The week of November 11–15 is set to be eventful, with significant economic data releases and corporate earnings reports that could influence market dynamics.

Market Overview

The S&P 500 recently surpassed the 6,000 mark for the first time, closing at 6,012.45 on November 8, 2024.

This milestone was achieved amid a post-election rally, with major indices recording substantial weekly gains:

S&P 500: Increased by approximately 4.66% over the week.

Dow Jones Industrial Average: Rose by about 3.2%, closing at a record high.

Nasdaq Composite: Advanced by 2.4%, also reaching a new peak.

Russell 2000: Climbed 5.8%, marking its best week since 2020.

Key Economic Data Releases

Tuesday, November 13:

Core Consumer Price Index (CPI) MoM and YoY: Investors will scrutinize these figures to assess inflation trends. A higher-than-expected reading could influence Federal Reserve policy decisions.

Thursday, November 15:

Producer Price Index (PPI) MoM: This data provides insight into wholesale inflation, which can precede consumer price changes.

Initial Jobless Claims: A key indicator of labor market health, with implications for consumer spending and economic growth.

Federal Reserve Chair Jerome Powell's Speech (3:00 PM ET): Market participants will listen closely for any hints regarding future monetary policy direction.

Friday, November 16:

Core Retail Sales MoM: This metric reflects consumer spending, a primary driver of economic activity.

Corporate Earnings

Here is a list of notable companies scheduled to release their earnings reports for the week of November 11–15, 2024:

Tuesday, November 12

Shopify Inc. (SHOP)

The Home Depot, Inc. (HD)

Spotify Technology S.A. (SPOT)

Marathon Digital Holdings, Inc. (MARA)

Rocket Companies, Inc. (RKT)

Wednesday, November 13Cisco Systems, Inc. (CSCO)

Helmerich & Payne, Inc. (HP)

Thursday, November 14The Walt Disney Company (DIS)

JD.com, Inc. (JD)

Applied Materials, Inc. (AMAT)

Advance Auto Parts, Inc. (AAP)

Friday, November 15Alibaba Group Holding Limited (BABA)

These earnings reports are highly anticipated and may influence market movements. Investors should monitor these releases closely to assess their potential impact on the respective sectors and the broader market.

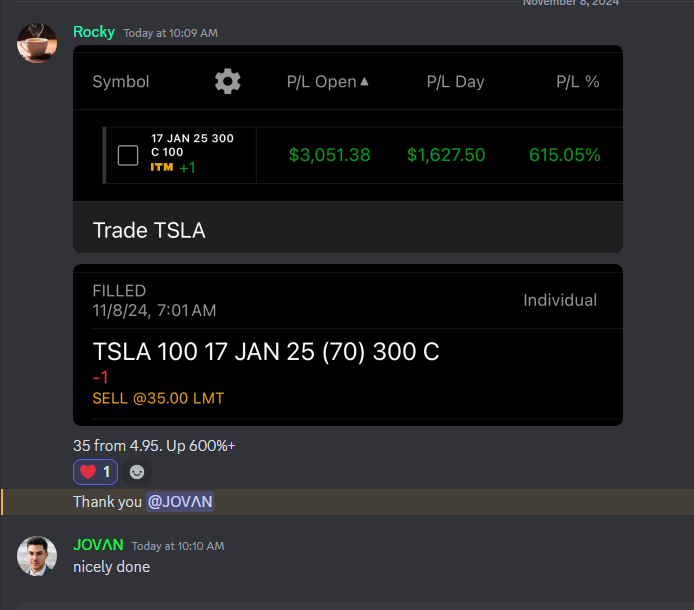

Target Achieved: Last Week's Successful Trades

Last week, Tesla (TSLA) experienced a remarkable surge, climbing from $240 to $325 and achieving all predefined targets within a single week. This impressive 35.4% increase was largely driven by the market's reaction to Donald Trump's election victory, which investors interpreted as favorable for the automotive and technology sectors. The trade setup capitalized on key support levels around $240, with momentum accelerating as TSLA surpassed critical resistance points, leading to a highly profitable outcome. Most of our members snagged $300 January call options on Tesla at $5.30 and watched them soar, flipping them for over $35—a more than sixfold return!

NVIDIA's stock rose from $137.31 on November 5 to $147.63 by November 8, marking a 7.5% increase.

Coinbase's stock saw a substantial increase, climbing from $180 to $273.50, resulting in an impressive 51.9% gain.

