resistance for a move back down to 604 unless overcome

QQQ: Monitoring breakout above 524, has an unfilled gap below at 517.15

TSLA: Breakout active over 370 targeting 435.

TLT: Watching for follow-through above 95 or potential consolidation for an eventual visit to 108-114.

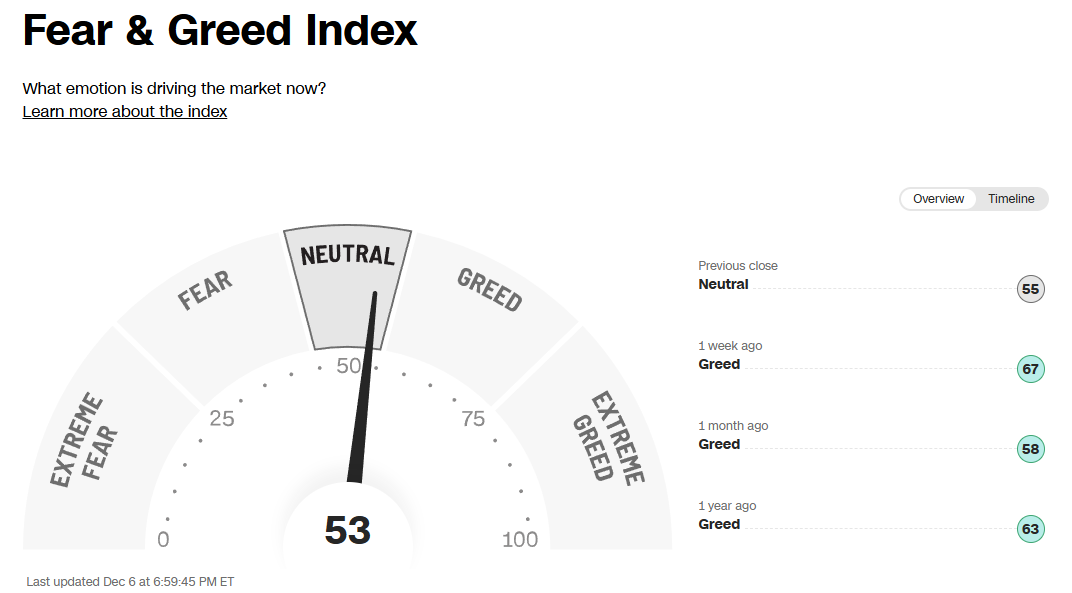

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Analysis:

Key Levels: 6009

Breakout is active above 6009 with an unfilled gap at 6049.87. Price currently at 6090.

Bullish Setups:

1. A failed breakdown of the unfilled gap at 6049 for a relong into 6180.

2. Chase long into 6180 (riskier)

Bear Setups:

1. A failed breakout of 6009 for a short back to 5916.

IWM 0.00%↑

The election triggered a decisive breakout on the weekly chart, breaking through a multi-year trendline. Fresh all time highs though a subtle wick above. Next week we likely get a big move with either a breakout to start towards 291 or a rejection at the highs and revisit of 226-232.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.