Trade setups August part 4

Hi everyone!

SPY 0.00%↑

As per SPX post the two likely scenarios are continuation up in the wedge, or a breakout of the wedge to fill gaps left below. If long use 556 as a stop / pivot point to switch.

AAPL 0.00%↑

Continuation long as mentioned past couple of weeks, over 219 we are targeting 232-237. Short below 219 to 205.

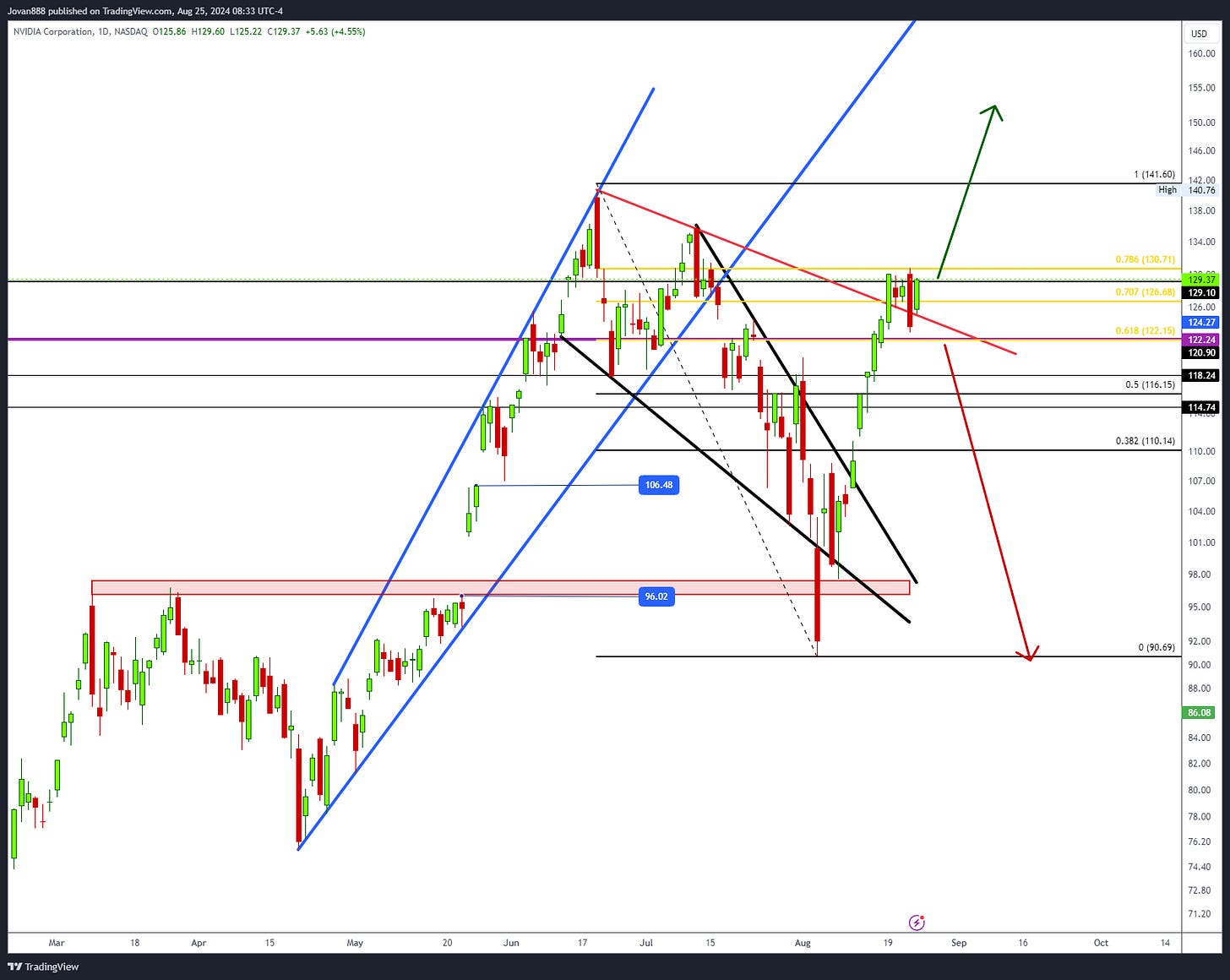

NVDA 0.00%↑

Earnings week ahead so expect volatility. Generally watching 131 and 122 levels. Above 131 we can target ATH and higher. Below 122 it becomes a short back to 94

TSLA 0.00%↑

224-230 zone to decide. If bulls overcome this zone then we can take out 245 level next. But if we get rejected, could see a sell down into 175. Potential bear flag on weekly.

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.