JR28 Weekly Market Blueprint

Week of July 14–18, 2025

JR28 | The Edge Within

🌟 "The market rewards discipline, not desire. Stick to your plan and execute with intention." – JR28

🔁 Market Recap: July 7–13, 2025

Last week was a wild ride.

Markets started the week sharply lower as tariff fears spiked, only to grind back and hit fresh all-time highs midweek before fading into the weekend. Volatility was front and center as traders digested aggressive trade rhetoric from the White House, macro data, and some early Q2 optimism.

Monday, July 7: The Dow dropped 422 pts and the Nasdaq lost nearly 1% as Trump announced potential 25% tariffs on goods from key trading partners (China, Japan, BRICS, etc). Uncertainty spooked risk appetite across the board.

Midweek Rally: Markets calmed as Fed rate cut hopes reignited and Delta Air Lines posted strong guidance. Nvidia hit a $4T valuation briefly, helping tech rip.

Thursday/Friday: The S&P and Nasdaq tagged new highs, but sentiment reversed into the weekend after Trump teased a “major statement” on Russia scheduled for Monday (July 14). Traders took risk off into the unknown.

📉 The VIX closed the week above 17.

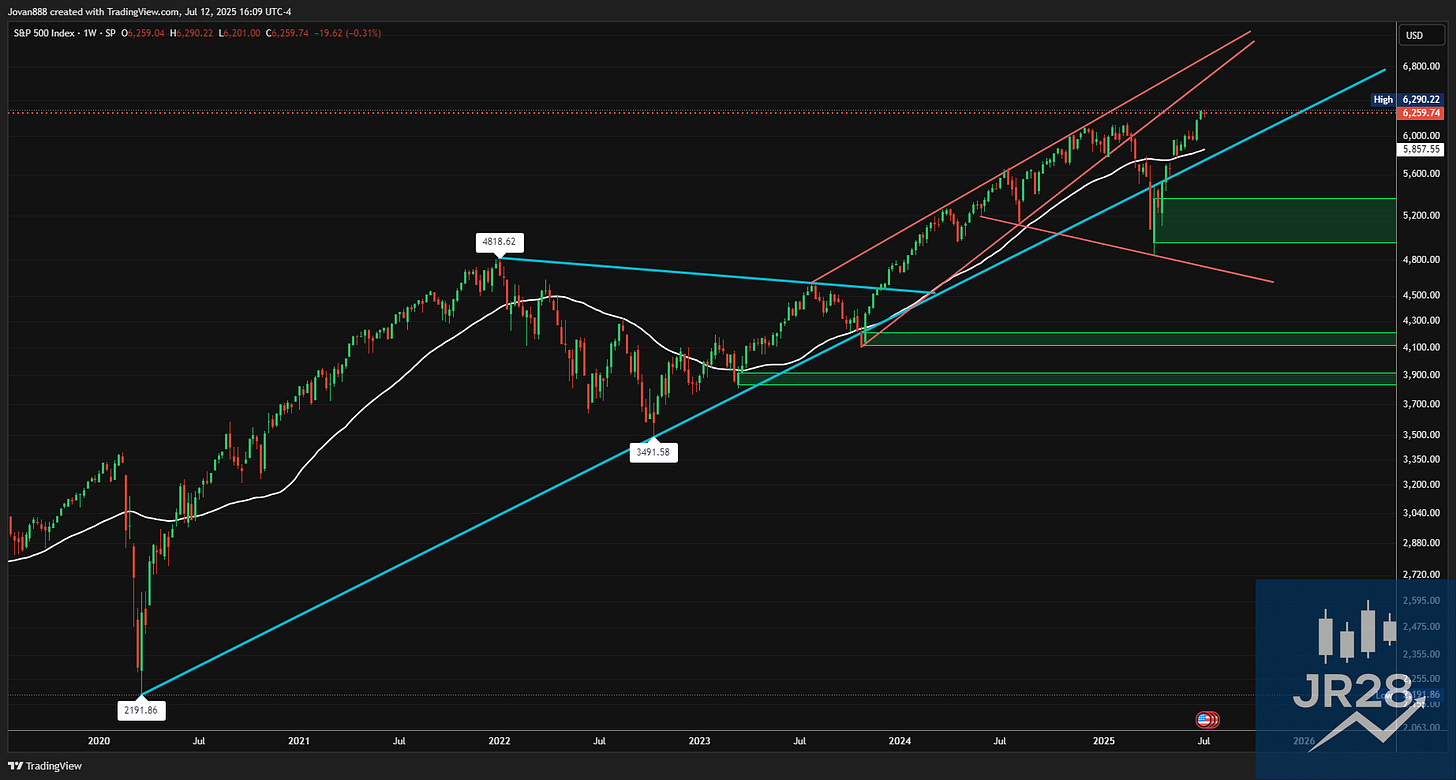

📊 The S&P 500 RSI showed negative divergence — a potential warning sign.

🧨 Key Headlines That Moved the Market

Trump Tariffs: Tension escalated as Trump threatened sweeping new tariffs, but extended the 90-day pause to August 1. The EU requested clarification before July 9, adding pressure. Markets are bracing for possible retaliation from BRICS countries.

Tesla Drama: TSLA tanked ~7% Monday after Musk’s political party announcement drew a jab from Trump. That added another layer of chaos to an already nervous Nasdaq.

