Hello Traders, welcome to this week's edition of JR28 Market Insights!

As we enter the third week of October, let's dive into the major themes driving the markets, key economic data releases to keep an eye on, and potential trading opportunities.

Earnings Season Kicks Off:

This week, earnings reports from major banks continue, and tech earnings kick off with Netflix reporting after-hours on Thursday.

Guidance Over Numbers: With macroeconomic uncertainty still looming, pay close attention to forward guidance from these companies. Traders should prepare for potential market swings based on any revisions to year-end forecasts.

Retail Sales & Consumer Sentiment Data

Retail Sales Report (October 17th): Consumer spending has been a strong pillar for the economy, but rising inflation and borrowing costs could start to weigh on discretionary purchases. Keep an eye on the retail sales figures—surprises here could either boost or suppress broader market sentiment.

Inflation and Interest Rates

Inflation remains a focal point for both the Fed and the markets. Any unexpected inflation data could impact expectations for interest rate hikes or pauses. Traders should stay alert to any sudden changes in bond yields, which could drive volatility in the equity markets.

As of October 12th, 2024, here is the year-to-date (YTD) performance for the major U.S. indices:

S&P 500 (SPX): The S&P 500 has posted a strong YTD return of approximately 22%.

NASDAQ-100 (NDX): The NASDAQ-100 is up about 21%, reflecting the continued dominance of large-cap tech stocks in the market.

Russell 2000 (IWM): The iShares Russell 2000 ETF (IWM), representing U.S. small-cap stocks, has seen more modest gains this year, with a YTD return of 10%.

These numbers illustrate the relative strength in large-cap stocks, especially in tech, while small-caps have lagged behind.

