🌟 “You don’t get what you want. You get what you believe you are.” — JR28

JR28 Weekly Market Blueprint

Week of June 23 – 27, 2025

JR28 | The Edge Within

⚡ 1-Minute Market Recap (Jun 13 – 20)

S&P 500: −0.15% → 5,980.87 • Nasdaq-100: −0.02% • Russell 2000: +0.15%

Middle-East flare-up: Israel–Iran conflict spiked oil +12% before retracing to $76.96 on de-escalation talk.

Gold: Hit $3,470 before cooling to $3,385.

Fed: Held rates steady → projecting 2 cuts in 2025, slower easing beyond.

VIX: Opened at 19.78 • High 21.79 • Low 18.67 • Closed 20.61 — fear elevated, not priced out.

Big Movers:

🟢 COIN +27% (crypto surge)

🟢 BSE Sensex/Nifty +1.29% (India bid)

🔴 SEDG −29% (solar flush)

🔭 Economic Events – Week at a Glance

Monday, June 23

• 09:45 AM — S&P Global Manufacturing PMI (Jun, Prelim)

• 09:45 AM — S&P Global Services PMI (Jun, Prelim)

• 10:00 AM — Existing Home Sales (May)

Tuesday, June 24

• 10:00 AM — CB Consumer Confidence (Jun)

• 10:00 AM — Fed Chair Powell Speaks

Wednesday, June 25

• 10:00 AM — Fed Chair Powell Speaks

• 10:00 AM — New Home Sales (May)

• 10:30 AM — Crude Oil Inventories

Thursday, June 26

• 08:30 AM — Durable Goods Orders (May, Prelim)

• 08:30 AM — GDP QoQ (Q1 Final)

• 08:30 AM — Initial Jobless Claims

Friday, June 27

• 08:30 AM — Core PCE Price Index (MoM)

• 08:30 AM — Core PCE Price Index (YoY)

💼 Key Earnings to Watch

Monday, June 23: $CMC

Tuesday, June 24: $CCL, $FDX, $BB

Wednesday, June 25: $GIS, $MU

Thursday, June 26: $MKC, $AYI, $WBA, $NKE

Friday, June 27: No major earnings expected

📊 Key Levels & Trade Setups

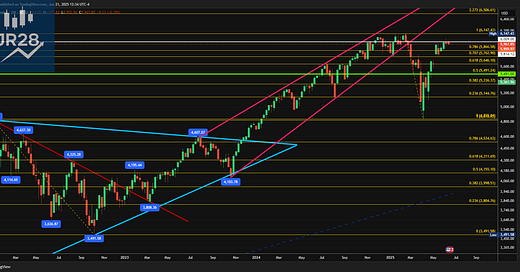

SPX

Leaning slightly bearish after failing to hold 6009.

• Pivot: 6009

• Above 6009: Rally to 6147 and potential new all-time highs

• Below 6009: Sell-off toward 5720 gap fill

NQ Futures

Key range compression — watching for breakout or breakdown.

• Resistance: 22177 → If cleared, target 22310 then 22480

• Support: 21687 → If lost, watch 21545, then 20503

TSLA

Watching 322 as a key level.

• Above 322: Push to 347–350

• Below 322: Watch for drop toward 310–295

NVDA

140 is the pivot level.

• Above 140: Room to run to 154

• Below 140: Likely fades to 130

AMZN

Still watching the 200 zone for potential re-entry.

• Support: 200

• Target: 217

• Risk Below: 194

AAPL

Green on Friday in a sea of red — showing relative strength.

• Above 194: Can retest 210, then 219–222

• Below 194: Likely pullback to 182

⚡ Futures Trading Pick: Tradeify

Looking to scale with a firm that actually pays? Here’s our go-to:

✅ Tradeify — Use code JR28

➡️ 50K Growth Account ≈ $90.35 w/ discount

🧠 JR28 Trade Tips of the Week

1. Don’t Front-Run the News.

With Core PCE on Friday and Powell speaking twice, the market is reactive. Let price confirm your thesis before sizing up.

2. Relative Strength ≠ Noise.

When the market is red and names like AAPL print green, that’s signal. Lean into strength when volatility’s elevated.

3. Fewer Trades, Cleaner Mind.

This is a week for quality > quantity. Trade the edges, sit on hands in the middle. Avoid overtrading when catalysts are stacked.

4. Watch the Close, Not Just the Open.

Volume and conviction tend to show up late in high-stakes weeks. How we close Monday–Thursday may hint how we open Friday post-PCE.

5. Journal Everything.

Use your JR28 trade bot or just jot it down. In uncertain macro weeks, your reaction to market behavior matters more than prediction.

For real-time insights and deeper analysis, join our JR28 Discord community. Let’s navigate the markets together!

At JR28, we don’t just chase trades — we help you become the kind of trader who wins consistently. Our mission is to guide you toward smart, sustainable setups without the gamble.

Be selective. Be intentional. The edge is already within.

— Jovan @ JR28