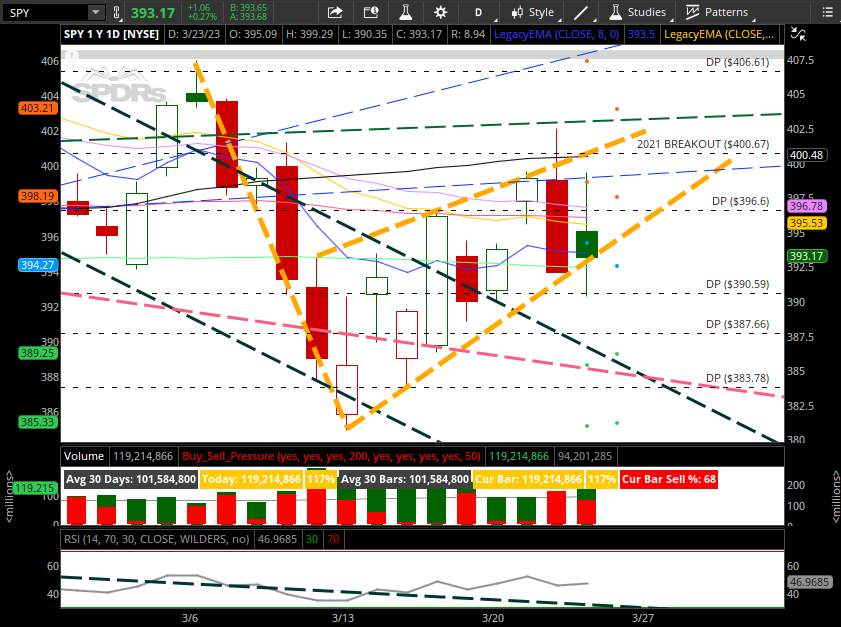

SPY 0.00%↑ trading in a tight range in an ascending wedge. Yesterday we attempted to breakout to the upside and sharply rejected. Today we attempted to breakout to the downside and rejected as 390.59 orderflow level supported the session.

We would need to see a daily close (or 2) below the 200sma 393.17 for continuation down into 383.78 (downside breakdown of wedge) or a daily close (or 2) above the 50SMA / orderflow level 400.67 for continuation up into 406.61 (upside breakout of wedge).

Typically rising/ascending wedges are bearish, however it is not assured, and you have to consider both the H and L range of the wedge for the next move.

Here’s what that looks like traditionally:

Here’s the economic calendar for tomorrow

Many tickers put in topping candles yesterday, and today even the ones that rallied, failed to take out yesterday’s high. All levels shared before are valid still, however new levels and setups will be sent out over the weekend in preparation for next week.

For trading tomorrow, here are the levels to lookout for:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.