JR28 Weekly Trading Newsletter: December 30 – January 3

Welcome to the final week of 2024 and the start of 2025!

Please note this is a shortened trading week, as markets will be closed on Tuesday, January 1, in observance of New Year’s Day.

Key Calendar Events

Here’s what’s on tap for economic data this week:

Monday, 9:45 AM: Chicago PMI (December)

Thursday, 8:30 AM: Jobless Claims

Thursday, 9:45 AM: S&P Global US Manufacturing PMI (December)

Friday, 10:00 AM: ISM Manufacturing PMI and ISM Prices (December)

Additional Note: Tesla (TSLA) delivery numbers are expected shortly after the New Year and could provide a catalyst for the stock. Stay tuned!

Recap of Last Week’s Trade Ideas

Last Week’s Top Trade Recap

It was a solid week of trading with several standout plays:

NVDA 135C JAN 31: Entry at 6.15, trimmed at 12.10 for a nearly 96% gain.

SPY 600C DEC 31: Entry at 1.73, exited at 3.62 (+109%).

SPY 570P JAN 24: Entry at 1.72, exited at 3.15 (+83%).

Key Highlights from Last Week:

TSLA: Buying the dip at 414 proved prescient, as the stock bottom-ticked there before surging back to 460.

NVDA: Despite concerns over a potential head and shoulders pattern, we anticipated it would result in a false breakdown (FBD) and move back to 142, which it achieved.

GME: Continued its upward momentum, approaching the 35.85 level as expected.

AMD: A well-timed FBD at 117 led to a strong move up to 127.

Opportunities Ahead

As we close out the year and head into a new one, focus remains on:

TSLA: Watch for delivery numbers and potential catalysts. Dips near key levels could offer excellent buying opportunities.

SPY & Major Indices: Monitor key data points this week for potential market-moving events.

Semiconductors (NVDA, AMD, etc.): Continued strength suggests opportunities for momentum plays.

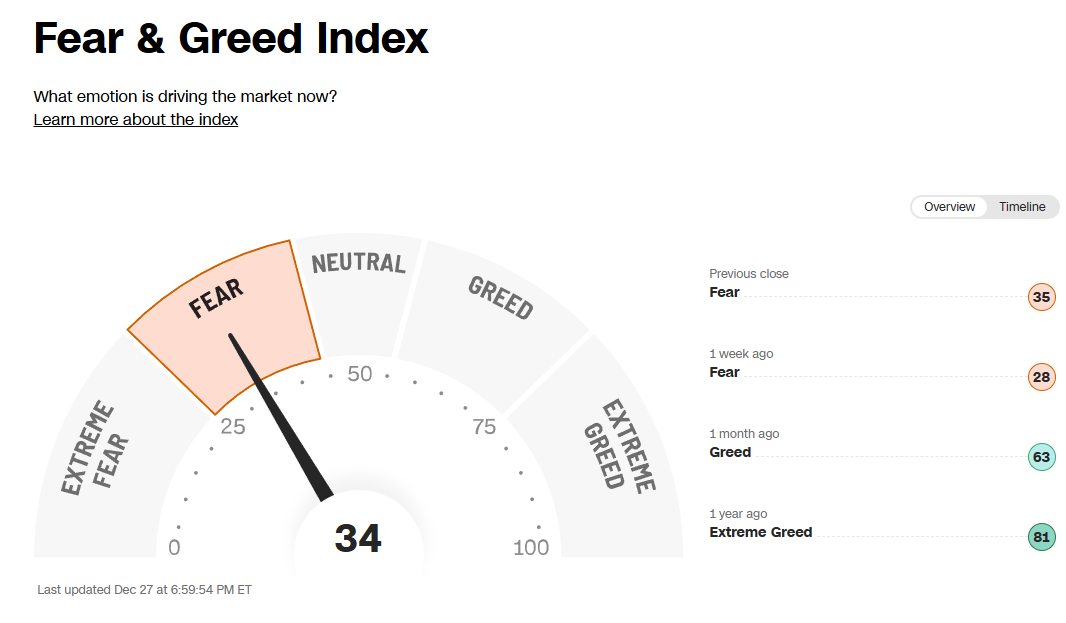

Market Sentiment:

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

Technical Analysis

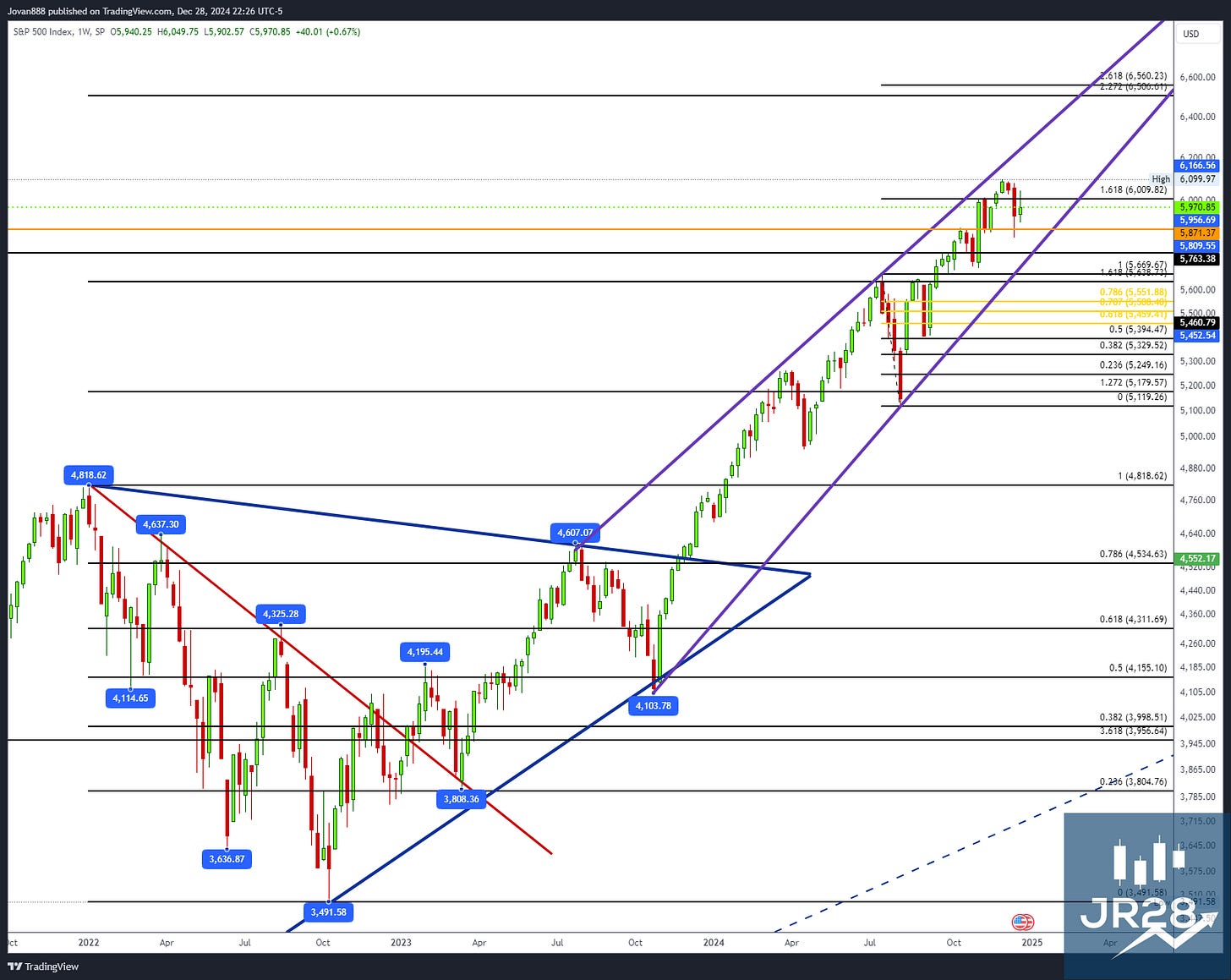

SPX Analysis:

Key Levels: 6009

6009 has been a key level for over a month and continues to be here as it forms a potential head and shoulders. Bulls will need to overcome 6009 again to get a rally going into 6200+

Bullish Setups:

1. A reclaim / failed breakdown of 6009 for a long into 6200

2. A reclaim / failed breakdown of 5763 for a long into 5870.

Bear Setups:

1. A head & shoulders, short against 6009 for a move down into 5871 - 5800.

IWM 0.00%↑

Possible failed breakout with a sweep above the prior ATH to take out stops before reversing lower.

Bullish: Above 226, we can re-long targeting a move back to ATH.

Bearish: Below 216, watch for a potential drop to 199.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.