Economic Data:

June jobs report was solid.

Initial jobless claims dropped to 227K (vs 242K expected).

Consumer credit came in light at $5.1B (vs $8.6B est).

Atlanta Fed’s GDPNow held steady at +2.6%.

FOMC Minutes: Revealed mixed views on future rate cuts, with traders pricing in just 6% odds of a cut on July 30. Total expected 2025 cuts dropped slightly to 2.01 from 2.05.

Geopolitical Risk: The Israel-Iran backdrop continued to weigh on oil, while U.S. supply data pressured prices lower. Trump’s upcoming Russia remarks could stir new volatility.

Sentiment Check: The Crowd Sentiment Poll climbed from “extreme pessimism” in April into a neutral/bullish zone, signaling room for upside — but caution short term.

🔎 What to Watch: July 14–18, 2025

This week will be data-heavy and event-driven. Expect volatility to continue.

💰 Earnings Kickoff: Big banks start reporting Q2 earnings Tuesday (July 15). These will set the tone — especially with margins in focus amid tariff risks.

📈 CPI + PPI Reports: Inflation data drops midweek and will be crucial for Fed expectations.

🛍 Retail Sales + Industrial Production: Key read on consumer demand and manufacturing activity.

🗣 Fed Watch: Traders will be parsing any speeches or hints from the Fed after last week’s minutes. Eyes are on July 30 for possible (but unlikely) action.

🌍 Geopolitical Risk: Trump’s Monday speech on Russia has potential to move global markets. Any escalation or surprise could spike VIX and shift sentiment sharply.

📉 Technical Caution:

RSI divergence and VIX rise could precede a pullback.

Seasonality favors weaker second half of July — stay nimble.

🚀 Upcoming Copy Trading Challenge — Get Ready!

We’re launching a new $5,000 small account copy trading challenge soon! To get ready, you need to:

Create and fund your brokerage account with Tradier now (essential for copy trading).

Sign up for the copy trading platform next week — we’ll share the signup link then.

Start your Tradier account here:

➡️ https://onboarding.tradier.com/signup?promo=JR28PRO&platform=304

Get set up early so you’re ready to copy trades the moment the challenge launches!

🗓️ Upcoming Economic Events

Week of July 15–18, 2025

TUESDAY, JULY 15

• 07:00 – OPEC Monthly Report

• 08:30 – CPI & Core CPI (June)

• 08:30 – NY Empire State Manufacturing Index (July)

• 09:15 – FOMC Member Bowman Speaks

• 12:45 – Fed Vice Chair Barr Speaks

• 16:30 – API Weekly Crude Oil Stock

WEDNESDAY, JULY 16

• 08:30 – PPI & Core PPI (June)

• 09:15 – Industrial Production (MoM & YoY, June)

• 10:00 – Fed Vice Chair Barr Speaks

• 10:30 – Crude Oil & Cushing Inventories

• 14:00 – Fed Beige Book

• 16:30 – FOMC Member Williams Speaks

THURSDAY, JULY 17

• 08:30 – Initial & Continuing Jobless Claims

• 08:30 – Retail Sales, Core Retail Sales, Retail Control (June)

• 08:30 – Philly Fed Index & Employment (July)

• 08:30 – Export/Import Price Index (June)

• 10:00 – Business & Retail Inventories (May)

• 12:45 – FOMC Member Daly Speaks

• 13:00 – Atlanta Fed GDPNow (Q2)

• 16:00 – TIC Net Long-Term Transactions (May)

• 18:30 – Fed Waller Speaks

FRIDAY, JULY 18

• 08:30 – Building Permits & Housing Starts (June)

• 10:00 – Michigan Consumer Sentiment & Inflation Expectations (July)

• 11:30 – Atlanta Fed GDPNow (Q2)

• 13:00 – Baker Hughes Rig Count (Oil & Total)

• 15:30 – CFTC Speculative Net Positions (Crude, Gold, Nasdaq 100, S&P 500)

💼 Key Earnings – Week of July 14th, 2025

Monday, July 14th:

$FAST

Tuesday, July 15th:

$JPM, $C, $WFC, $BLK

Wednesday, July 16th:

$ASML, $BAC, $GS, $MS, $JNJ, $PGR

Thursday, July 17th:

$TSM, $PEP, $CTAS, $USB, $ABT, $NFLX, $IBKR

Friday, July 18th:

$AXP, $SLB, $MMM, $ALLY, $SCHW

⚡ Futures Trading Pick: Tradeify

Looking to scale with a firm that actually pays? Here’s our go-to:

✅ Tradeify — Use code JR28

➡️ 50K Growth Account ≈ $90.35 w/ discount

Our 30-day futures challenge on Tradeify was a huge success — turning $93 (cost of an evaluation) into $26,000 withdrawable profits in just 35 days!

🧠 Strategy for the Week Ahead

The market is juggling optimism with landmines.

Stay tactical. Stay aware.

Earnings will dictate tone. Strong results may keep this melt-up going.

But geopolitical landmines + tariff noise = risk of sharp sentiment shifts.

Be selective, take profit on strength, and don’t chase extended moves.

Defensive setups + watching VIX/RSI divergences can give early warning.

Watch tech — it’s led the charge but may pause for rotation.

📊 Key Levels & Trade Setups

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.