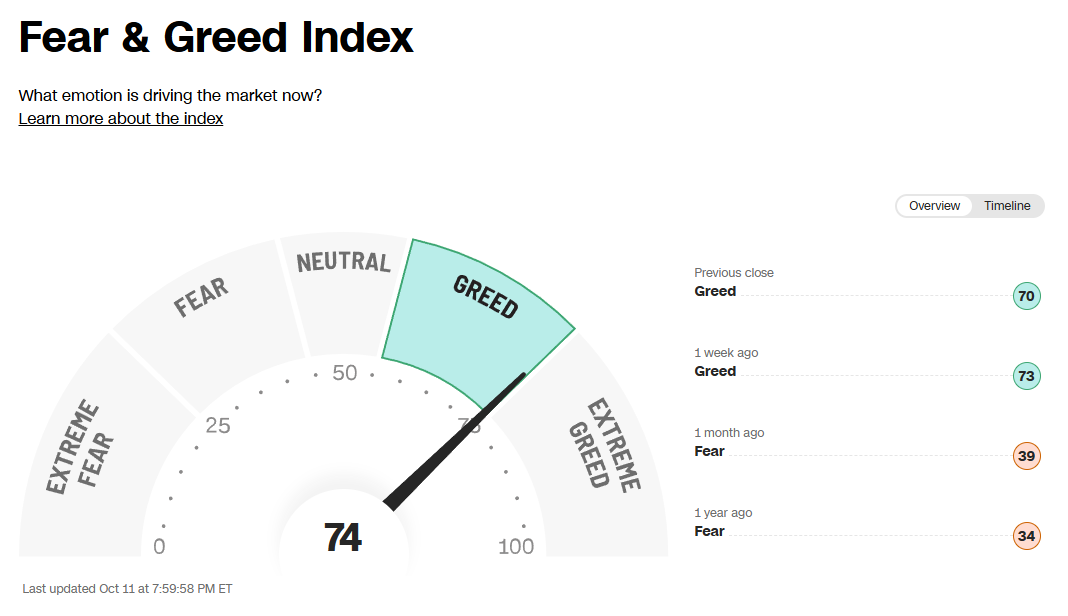

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

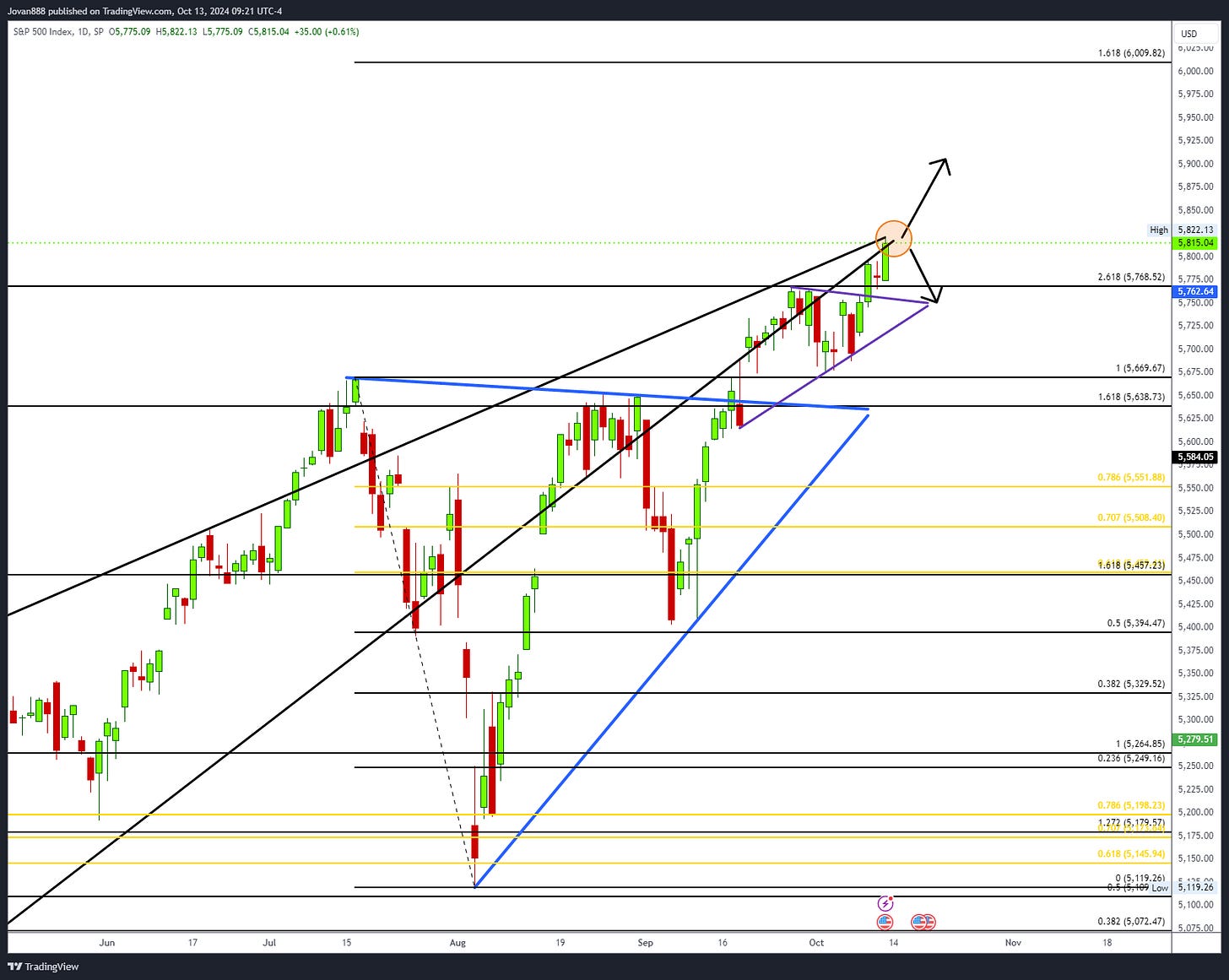

SPX Analysis:

Key Levels: 5768 & 5824

Bullish Trajectory: Bulls are in control above 5768 in active breakout. Above 5768 is 5824 which needs to be cleared for continuation into 5918 & 6000. Bulls do not want price to drop back below 5768 or else it turns into a failed breakout.

Bear Trajectory: There’s no major bear scenario right now, but a short trade could develop at any moment if 5768 were to fall. Bears being so close to ATH, should watch for failed breakouts (2b tops) to initiate a short trade with a tight stop. A failed breakout of 5768 that sees a move above it only to wick below and close lower could signal that failed breakout.

Summary:

Draw a line at 5638. Above this, bulls have the edge and failed breakdowns on dips are ideal. Below this, bears begin to take the edge and failed breakouts on rips are ideal.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.