Welcome back to JR28’s weekly market newsletter! Here’s what to watch as we wrap up October and roll into November.

1. Key Earnings Reports to Watch

As earnings season heats up, this week’s lineup will include reports from major tech, finance, and consumer goods companies. Look out for big names like Apple (AAPL), Amazon (AMZN), and Exxon Mobil (XOM), each poised to reveal insights into consumer spending, tech demand, and energy trends.

$GOOGL - Oct 29th

$META - Oct 30th

$MSFT - Oct 30th

$AAPL - Oct 31st

$AMZN - Oct 31st

2. The Fed’s Next Moves: FOMC Meeting on November 7

The Federal Open Market Committee (FOMC) is set to meet on November 7th. Although many expect the Fed to hold rates steady or a 25bps cut, investors will be watching for signals on future rate hikes or cuts. Any suggestion of loosening monetary policy could provide a tailwind for tech stocks, while a hawkish tone could benefit sectors like energy and finance. Keep a close eye on the Fed’s language around inflation and economic resilience.

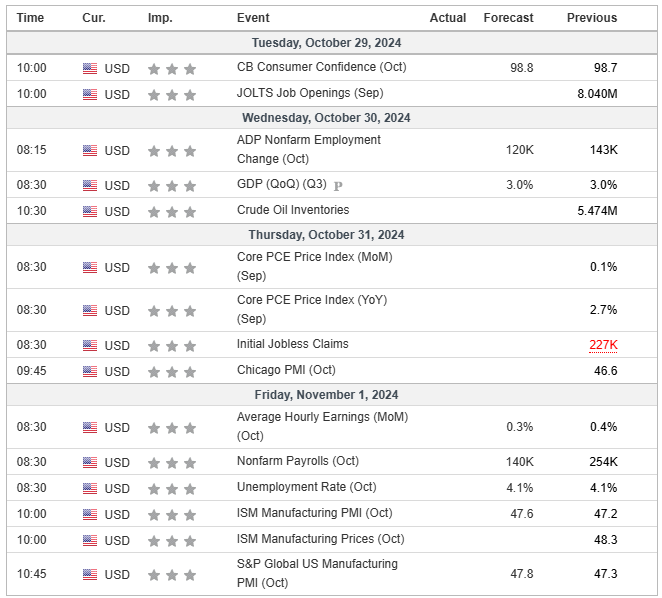

3. Market Indicators: GDP, PCE, PMI & Employment Data

Economic calendar for the upcoming week:

4. Sectors in Focus

Tech: Q3 earnings from major tech companies should provide insights into how inflation and supply chain challenges are impacting tech growth. A dovish tone from the Fed could fuel further growth here.

Energy: With recent volatility in oil prices, energy stocks remain in the spotlight. Look for opportunities in companies with strong fundamentals that can withstand fluctuating commodity prices.

Financials: With interest rates potentially remaining high, banks and other financial services may see sustained gains. Regional banks, in particular, may show strength as long as credit conditions remain stable.

5. Trade Idea of the Week: Quality Stocks in Defensive Sectors

This week, consider adding positions in high-quality defensive stocks, particularly in sectors like healthcare, utilities, and consumer staples. These sectors historically perform well during periods of economic uncertainty and can provide stability in your portfolio as the market absorbs new data from the Fed and key earnings.

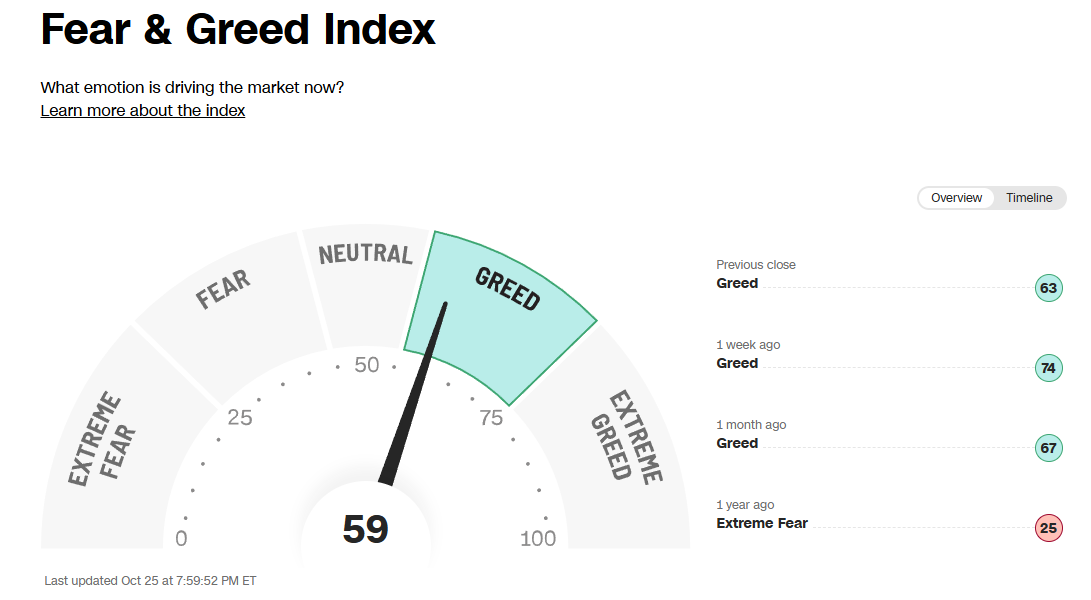

Market Sentiment:

Just one red week with barely a pullback was enough to reset the fear & greed index from extreme greed 76 to greed 59.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader) & TRADEIFY

Promo code: JR28

TPT offers the best payout system in the industry with no restrictions or limitations on payouts. You can pay yourself daily, any amount in your PRO accounts.

