Weekly Market Insights: November 25th – November 29th, 2024

Market Recap and Trends

November continues to reflect the resilience of the markets, with impressive Month-to-Date gains:

SPY: Up 4.63% Month-to-Date

QQQ: Up 4.53% Month-to-Date

IWM: Up 9.65% Month-to-Date

Despite bearish technical patterns and ongoing global uncertainties, the past six months have showcased incredible strength. This is a market that simply doesn’t want to pull back, defying many expectations.

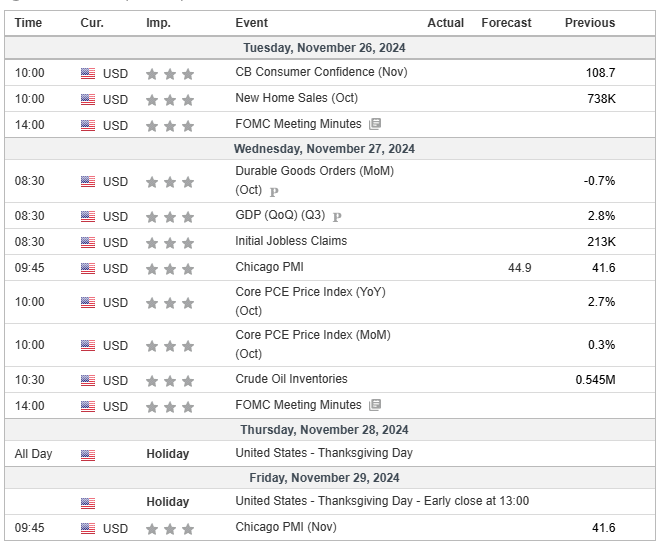

Economic Calendar Highlights

Tuesday, November 26th:

CB Consumer Confidence: A vital measure of economic sentiment.

FOMC Meeting Minutes: Insights into the Fed’s thoughts on inflation and monetary policy.

Wednesday, November 27th:

GDP (QoQ) for Q3: A comprehensive look at the economy’s Q3 performance.

Chicago PMI: A key indicator of manufacturing activity in November.

Durable Goods Orders: Reflecting future economic momentum.

Thursday, November 28th:

Thanksgiving Holiday: Markets are closed.

Friday, November 29th:

Chicago PMI (Final): Further clarity on manufacturing trends for November.

Trade Review: Winning Streak Continues

Our trade ideas from last week delivered once again:

SPX Relong: We targeted a relong at 5870, aiming for 5942, and smashed through to hit 5969.

QQQ: Played the bounce off 494, successfully retesting 505.

TSLA: Relong at 300, targeting 350—momentum remains strong as it climbs towards the goal.

NVDA Earnings Play: Expected a hit at 156, which tapped briefly before a selloff.

GME: Identified a breakout in the making—this setup is gaining traction and looks primed for further upside.

Looking Ahead

With a shortened trading week due to the Thanksgiving holiday, focus will be on key economic data, including consumer confidence, GDP, and durable goods. These could bring volatility and opportunities for strategic plays.

