Weekly Market Insights: November 18th – November 22nd, 2024

Market Recap: Indices Performance (Week of Nov 11th – Nov 15th)

Last week, the major U.S. indices saw sharp declines:

S&P 500 (SPX): Decreased by -2.38%, closing at 5,870.

NASDAQ 100 (NDX): Fell by -3.42%, ending at 20,394.

Dow Jones Industrial Average (DJIA): Dropped -1.24%, finishing at 43,440.

Russell 2000 (RUT): Declined by -4.05%, closing at 2,303.

Key Events This Week

While the calendar is relatively light, a few pivotal events could influence market sentiment:

1. NVIDIA (NVDA) Earnings – Wednesday, November 20th

NVIDIA's Q3 earnings are this week's most anticipated event, given its critical role in shaping market sentiment this year.

YTD Performance: NVIDIA has surged +189.78% year-to-date, driven by its leadership in AI and semiconductors.

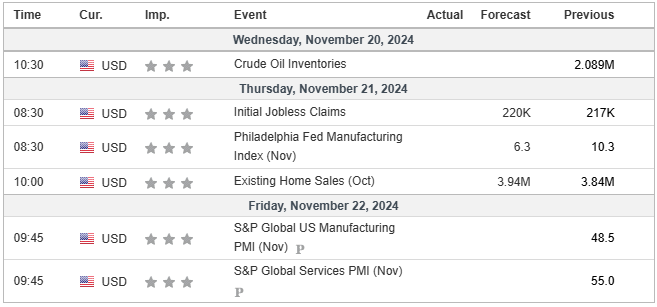

2. Economic Data Releases

Thursday, November 21st:

Initial Jobless Claims: A closely watched labor market indicator.

Philadelphia Fed Manufacturing Index: A barometer for the health of the manufacturing sector.

Friday, November 22nd:

Flash PMI (Purchasing Managers’ Index): A vital snapshot of manufacturing and services activity. Markets will react strongly to deviations, as these readings signal broader economic health.

Market Outlook

The week ahead could see continued caution, but NVIDIA earnings and economic data may drive sentiment. The tech sector, as represented by the NASDAQ, remains in focus.

Bullish Scenario: Strong earnings from NVIDIA and better-than-expected economic data could reignite risk-on sentiment, particularly for growth and tech stocks.

Bearish Scenario: A miss on NVIDIA earnings or disappointing PMI readings could deepen losses across indices, pushing investors toward defensive sectors.

Strategic Notes

For Investors:

Maintain balanced exposure. Consider defensive sectors like healthcare and utilities if risk-off sentiment grows.

Tech leadership remains vital—track NVIDIA's results closely.

For Traders:

Earnings Play: Consider straddle or strangle options strategies on NVIDIA to benefit from potential post-earnings volatility.

Levels to Watch:

SPX must hold 5870 for bulls to regain control, otherwise can continue selling towards the election gap at 5783.

Target Achieved: Last Week's Successful Trades

Last week, we called for a pullback on SPX towards 5870. We closed the week exactly at 5870: “Unless 6009 is overcome, a reset likely takes place with a small pullback to reset overbought indicators. Bulls should look for failed breakdowns of key levels to re-enter longs. Bears could use 6009 as a LIS and attempt a short back to 5870 area.”

We called for a pullback on TSLA.

We called for a continuation rally on AMZN towards 224.

We caught a breakout on GME.

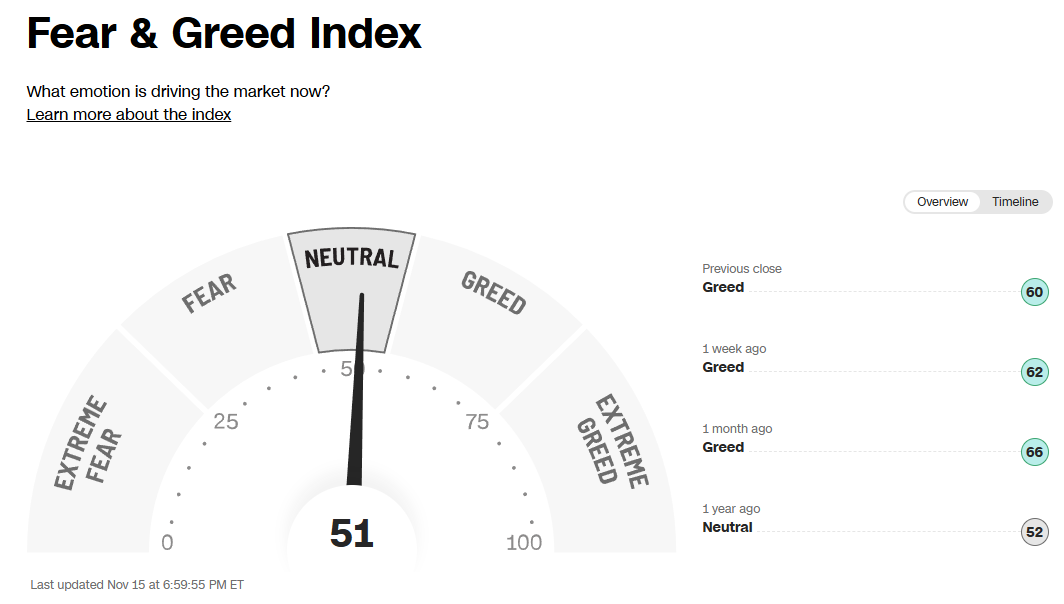

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

SPX Analysis:

Key Levels: 5772 & 5870

Using 5870 as a guide, if we are above this, I lean towards a retracement towards 5915 and an attempt to take out the island gap at 5942. If we have a “look above and fail” scenario where we fail to close the gap, we likely retest the lows near 5853 and if that does not hold, we could get closer to the election gap around 5782.

Bullish Setups:

1. A failed breakdown of 5870 would be an ideal relong, trailing stops up on the way towards the prior Friday high at 5915 and the gap above at 5942.

Bear Setups:

1. A failed breakout / look above and fail around 5915-5930 could be a good short opportunity back towards 5870 & 5853

2. A break of 5853 could be a good short towards 5782.

IWM 0.00%↑

The election triggered a decisive breakout on the weekly chart, breaking through a multi-year trendline. For bulls to maintain momentum toward new all-time highs, it’s essential to hold above 232. Last week we dipped below to 228 and this week is going to be very important that we hold 226 and bounce back over 232 for bullish continuation.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.