Weekly Newsletter: December 2 - December 6, 2024

Market Recap: November 2024

S&P 500 (SPX): +5.73%

Nasdaq 100 (NDX): +5.23%

Russell 2000 (IWM): +11.07%

The Russell 2000 (IWM) achieved a fresh all-time high, highlighting strong momentum in small-cap stocks. This surge reflects improving market sentiment, with broad participation across sectors.

Trade Recap: Last Week's Highlights

SPY $595C NOV 29: Entry $1.81 → Exit $5.94 (+228%)

ENPH $100C MAR 2025: Entry $1.58 → High $3.60 (+127%)

GME $30C JAN 17: Entry $3.55 → High $7.00 (+97%)

AAPL $240C DEC 13: Entry $1.35 → Exit $2.00 (+48%)

ENPH Commons: Entry $61.16 → Exit $74.00 (+21%)

Earnings to Watch This Week

A packed earnings calendar this week, with key reports likely to move markets:

Tuesday (After Close): $CRM, $OCTA

Wednesday (Before Open): $CHWY, $DLTR

After Close: $AE, $FIVE

Thursday (Before Open): $DG, $TD, $KR

After Close: $ULTA, $LULU, $HPE, DOCU 0.00%↑

Economic Data Calendar: December 2 - December 6, 2024

Monday, December 2, 2024

9:45 AM: S&P Global US Manufacturing PMI (Nov)

Forecast: 48.8 | Previous: 48.5

10:00 AM: ISM Manufacturing PMI (Nov)

Forecast: 47.7 | Previous: 46.5

10:00 AM: ISM Manufacturing Prices (Nov)

Forecast: 55.2 | Previous: 54.8

Tuesday, December 3, 2024

10:00 AM: JOLTS Job Openings (Oct)

Forecast: 7.490M | Previous: 7.443M

Wednesday, December 4, 2024

8:15 AM: ADP Nonfarm Employment Change (Nov)

Forecast: 166K | Previous: 233K

9:45 AM: S&P Global Services PMI (Nov)

Forecast: 57.0 | Previous: 55.0

10:00 AM: ISM Non-Manufacturing PMI (Nov)

Forecast: 55.5 | Previous: 56.0

10:00 AM: ISM Non-Manufacturing Prices (Nov)

Forecast: 58.1 | Previous: -

1:45 PM: Fed Chair Powell Speaks

Thursday, December 5, 2024

8:30 AM: Initial Jobless Claims

Forecast: 215K | Previous: 213K

Friday, December 6, 2024

8:30 AM: Average Hourly Earnings (MoM, Nov)

Forecast: 0.3% | Previous: 0.4%

8:30 AM: Nonfarm Payrolls (Nov)

Forecast: 202K | Previous: 12K

8:30 AM: Unemployment Rate (Nov)

Forecast: 4.2% | Previous: 4.1%

Key Takeaways for the Week

Earnings Spotlight: Keep an eye on sector leaders like $CRM, $ULTA, $LULU, and $DOCU for insights into consumer trends and enterprise spending.

Market Trends: Strong November performance sets an optimistic tone for December, with IWM hitting an all-time high.

Economic Data Focus: Labor market data and Fed Chair Powell's speech will provide key macro insights for the week.

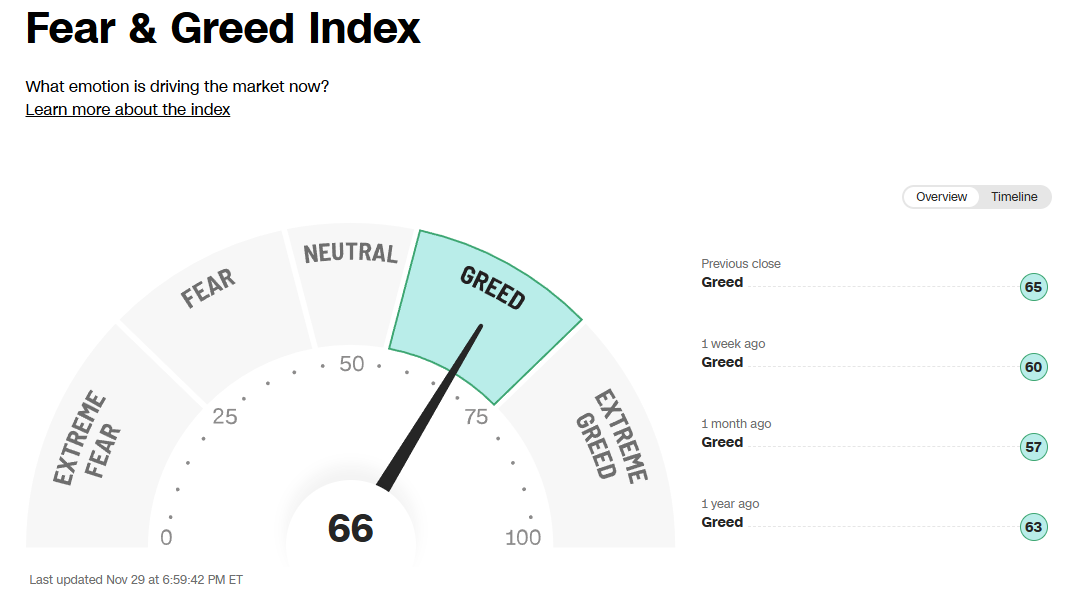

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Analysis:

Key Levels: 6009

Big decision coming here as SPX decides if this will breakout or become a failed breakout at 6009 level. If bulls can take it out we can head north to 6140’s. If Bears can hold 6009, we could sell back to

Plan for next 2 weeks as this upcoming week is a short week:

Bullish Setups:

1. A failed breakdown or relong of 6009 to target 6146

2. A failed breakdown or relog of 5980 to target 6146.

3. A chase long on a breakaway gap over 6009 to target 6094-6146.

Bear Setups:

1. A failed breakout / look above and fail around 6009-6024 for a short back to 5916. (Can short with stop at 6044)

2. A break of 5916 for a short back to 5856-5870 zone.

3. A break of 5856 for a full 2b top/ FBO move down to the unfilled gaps at 5783-5811

IWM 0.00%↑

The election triggered a decisive breakout on the weekly chart, breaking through a multi-year trendline. Fresh all time highs though a subtle wick above. Next week we likely get a big move with either a breakout to start towards 291 or a rejection at the highs and revisit of 226-232.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.