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

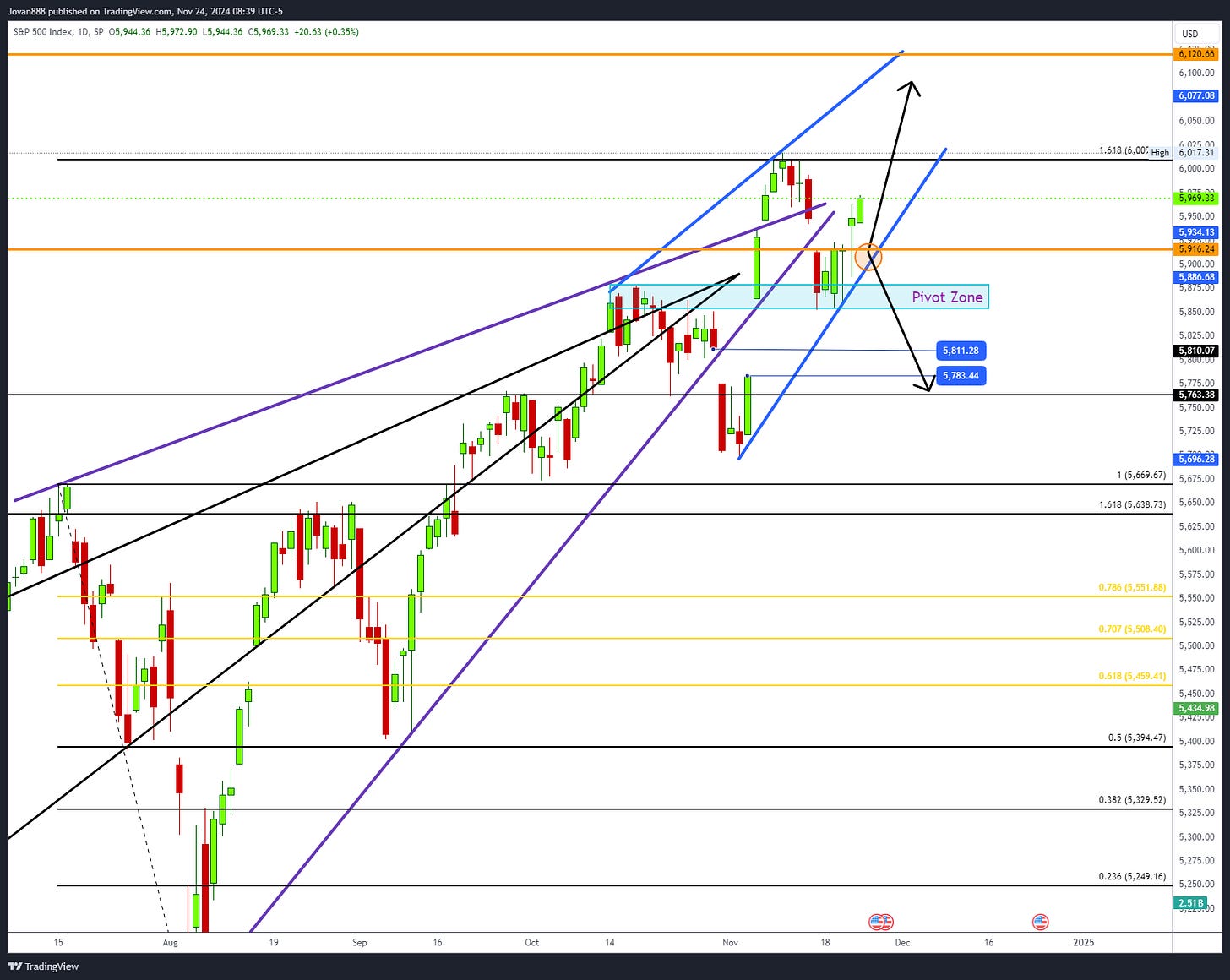

SPX Analysis:

Key Levels: 5916 & 6009

As mentioned last week, using 5870 as a guide, if we are above this the bulls retain the control and can take us back to that 6009 level and try for breakout. If we are below this, bears have a chance to take the ball from the bulls and can send us lower towards the unfilled gaps at 5783-5811.

Plan for next 2 weeks as this upcoming week is a short week:

Bullish Setups:

1. A failed breakdown or relong of 5916 to target 6009.

2. A failed breakdown or relog of 5942 to target 6009.

3. A chase long on a breakaway gap over 6009 to target 6094.

Bear Setups:

1. A failed breakout / look above and fail around 6009-6024 for a short back to 5916

2. A break of 5916 for a short back to 5856-5870 zone.

3. A break of 5856 for a full 2b top/ FBO move down to the unfilled gaps at 5783-5811

IWM 0.00%↑

The election triggered a decisive breakout on the weekly chart, breaking through a multi-year trendline. For bulls to maintain momentum toward new all-time highs, it’s essential to hold above 232. So far it completed a backtest of 226 which held and we are back to 238 just an inch away from all time highs.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.