JR28 Weekly Trading Newsletter: March 10 - March 14, 2025

📰 Market Recap & Trade Review

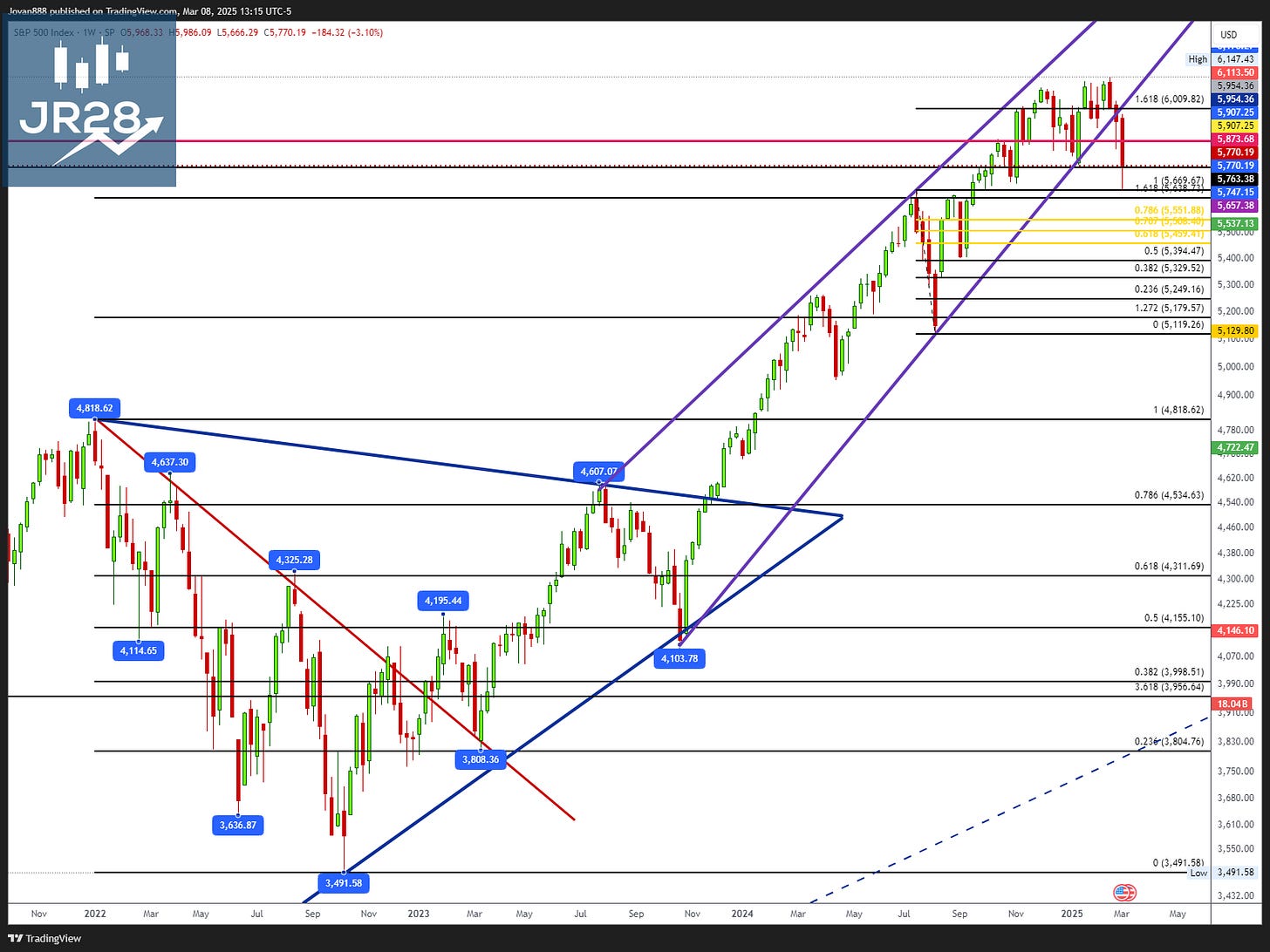

Last week, we saw some big moves across the board, with our SPX short call playing out beautifully. We mentioned shorts below 6009 with a target toward 5638—SPX started at 5968 and sold off hard to 5666, before bouncing strong.

🔥 Trade Recap

SPY 580P (MAR 7) – Entry at $1.67, ran over $15+ 🚀

SPY 590C (MAR 28) – Entry at $3.10, ran over $5.15 ✅

📉 Key Takeaway: Volatility continues to present major trading opportunities. Keep sizing right and staying nimble in this environment.

📆 Key Economic Events This Week

This week brings major catalysts, especially with NFP & Powell's speech on Friday. Expect some volatility spikes around these events.

🔹 Monday (Mar 10)

9:45 AM – S&P Global Manufacturing PMI (Feb)

10:00 AM – ISM Manufacturing PMI & Prices (Feb)

🔹 Tuesday (Mar 11)

9:10 PM – Trump Speaks 🗣️ (Potential market-moving event)

🔹 Wednesday (Mar 12)

8:15 AM – ADP Nonfarm Employment Change (Feb)

9:45 AM – S&P Global Services PMI (Feb)

10:00 AM – ISM Non-Manufacturing PMI & Prices (Feb)

🔹 Thursday (Mar 13)

8:30 AM – Initial Jobless Claims

🔹 Friday (Mar 14) – 🔥 Huge Day!

