Trade setups August part 2

Hi everyone!

SPY 0.00%↑

Last 2 weeks I gave the short trigger to short 551 to target 516 which we met before finding a relief bounce back to 533.

As of now I am neutral and watching the 50d sma above and the 200d sma below.

Currently multiple bearish patterns active and obvious downtrend

Not looking like a clean low yet so stay cautious if positioning long.

Trade Ideas:

1. Long 535.84 to target 543.23 (50dsma). Expecting major resistance there

2. Long any failed breakdowns around 519-522 to test 543.

3. Short below 519 to target 200dsma at 501.91.

AAPL 0.00%↑

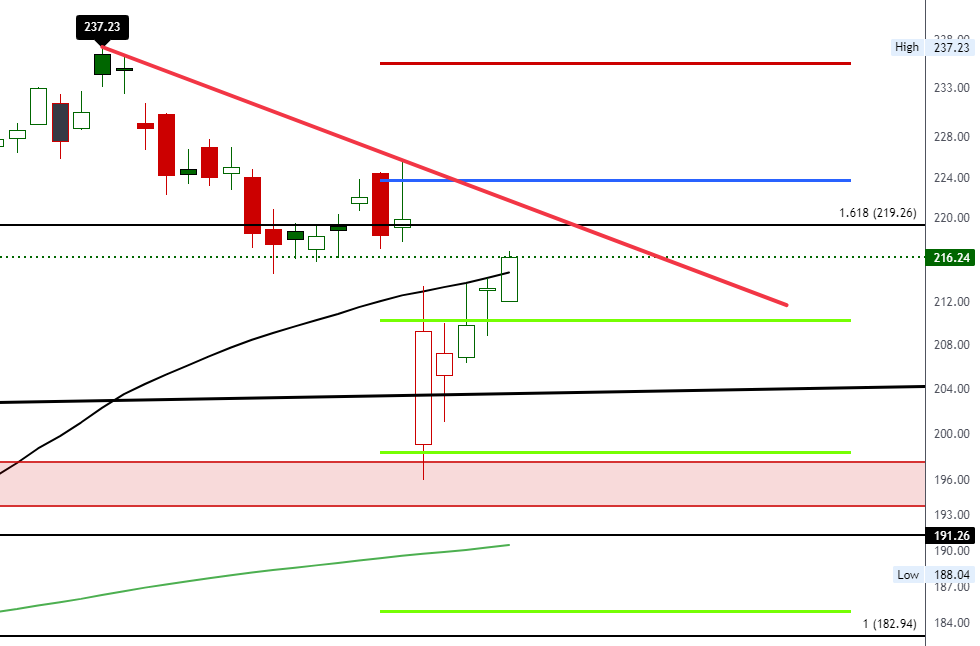

Last 2 weeks I mentioned below 219.26 we could sell down into 205 which we did and went lower into my red box. From there we had a sharp bounce and now we are retesting the downtrend line.

Trade ideas:

1. If downtrend line is broken and we are trading over 219.26 we could continue back higher to retest recent highs in 232-237 area.

2. If we reject and revisit the red box, can short down into 191 and 183.

NVDA 0.00%↑

Obvious downtrend which we had mentioned below 122 we could see 97 (red box).

Trade Ideas:

1. Above the red box longs are ok with a stop at the red box.

2. Below the red box, switch to shorts and target the 200dsma

TSLA 0.00%↑

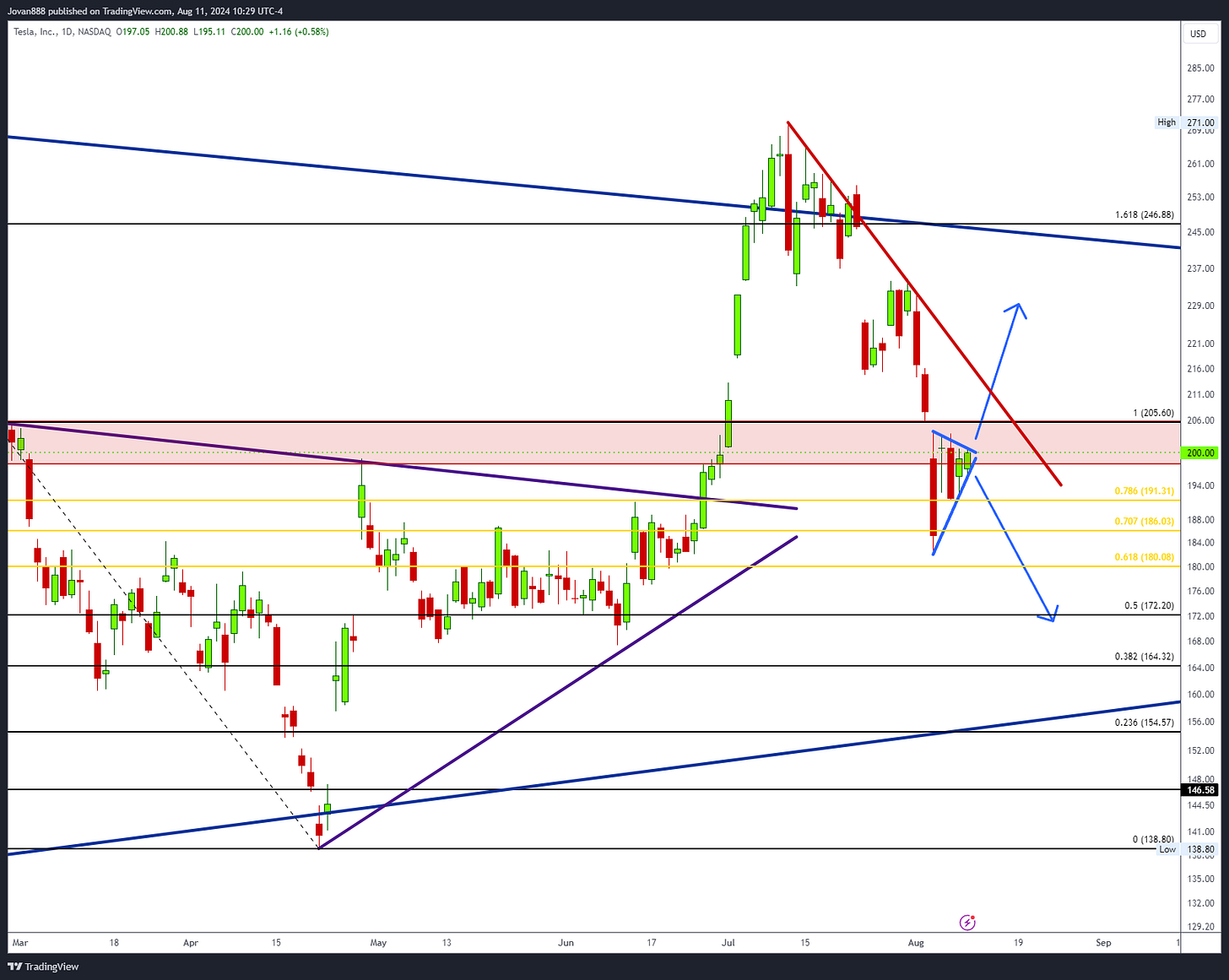

Same common trend as all the others where it is near a retest of the downtrend line. Both the 50d sma and 200d sma above it.

Trade Ideas:

1. Long over 206 with stop loss at 200 to target 224-230

2. Short under 190 with stop loss at 196 to target 180, 172

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.