Hello Traders, welcome to this week's edition of JR28 Market Insights!

The first full week of October presents a pivotal moment for traders. We’re entering the Q4 earnings season, and economic data releases will have a significant impact on market sentiment. Here's what to watch:

Earnings Season Kicks Off:

Expect earnings reports from major banks later this week, setting the tone for how the financial sector is navigating rising interest rates and market volatility.

Keep an eye on how companies are handling inflation, supply chain disruptions, and consumer demand.

Federal Reserve Minutes Release (October 9th):

The Fed will release the minutes from its most recent FOMC meeting. Investors will parse these for clues on future interest rate cuts. This could influence sectors like tech and consumer goods, which are sensitive to rate fluctuations.

Inflation Data (CPI, October 10th):

The Consumer Price Index (CPI) will be released, providing a snapshot of inflation. A lower CPI could give stocks a boost, while another hot print may cause market jitters.

Geopolitical Developments:

Global events, particularly in the Middle East and Ukraine, could influence energy prices. Oil has been volatile recently, so watch energy stocks closely as developments unfold.

Sectors in Focus:

Financials: Banks are reporting earnings, and their outlooks will be critical to gauging consumer credit health and loan growth.

Energy: With oil prices climbing recently, energy stocks may see more movement. This week’s developments could present short-term trading opportunities.

Tech: Tech stocks have been sensitive to interest rate concerns. A dovish Fed tone in the minutes or a cooler inflation reading could give this sector a boost.

Trades & Opportunities:

Bank Earnings Plays:

Consider short-term positions around earnings reports. Watch for guidance on loan growth and net interest margins.

Possible bank stocks to monitor: JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC).

Energy Moves:

Rising oil prices can present opportunities in the energy sector, particularly in companies like ExxonMobil (XOM) and Chevron (CVX).

Defensive Stocks:

In times of economic uncertainty, defensive sectors like consumer staples and utilities may offer safer bets. Consider companies like Procter & Gamble (PG) and NextEra Energy (NEE).

JR28’s Strategy Corner: As always, our approach centers around realistic and sustainable trades, avoiding high-risk plays that can wipe out portfolios. This week, we’re focusing on earnings-driven moves and inflation hedges. For those with smaller portfolios, look to capitalize on volatility through options trading around key earnings reports and CPI data. Keep your eyes on the market, stay informed, and always have an exit strategy.

As of October 5, 2024, here is the year-to-date (YTD) performance for the major U.S. indices:

S&P 500 (SPX): The S&P 500 has posted a strong YTD return of approximately 21.87%.

NASDAQ-100 (NDX): The NASDAQ-100 is up about 36.75%, reflecting the continued dominance of large-cap tech stocks in the market.

Russell 2000 (IWM): The iShares Russell 2000 ETF (IWM), representing U.S. small-cap stocks, has seen more modest gains this year, with a YTD return of 2.22%.

These numbers illustrate the relative strength in large-cap stocks, especially in tech, while small-caps have lagged behind.

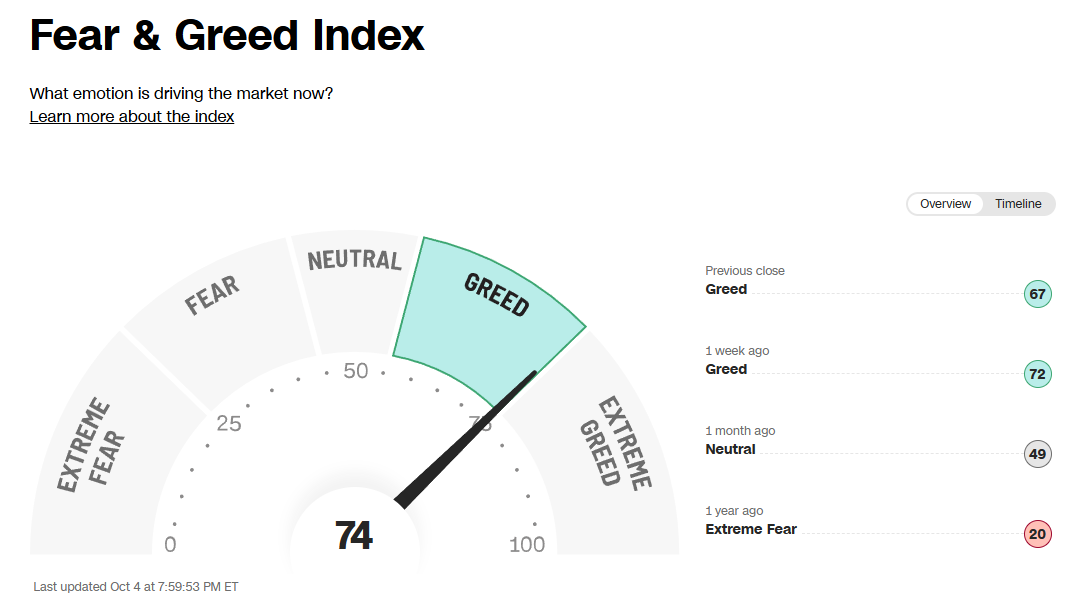

Market Sentiment:

I've mentioned this many times before, but the "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, which should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn. “The trend is your friend.”

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

SPX Analysis:

Key Levels: 5768 & 5638

Bullish Trajectory: Bulls are in control above 5638. Continue to watch for failed breakdowns for entries on new longs, we had one this past week on Wednesday. Above 5638 is 5735 & 5768. If bulls get above 5768 can target 5800. Bulls should not try to knife catch if there is dips below 5633-38. In the case of a downturn, bulls should wait and watch for failed breakdowns (2b bottom) instead of chasing long.

Bear Trajectory: There’s no major bear scenario right now, but a short trade could develop at any moment if 5633-38 were to fall. Bears being so close to ATH, should watch for failed breakouts (2b tops) to initiate a short trade with a tight stop. A failed breakout of 5768 that sees a move above it only to wick below and close lower could signal that failed breakout.

Summary:

Draw a line at 5638. Above this, bulls have the edge and failed breakdowns on dips are ideal. Below this, bears begin to take the edge and failed breakouts on rips are ideal.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.