📬 JR28 Weekly Market Outlook

June 2nd – June 6th, 2025

“The edge isn't found in the noise. It's built in your process.”

✨ Weekly Inspiration

"Your job isn’t to predict the future—it’s to prepare your edge for whatever it brings."

This week: Clarity over control. Process over prediction.

⚠️ What Moved the Market in May 2025

Markets were volatile in May, driven by tariff headlines, inflation data, and a cautious Fed stance.

📈 Performance Recap:

SPY: +6.28% QQQ: +9.18% IWM: +5.24%

Tech led on AI/crypto optimism. Small caps rebounded late after lagging on trade concerns.

🔥 Key Drivers of Volatility

🇨🇳 China Tariffs: Trump’s May 30 accusation of trade violations (after April’s 145% tariff hike) triggered futures drop (S&P -0.5%, Nasdaq -0.7%).

🇪🇺 EU Tariffs: 50% tariffs announced May 23 (effective June 1) hit global markets. Delay to July 9 (May 26) sparked a rally.

📈 May 12 Relief Rally: A 90-day China tariff pause drove Nasdaq +4.35%, SPX +3.26%.

📊 Economic Data Highlights

CPI (Mid-May): 2.3%. Hot core reading sparked May 19 selloff (S&P -1%, Nasdaq -1.3%), quickly reversed by dip-buyers.

PCE (Late May): Core 2.6% (in-line), Headline 2.1% (below forecast).

→ Week ending May 30: SPX +1.88%, QQQ +2.01%

🏦 Federal Reserve’s Cautious Stance

May 7: Fed flagged sticky inflation + Q1 GDP -2.7% → Cut odds fell to 36.6%

VIX held elevated after April’s spike to 52.33

→ Result: No cuts in sight, risk remained high

🧩 Other Market Influences

May 28: Court overturned Trump tariffs → SPY +1.5%, QQQ +2%, IWM +1.9% premarket

Later reinstated during appealMay 19: Coinbase added to S&P 500 → Boosted crypto/tech sentiment

Macro Pressure:

• GDP: -2.7% • 10Y Yield: 4.39% by May 16

• Small caps pressured but recovered on tariff relief + retail flow

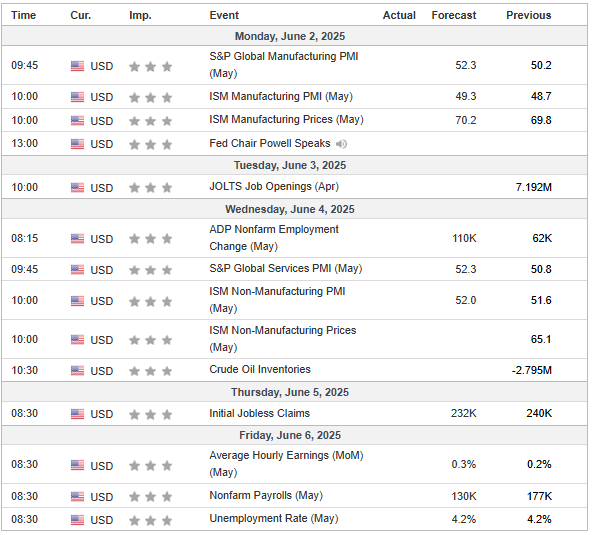

📅 Upcoming Economic Events (June 2–6, 2025)

📈 Key Earnings

Tue (Jun 3): CrowdStrike (CRWD)

Wed (Jun 4): MongoDB (MDB), Dollar Tree (DLTR)

Thu (Jun 5): Lululemon (LULU)

🔥 Upcoming: JR28 Copy Trading + $5K Challenge

We’re launching two major initiatives:

📈 JR28 Copy Trading (Starting w/ $5K)

💪 Small Account Challenge – $5K → ??

Full transparency on risk, sizing, and pro-level trade management — all inside Discord + Substack.

🚨 Lifetime Access Deal – $656

One-time payment. No monthly fees.

Get trade alerts, setups, education, and full community access.

⚡ Futures Trading Pick: Tradeify

Looking to scale with a firm that actually pays? Here’s our go-to:

✅ Tradeify — Use code JR28

➡️ 50K Growth Account ≈ $90.35 w/ discount

📈 Index Forecast: Navigating SPX, QQQ & IWM

SPX Recap & Outlook

Last Week Recap:

Our game plan: “If 5762 holds, we could bounce back toward 5960–6009.”

→ SPX opened above 5767 and rallied straight to 5942 — bounce confirmed.

This Week’s Gameplan:

🔑 Key Level: 5866

Above: Target 6009

Below: Watch 5762, then open gap at 5691

QQQ Outlook

Holding above 504 keeps the trend bullish

Above 504: ATH retest near 540

Below: Gap fill likely toward 491

IWM Outlook

Still inside prior week — neutral until a break

🔍 Watching 210–214 zone

Breakout above: Rally to 221

221: Major resistance + trigger for small-cap strength

📌 A confirmed breakout above 221 could signal broad market rotation and upside momentum into June.

⚙️ Stocks to Watch: Trade Setups

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.