8:30 AM – Average Hourly Earnings (Feb)

8:30 AM – Nonfarm Payrolls (Feb) 🏆

8:30 AM – Unemployment Rate (Feb)

11:00 AM – Fed Monetary Policy Report

12:30 PM – Fed Chair Powell Speaks 🎙️

1:30 PM – U.S. President Trump Speaks

💰 Earnings to Watch

🔹 Monday (Mar 10) – $ORCL (Oracle)

🔹 Tuesday (Mar 11) – $KSS (Kohl’s), $DKS (Dick’s Sporting Goods)

🔹 Wednesday (Mar 12) – $ADBE (Adobe), $AEO (American Eagle), $CCI (Crown Castle)

🔹 Thursday (Mar 13) – $ULTA (Ulta Beauty), $DOCU (DocuSign)

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Outlook & Key Levels

We gave 6009 as the pivot for the last couple of months and warned that if we broke below, it that we would sell towards 5638. We just completed this move so now we have a new pivot of 5638.

📊 Key Levels: 5638, 5873, 6009

Above 5638 (higher likelihood) → Oversold/relief rally back to red line at 5873 and overshoot back to 5920, 6009.

Below 5638 → Breakdown that takes us down into 5551

🔹 Bullish Setup: Longs against 5638 for a relief bounce move to 5873, 5920+.

🔻 Bearish Setup: Shorts against 5638 for a breakdown toward 5551

QQQ & IWM

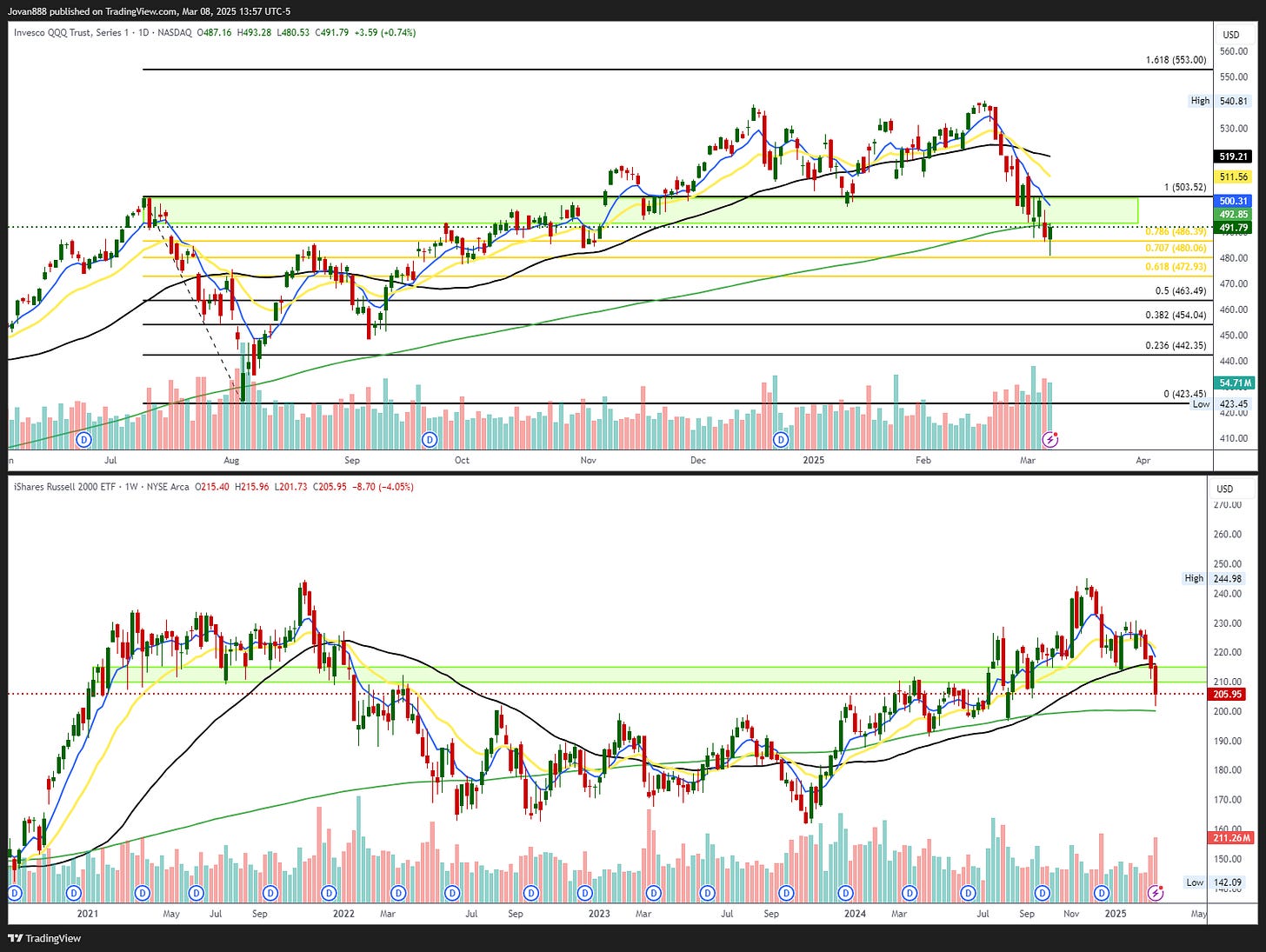

No change in outlook—continuing the same setup given months ago.

QQQ: > 494 Pivot trigger for upside. bounce back to 503 likely.

< 480 = more downside to 472, 463

IWM: > 210 pivot trigger for upside bounce back to 216 likely.

< 200 = more downside towards 193

Trade Ideas: Stocks to Watch

Tesla (TSLA): TSLA election gap has now filled at 255. While there is still a bit more room lower on this backtest, I think that this 230-260 area is a good area to scoop longs for a move back to 320-347. Stops below 230.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.