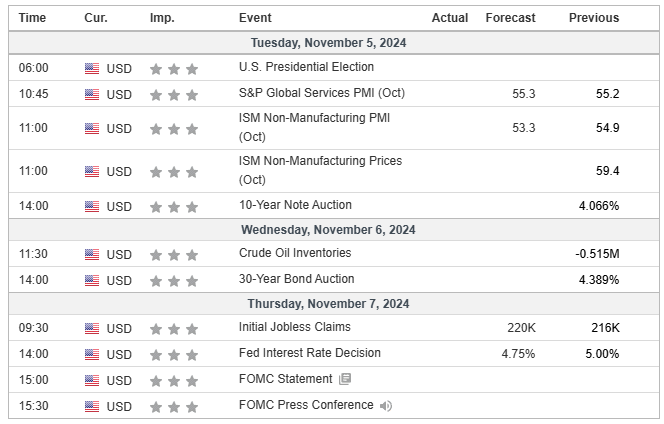

Welcome to another critical week in the markets with two major events on the horizon: the U.S. Election Night on Tuesday and the FOMC meeting on Thursday.

1. Election Night and Historical Market Trends

With the 2024 U.S. election set for Tuesday, November 5, traders should prepare for potential volatility across all sectors. Historically, election week has seen notable market swings as investors react to both anticipated and unexpected outcomes.

Historical Trends: The stock market often experiences volatility leading into and following elections. According to data, during midterm and presidential elections, the S&P 500 has shown a tendency to rally in the weeks following the election, regardless of which party wins, often called the "Post-Election Rally" phenomenon. During the 2020 U.S. election week, the S&P 500 rose by approximately 7.3% from Monday, November 2, through Friday, November 6, 2020. This rally came as investors anticipated economic stimulus and stability, regardless of the election outcome.

Sector Reactions: Technology and healthcare sectors often see significant activity due to anticipated regulatory impacts. Energy and financials could also be in focus based on election-driven policy expectations.

Short-Term Strategies: Watch for potential breakouts or breakdowns in key indexes, especially if election results come with surprises or delayed clarity.

Keep an eye on market sentiment during and after election night. Sudden sector rotations could present opportunities for short-term trades, particularly in technology and energy, which are often impacted by policy outcomes.

2. FOMC Meeting on Thursday, November 7

The Federal Reserve recently implemented a 50 basis point rate cut, responding to economic pressures and signaling a potential easing cycle. As we approach this FOMC meeting, there’s a high probability of an additional 25 basis point rate cut, with markets eagerly awaiting confirmation.

Market Implications: A 25bps cut would bring rates lower, aiming to support the economy amid inflationary concerns. This easing environment is likely to favor growth sectors, particularly technology and real estate, which benefit from lower borrowing costs. The financial sector, however, could see tighter margins as lower rates impact profitability.

Investor Sentiment: Another rate cut could strengthen bullish sentiment, as investors anticipate increased liquidity and economic support from the Fed. This environment often leads to positive movement in the NASDAQ-100 and S&P 500, with traders pricing in potential gains for high-growth stocks.

Strategies for This Week:

Tech and Growth Stocks: Consider setups in tech-heavy indexes or ETFs, as these could benefit the most from lower interest rates.

Rate-Sensitive Plays: Real estate and utility stocks may see momentum, given their reliance on favorable borrowing conditions.

Bank Stocks: Remain cautious, as further cuts could pressure profit margins for financial institutions, leading to potential pullbacks.

3. Key Economic Data and Earnings

Aside from these major events, keep an eye on other key economic releases this week:

Jobless Claims (Thursday) will provide insights into the labor market and could sway Fed sentiment.

Consumer Sentiment (Friday) will offer a snapshot of consumer confidence heading into the holiday season, impacting retail and discretionary sectors.

4. Bond Market Collapse and Dollar Strength

This week, bond markets continue to show significant weakness, with yields rising as bond prices fall, signaling a potential shift in market dynamics. Despite recent Fed rate cuts aimed at easing financial conditions, the U.S. dollar has remained resilient, even appreciating, which is unusual in a rate-cutting environment.

Bond Market Insight: The ongoing selloff in bonds indicates investor skepticism about long-term economic stability and inflation control. This trend could lead to higher borrowing costs, impacting sectors sensitive to rates, like real estate and utilities.

