JR28 Weekly Trading Newsletter: January 20 – January 24

Market Overview

Holiday Reminder: Markets are closed on Monday, January 20 for Martin Luther King Jr. Day and President Trump's inauguration.

Economic Calendar:

Thursday: Initial Jobless Claims (8:30 AM ET)

Friday: Global Services PMI and Manufacturing PMI (9:45 AM ET)

Earnings Week Kickoff

The first big earnings week of the year is here. Key reports to watch:

Tuesday: Netflix (NFLX), United Airlines (UAL)

Wednesday: Abbott (ABT), Ally (ALLY), Johnson & Johnson (JNJ)

Thursday: American Airlines (AAL), General Electric (GE), TX Instruments (TXI)

Friday: Verizon (VZ), American Express (AXP)

Trade Recap – Prior Week

Last week was a solid one for our trades and setups:

SPX: We anticipated a revisit to 6009 if 5800 held, and the market delivered, reaching 6014.

SPY $585C JAN 17: Alerted at 2.13, this ran up over 13+, a phenomenal move!

TSLA $500C FEB 21: Alerted at 7.6, this surged to 18+, rewarding patience.

MU Commons: Acquired at 89 and trimmed profitably at 105.

COIN Commons: Entered at 268 and trimmed at 296.50, capturing strong gains during an impressive week for the stock.

Market Developments

Trump's Inauguration and Executive Orders:

The market is bracing for volatility as President Trump takes office. Expect a surge in executive orders in his first week, and markets are already beginning to price in their potential impact.

Historically, new administrations introduce significant changes, and this one is already sparking movement.

Trump's Memecoin Launch:

On Friday, President Trump launched a memecoin, which has reached a staggering $70 billion market cap in just a few days.

However, this has caused liquidity to flow out of the broader crypto market, with Solana being the sole beneficiary while most other altcoins declined.

Outlook for the Week Ahead

A short trading week often brings compressed volatility. With new economic data and the earnings calendar heating up, opportunities will present themselves in equities and options.

Keep an eye on the reaction to executive orders and headlines around fiscal policies. They could influence sector-specific moves.

The crypto market is one to watch, particularly for signs of stabilization as liquidity dynamics evolve.

Market Sentiment:

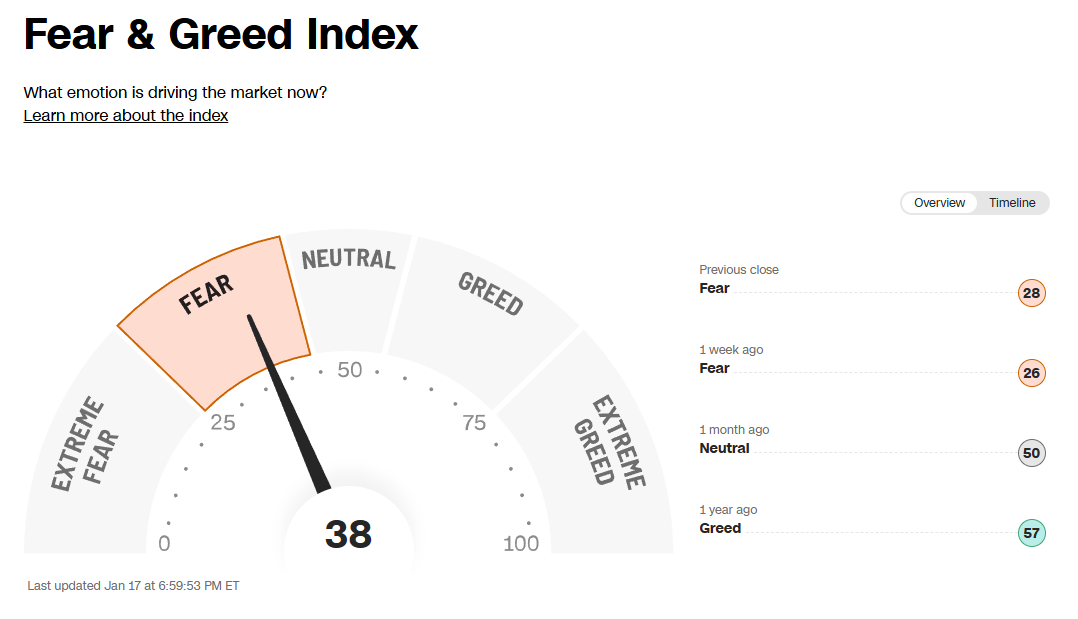

Market sentiment remains cautious despite proximity to all-time highs, with the Fear & Greed Index at 38 signaling fear and the AAII Investor Sentiment Survey showing 40.6% bearishness, a one-year high. This divergence suggests underlying skepticism and hesitation among investors, potentially setting the stage for increased volatility.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Analysis:

Key Levels: 6009

The same level has been key for the entire month and it is what the bulls need to cross to get the breakout. If there is a sustained move over 6009 we are likely to see 6150+. However, another failed breakout would have consequences leading to a steep sell so continue to trade cautiously into these upcoming volatile weeks.

Bullish Setups:

1. Continuation FBD long from 5780 into 6100+. If you took this last week all you have to do is raise stops

2. There is an open gap below at 5871. As long as this gap holds look for FBD to relong back to 6009+.

Bear Setups:

1. A failure again at 6009 leading to a gap fill test below at 5871. Strong bearish conditions would completely fill the gap versus if we get to around 5924-5930 and then reverse, would imply strength favoring the bulls.

IWM 0.00%↑

Possible failed breakout however we are now retesting this downtrend line so this could be the start of the rally to 270+

Bullish: Above 226, we can re-long targeting a move back to ATH.

Bearish: Below 216, watch for a potential drop to 199.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.