Tradeify allows you to skip evaluations and jump straight into funded accounts where you can earn real profits however there are restrictions and limitations on the payouts.

Technical Analysis

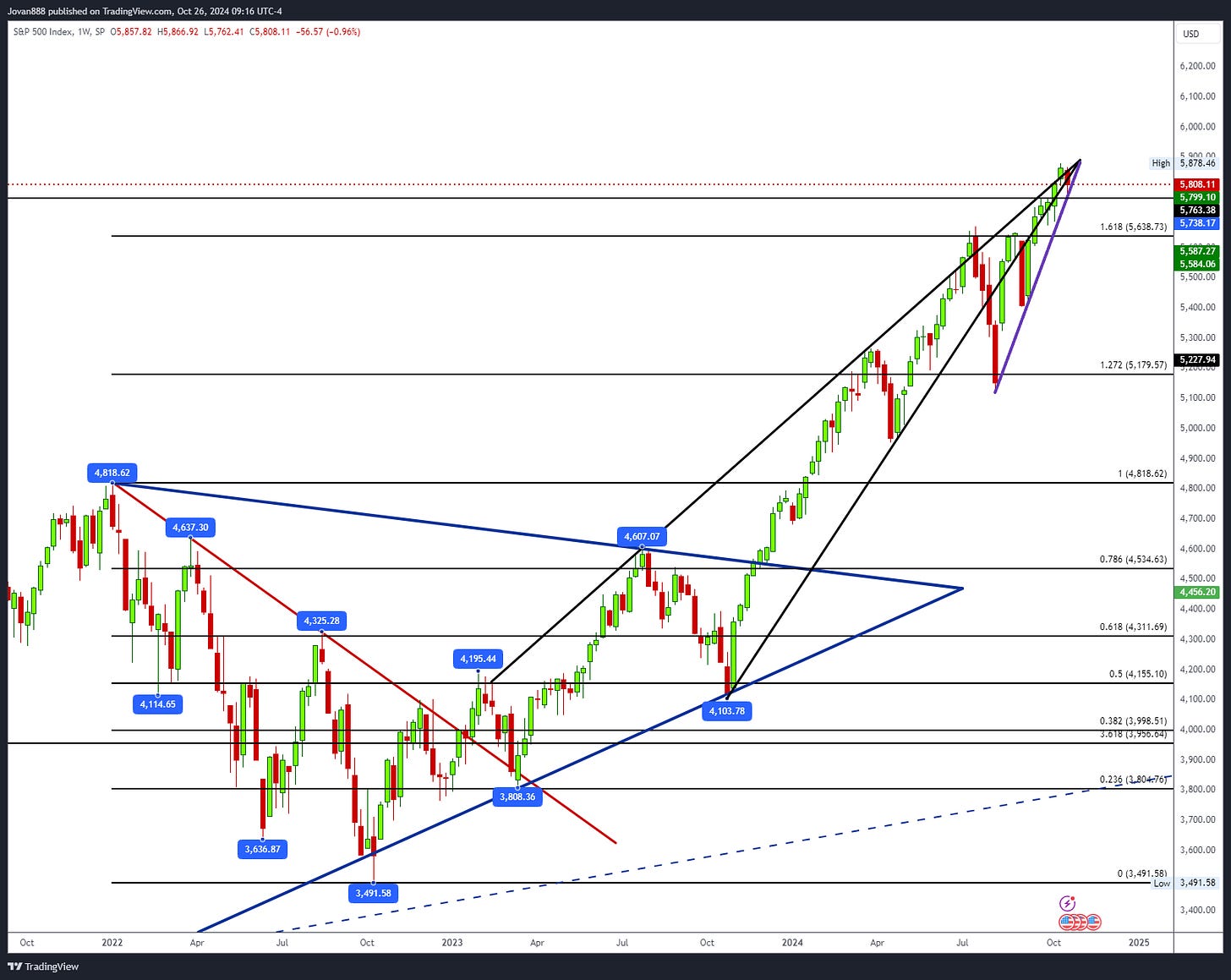

SPX Analysis:

Key Levels: 5763

Rising wedge throwover.

Bullish Trajectory: Bulls are in control above 5763 in active breakout. 5763 has already been backtested and held so this will continue to be our LIS for this current breakout. If above 5763 continue to look for failed breakdowns to initiate longs towards 5900.

Bear Trajectory: There’s no major bear scenario right now, but a short trade could develop at any moment if 5763 were to fall. Bears being so close to ATH, should watch for failed breakouts (2b tops) to initiate a short trade with a tight stop. At this point any failure below 5820 could lead to a retest of 5763 and setup the short swing trade.

Summary:

Draw a line at 5763 (blue box in my chart below). Above this, bulls have the edge and failed breakdowns on dips are ideal. Below this, bears begin to take the edge and failed breakouts on rips are ideal.

IWM 0.00%↑

Longs are favorable above 216.83 but not below. IWM has stalled for months now at this long term trendline. If it can hold above this 224 area where it struggled earlier in the year, it could continue higher into new highs and ultimately 295. It is right at that line now so it either rejects or attempts breakout for new ATH imminently.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.