Dollar Dynamics: The dollar's strength, despite rate cuts, reflects global demand for safe-haven assets and confidence in U.S. economic resilience. This has implications for multinational companies, as a stronger dollar can pressure exports and impact the earnings of companies with significant international revenue.

Trade Considerations:

Watch Rate-Sensitive Sectors: Rising yields may put further pressure on bonds, affecting companies reliant on low-rate environments.

Multinationals and Exporters: Consider monitoring sectors that could be negatively impacted by dollar strength, such as industrials and tech with significant overseas exposure.

The bond market’s decline and dollar resilience add complexity to the investment landscape, especially in a week already loaded with election results and an FOMC decision. Stay vigilant for shifts in sentiment and keep an eye on these dynamics as they evolve.

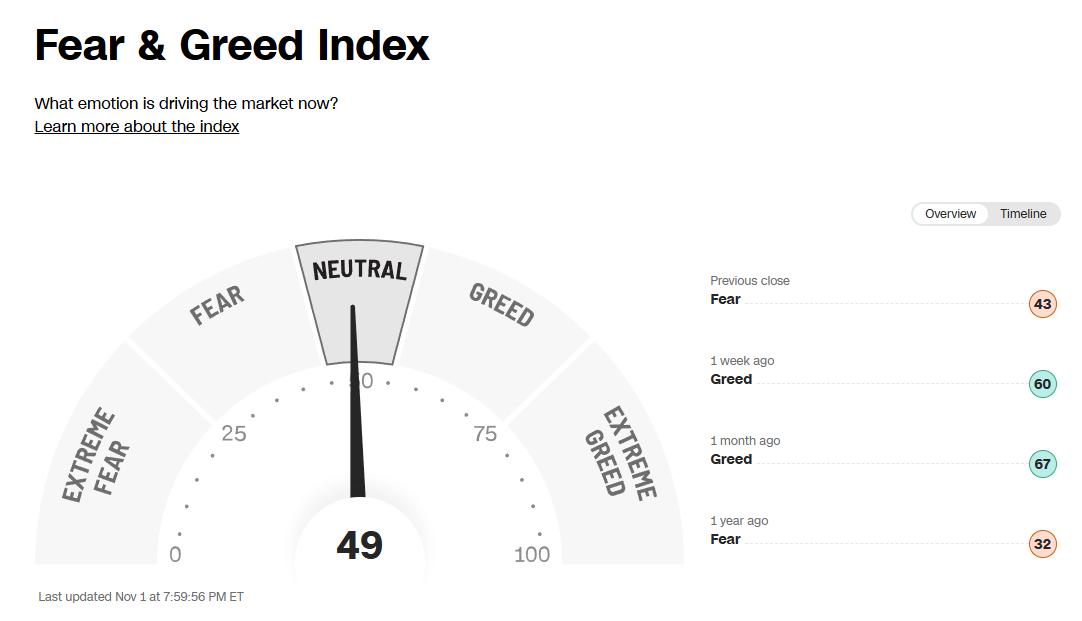

Market Sentiment:

Just two red weeks with barely a pullback was enough to reset the fear & greed index from extreme greed 76 to neutral 49.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

SPX Analysis:

Key Levels: 5763 & 5638

Rising wedge breakdown attempt

Bullish Trajectory: Bulls need to reclaim 5763 for a gap fill attempt at 5813 and a move back up to 5842+. As long as above 5638 the breakout is intact and bulls have the upper hand. Longs in the form of failed breakdowns are favorable as long as above 5638.

Bear Trajectory: Bears have an opening here while below 5763. If they can hold 5763, can target a retest of the September breakout at 5638. At this zone bears should expect bulls to put in a fight and breakdowns may fail. If they can get below 5638, a downside move and failed breakout begins, targeting 5551 & 5508.

Summary:

Between 5638 & 5763 is a battle zone between bulls and bears. Above 5763 bulls take back control for a move back to 5813 & 5842. Below 5638 the bears take control for a move down to 5551.

IWM 0.00%↑

IWM has stalled for months now at this long term trendline waiting on the election & FOMC. If it can hold above this 224 area after election and FOMC where it struggled earlier in the year, it could continue higher into new highs and ultimately 295. It is right at that line now so it either rejects or attempts breakout for new ATH imminently.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.