JR28 Weekly Trading Newsletter: Dec 23 – Dec 27, 2024

Market Outlook for the Week

It’s a short week with the market observing the Christmas holiday. Key market hours and events to note:

Tuesday, Dec 24: Market closes early for Christmas Eve.

Wednesday, Dec 25: Market is closed for Christmas.

Economic Calendar

While it’s a quieter week for economic data, we do have some key releases:

Monday, Dec 23 @ 10:00 AM: CB Consumer Confidence (Dec)

Tuesday, Dec 24 @ 8:30 AM: Durable Goods Orders (MoM Nov)

Thursday, Dec 26 @ 9:30 AM: Jobless Claims

These reports could drive some pre-holiday price action, so stay alert if trading into lighter volume.

Recap of Last Week’s Trade Ideas

We had a strong week with some impressive moves on our setups:

SPY $600P Dec 20

Entry: 2.42

Peak: Ran over 13.00 for an exceptional return.

BA (Boeing) Commons

Bought at: $142

Sold partial at: $178, locking in significant gains.

NVDA $135C Jan 31

Entry: 6.15

Peak: Reached 9.90, providing solid upside potential.

TSLA $300C Jan 17

Entry: 5.30

Peak: Exploded past 200.00, delivering a blockbuster trade.

COIN (Coinbase) Commons

Entry: $268

High: Touched $280, a strong intraday trade.

SPX Levels Played to Perfection

Last week, we identified a potential failed breakout of SPX at 6009, calling for a short back to 5916 and 5782. SPX delivered:

Low of the week: 5832 before rallying into Friday's close at 5930.

Our levels and analysis guided traders to capitalize on the downside move and the subsequent recovery.

Key Focus for This Week

With lighter volume and a shortened trading schedule, the focus shifts to strategic opportunities and disciplined trading. A few things to consider:

Small Moves Can Lead to Big Swings: Low-volume markets can see exaggerated price action. Stay nimble and prioritize setups with high probability.

Economic Data Impact: Durable Goods Orders and Jobless Claims could be catalysts, especially in sectors sensitive to economic sentiment.

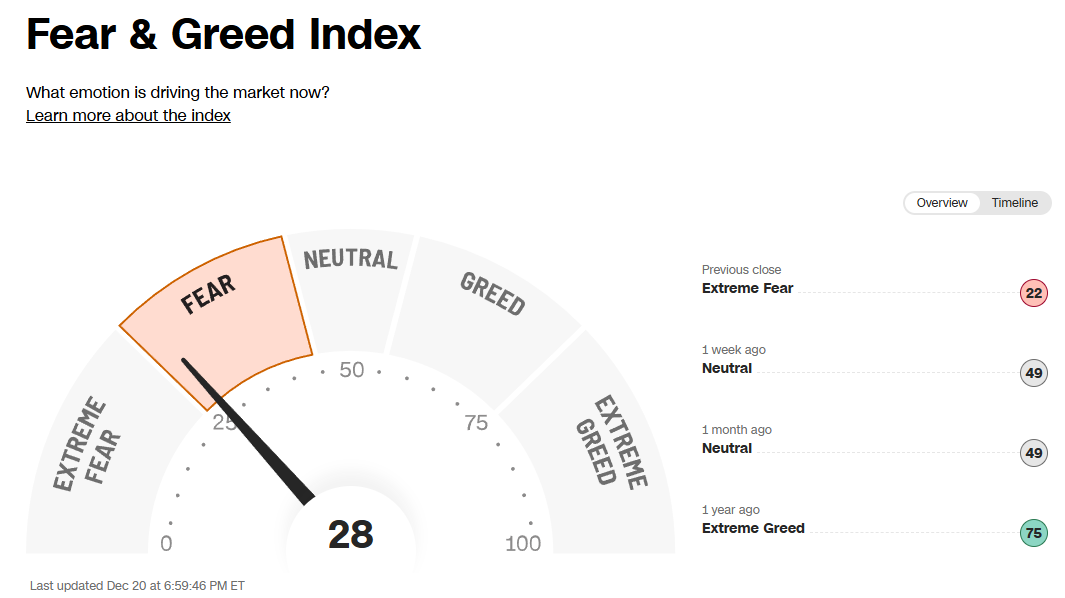

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Analysis:

Key Levels: 6009

6009 has been a key level for over a month and continues to be here as it forms a potential head and shoulders. Bulls will need to overcome 6009 again to get a rally going into 6200+

Bullish Setups:

1. A failed breakdown of 5870 for a move higher into 6240.

2. Chase long on move over 6009 for a move higher into 6240

Bear Setups:

1. A rejection at 6009 setting up the right shoulder for a retest of 5871 and possible gap fill at 5782

2. A chase short below 5870 for a retest of the low at 5832 and possible gap fill at 5782

IWM 0.00%↑

Possible failed breakout with a sweep above the prior ATH to take out stops before reversing lower.

Bullish: Above 226, we can re-long targeting a move back to ATH.

Bearish: Below 216, watch for a potential drop to 199.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.