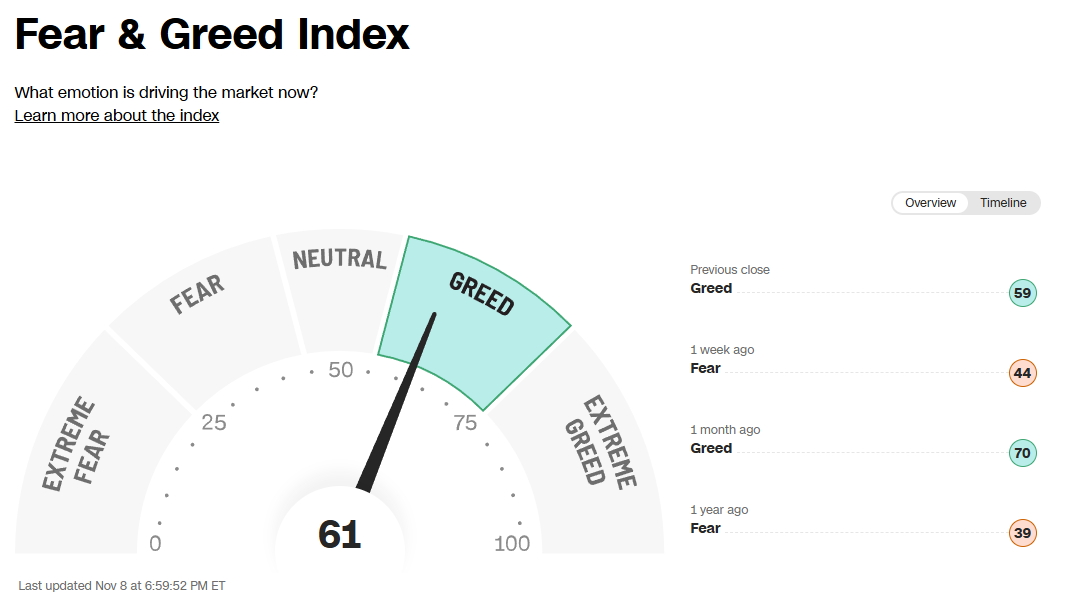

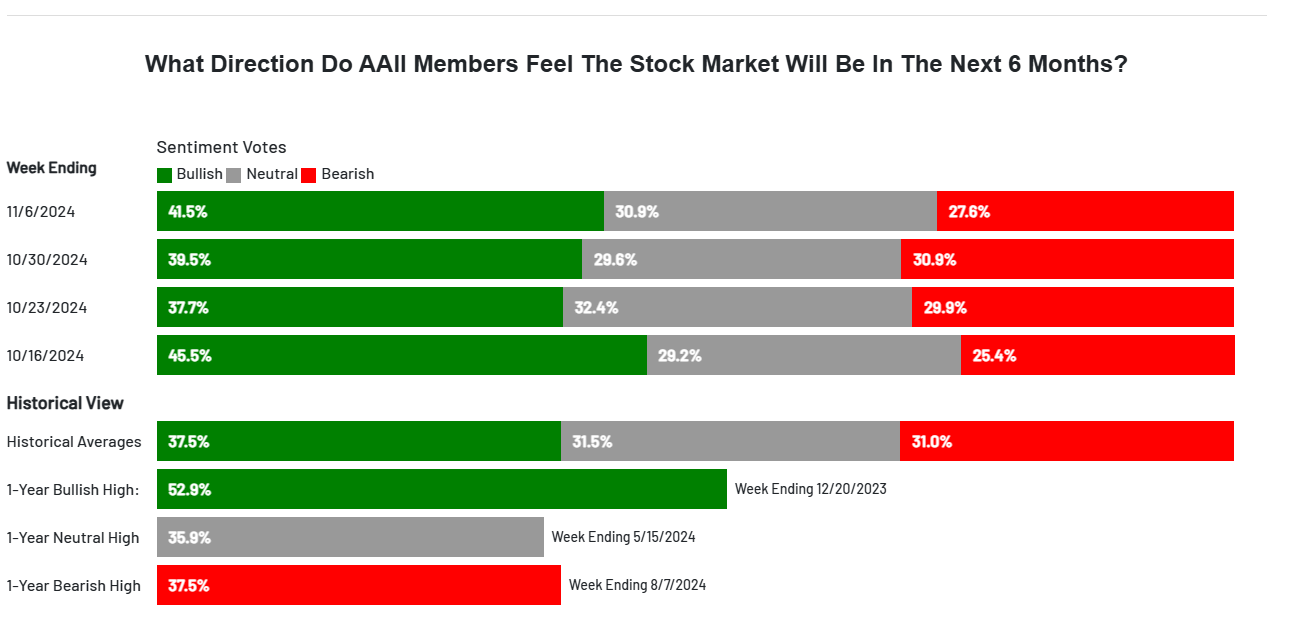

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

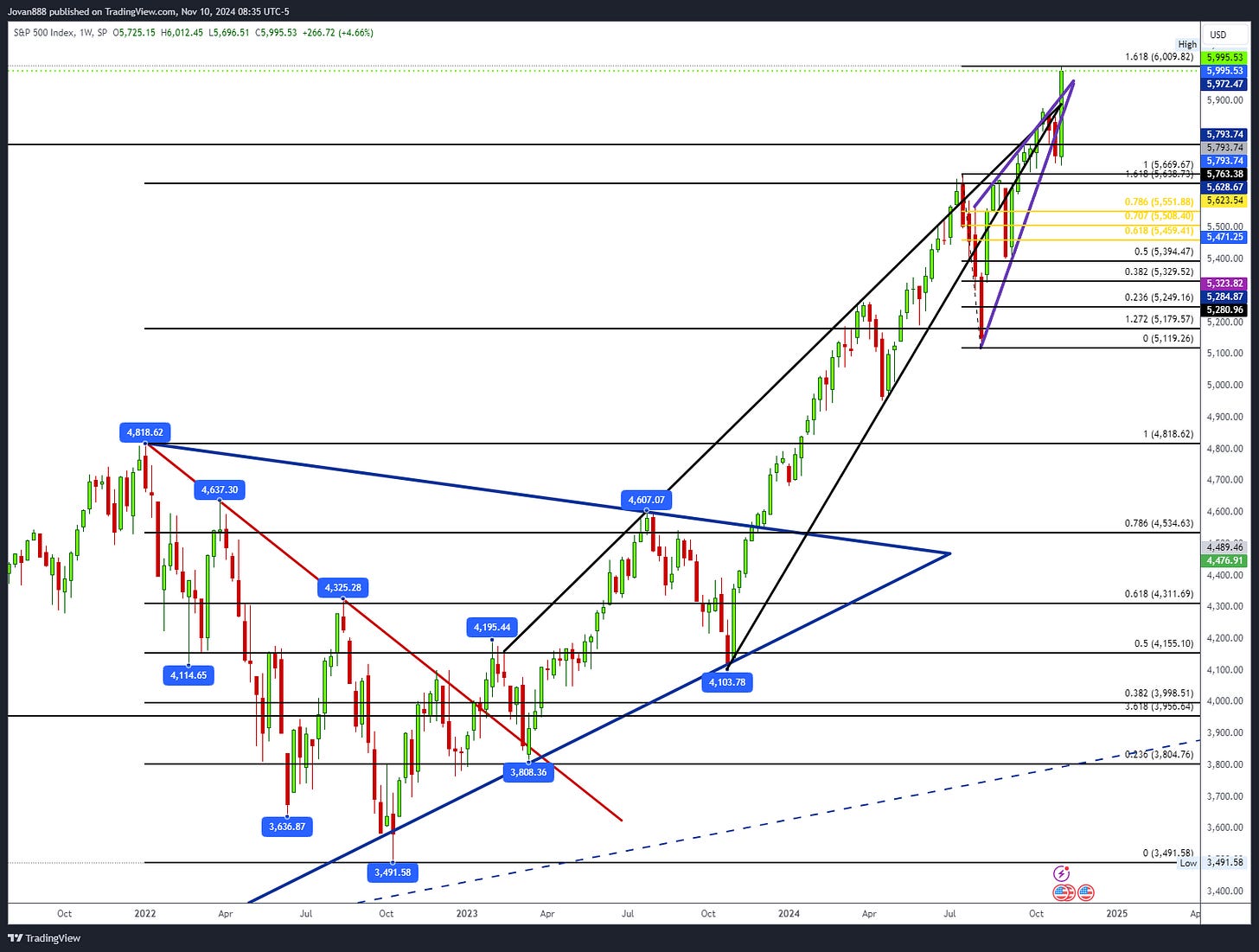

SPX Analysis:

Key Levels: 6009 & 5870

Unless 6009 is overcome, a reset likely takes place with a small pullback to reset overbought indicators. Bulls should look for failed breakdowns of key levels to re-enter longs. Bears could use 6009 as a LIS and attempt a short back to 5870 area.

Bullish Trajectory: A failed breakdown of 5870 would be an ideal relong. Alternatively, a high-risk chase long if it gaps over 6009 is another possibility.

Bear Trajectory: A short close to 6009 using a tight stop just a few ticks above 6009 could work as it would be a low-risk setup with the stop being so close. Would want to see a retest of this blue box below.

Summary:

Bulls in clear control above 5782 as it had a breakaway gap with 3 consecutive gap ups. Bulls need to avoid filling that gap next week to keep the momentum going. Things can unravel rapidly if it were to fall below 5763.

IWM 0.00%↑

The election triggered a decisive breakout on the weekly chart, breaking through a multi-year trendline. For bulls to maintain momentum toward new all-time highs, it’s essential to hold above 232. A revisit to 216 would signal a failed breakout, potentially undermining the structure and shifting momentum away from the bulls.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.