Hi everyone!

This past week we finally got some downside acceleration since the breakdown from the wedge. Last week we had some sideways action after falling out of the wedge and attempted to breakdown but could not. However, with this conviction sell below 5179 this breakdown is now active, and it marks the return of volatility and that predictable repetitive price action we’ve had for several months now is coming to an end. I have been warning the past several weeks that we were nearing the point where one of these next tests of the wedge will not hold and it will lead to a breakout and shift from this recent trend.

Last week I mentioned in our analysis of SPX:

“Bullish Trajectory: 5179 is the breakout origin and the bull last stand. Above this level longs are still playable however there is heavy resistance now at 5230 that must be overcome for any upside continuation.

Bear Trajectory: A breakdown of 5179 turns this into a failed breakout which could lead to a sell towards 5110 and 5056. If 5056 falls, then we start a sell leg to fill the gap at 4983 and head into 4800’s.”

We started the week with an attempt at that 5230-resistance level that I mentioned and failed, leading to sells lower into my 5110 level.

I will keep mentioning this because the risks are currently elevated: Crucial for the upcoming weeks: "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, and this short position should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn.

The 5179 fib extension continues to be the important zone to watch for the upcoming week it continues to define who is in control between bulls vs bears. Bulls are in control above 5179, bears in control below 5179. By control - I mean the trend goes from buy the dips (bull) to short the rips (bear).

SPX Analysis:

Key Levels: 5179 & 5110

Bullish Trajectory: No bull case below 5179 other than knife catches and to watch for a failed breakdown setup. 5179 is the breakout origin and the bull last stand. Above this level longs are still playable however there is heavy resistance now at 5230 that must be overcome for any upside continuation.

Bear Trajectory: Bears can maintain pressure as long as below 5179 which could lead to a sell that breaks 5110 and targets 5056. If 5056 falls, then we start a sell leg to fill the gap at 4983 and head into 4800’s.

Summary:

Bears in control below 5179. We could see some balance between 5179 and 5110 but below 5110 we can see continued selling into 5056 and 4983. No real bull case here unless 5179 is reclaimed and more importantly 5230 is cleared.

IWM 0.00%↑

Closed slightly under but near that 200 mark. If we bounce up next week and 200 holds then we could still stage a move into 216 (failed breakdown). If 200 falls / holds as resistance, then we could see a rising wedge breakdown and 2b TOP (failed breakout) that takes us back to 190.

QQQ 0.00%↑

QQQ remains in active breakout with 408 continuing to be the pivot spot of control. Above 408 there is plenty of upside room into 472 (measured move).

436 must hold for the bulls otherwise 427 is retested, 427 is last line of defense otherwise large sell into 408-411.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

On the subscriber only newsletter:

We covered amazing setups and gave clear LONG or SHORT recommendations on each ticker.

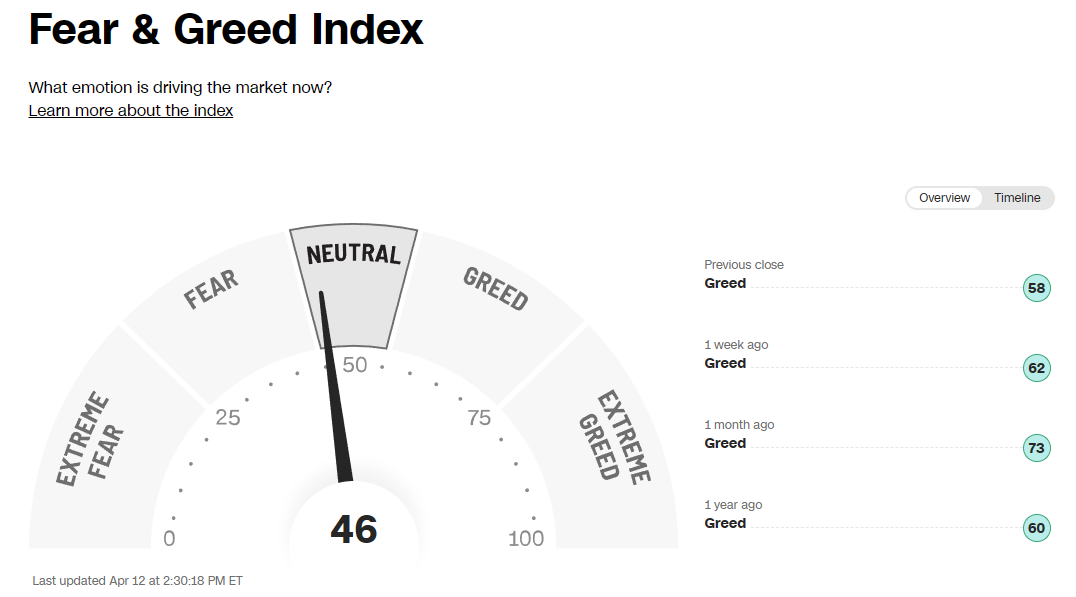

Sentiment Check

Here is the economic calendar for next week:

A separate newsletter will be sent tomorrow with the setups I am watching for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan