Week of August 14th, 2023

July over, pullback has started, what's next?

Hi everyone!

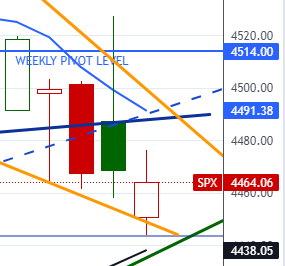

In our previous newsletter, I gave 4514 on $SPX as the pivot for this week which determined control between bulls & bears. I mentioned that if the bears managed to hold this level, we could see continued pullback movement towards 4443. Bears held this level the entire week taking us into a lower low each day for the entire week. I’ve mentioned a few times that the bull’s biggest enemy is not the bear, it’s the other bulls who see their unrealized gains start to dwindle and then step on each other’s toes on the way out.

Key Levels: 4514 will be the key level for the week.

Bearish Trajectory: If bears hold below 4514 then pullback continues towards backtest zone at 4474 and gap fill at 4443. If below 4443 can target 4425 and 50sma at 4406.

The range for the week was 4527 to 4443 and we closed at 4464. The low was the exact gap fill at 4443 before a 20 point bounce into the close.

We have moved down from “extreme greed” into “greed.” The markets have effectively completed a “reset” and filled the immediate gap that was left below at 4443 before the large breakout leading to a run over 4600+.

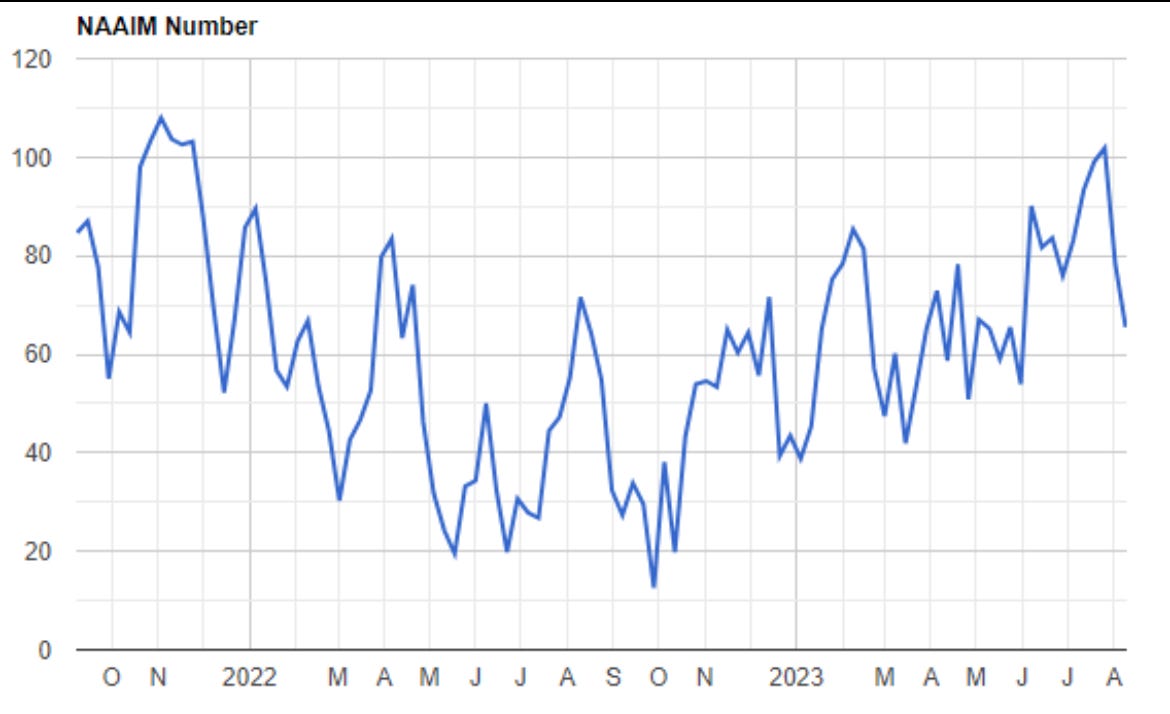

AAII survey continues to maintain high levels of bullish sentiment despite the past 2 weeks of selling. However, I want to point out that the NAAIM exposure index has dropped from over 100 2 weeks ago to 65.5. That’s a big dial back and its showing caution is the current trend.

On July 27th, active manager equity exposure was over 100% due to leveraged longs with the S&P over 4500. As of August 11th, that has dropped to 65.6.

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPX Analysis:

There is a bullish falling wedge right at that gap fill mark that can support the market for the upcoming week. That will be our pivot for the week.

Key Levels: 4443 will be the key level for the week.

Bullish Trajectory: If bulls hold above 4443 we can retest the 8ema at 4491 and setup for a retest of 4514. If 4514 is taken out we will likely see a short squeeze to fill the gap at 4567 and test the highs at 4607.

Bearish Trajectory: If bears hold below 4443 then pullback continues towards backtest zone at 4406 and 4393.

SPY 0.00%↑

Key level for the week is 442.97

Bull case: Above 442.97 falling wedge is in play to target 445.32 then 448.65 and 451.94. Big squeeze above 451.94 to target 455.49 and then test the highs at 459.44

Bear case: Below 442.97 target 441.98. There is heavy support at 441.98-442.97 and it won’t go down easily. If bears can take it down, then targets 437.86 and 431.19.

QQQ 0.00%↑

QQQ last week went EXACTLY as the red path we had posted:

Here is the after…

Outlined bull & bear case paths for next week below.

Key level for the week: 365.98

Bull case: Above 365.98 likely 50sma backtest to 369.06 then 8ema backtest to 371.17. Above 8ema can test fib at 375.66

Bear case : Below 365.98 is continued consolidation in the wedge lower towards 361

Note: 8 ema and 50sma coming together - if there is a crossunder it will indicate more downside to follow. If the 8ema remains above the 50sma it will indicate the end of the corrective wave.

TSLA 0.00%↑

Key level: 240

Bull case: Above 240 is an 8ema retest at 249.55. If above 249.55 target 254.12 then 50sma at 257.95 and fib at 258.15.

Bear case: Below 240 can see move to gap fill below at 235.23. Below that is 226.20 and then another unfilled gap below at 221.91

Note: There continues to be 300C flow for JAN 2024. On the monthly chart there is a potential IHS setting up with 194-221 as the right shoulder. Also note the 8ema has crossed under the 50sma and if it was going to bounce this is the spot. Otherwise no bounce till 221 or lower.

BA 0.00%↑

Weekly breakout as long as above 225 to targets 240 and 267.51.

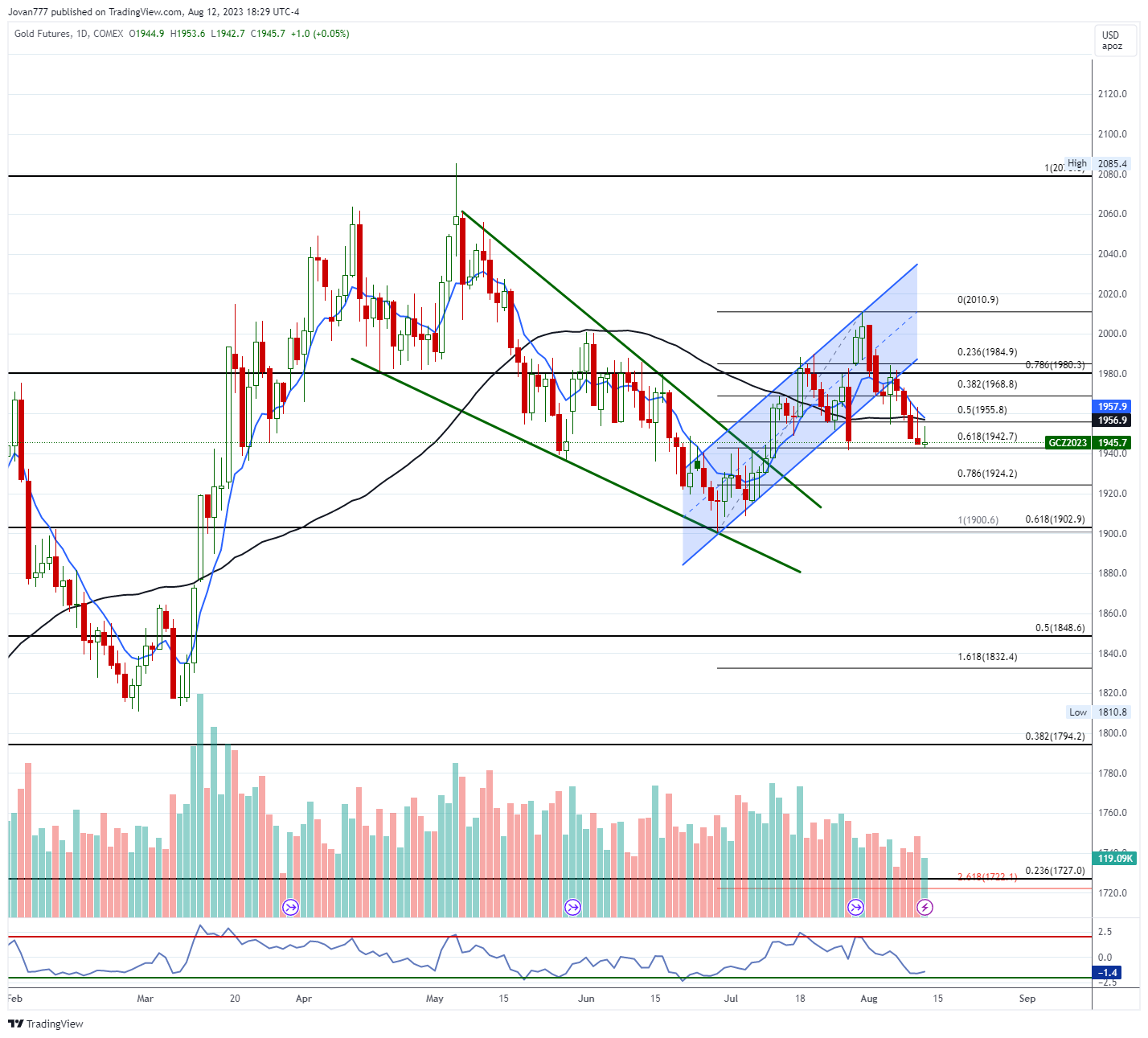

/GCQ23 (GOLD)

Breakout on daily & weekly as long as above 1945 to targets 2004 and 2044.

1945 must hold.

Watch the 8/50 cross

Chart valid for GDX 0.00%↑ GLD 0.00%↑ NEM 0.00%↑

BABA 0.00%↑

Breakout so far has failed even with the good ER. However, the 50SMA has JUST crossed over the 200sma and this typically leads to large moves. There has been repeat 100C flow.

There is a concerning H&S pattern forming at the top - however as long as BABA holds a higher low, it is likely to breakout one way or another. For the immediate short term 94 LIS must hold otherwise the H&S fires down to 90 and 86. Bulls want to reclaim that 98 early next week to target 103 and try for breakout to 117

XLE 0.00%↑

Breakout is in progress. 8ema has crossed over the 50sma. This is likely to continue higher as long as it holds $84 to target $90 and $94

NVDA 0.00%↑

Continue to watch - 8/50 crossover and broken channel. Below 400 can retest 380 area. ER is coming up. However, it is oversold so it can see a dead cat bounce possibly to retest the bottom part of the channel before continuation unless it is saved by ER. Note that volume is increasing on the fall.

MSFT 0.00%↑

Approaching apex of the falling wedge - if 320 holds likely to retest 8ema at 326 and 50sma at 336.

AAPL 0.00%↑

Has not yet filled the gap below at 175.77. It has had every chance to bounce but so far has failed. Likely completes this wedge or forms a bear pennant / flag and continues lower after an initial bounce.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan