Hi everyone!

In our previous newsletter, I gave 4443 on $SPX as the pivot for this week and mentioned that if the bears managed to hold this level, we could see a retest of last week’s lows at 4335 to complete a H&S on the daily chart. Bears lost this level on Wednesday briefly after NVDA earnings but quickly recovered it and have pushed lower for a test of the lows. The bears did drop the ball in my opinion as they had a chance to get a lower low, but we bounced hard from a higher low and closed over 4400.

From last week’s newsletter:

“Key Levels: 4434 will be the key level for the week for direction.

Note that between 4380-4434 can be a choppy zone.

Bullish Trajectory: If bulls reclaim 4434, we can retest the 50sma at 4452 and setup a squeeze for a retest of 4514. If 4514 is taken out, we will likely see a continued large squeeze to fill the gap at 4567.

Bearish Trajectory: If bears hold below 4434 we can retest the recent lows at 4335 and if they break we can target 4284 and 4232. if 4232 falls the next target is the 200sma at 4129 and then the ascending triangle original breakout at 4094. Yes, we can get that low in one week if there is acceleration to the downside.”

The range for the week was 4458 to 4356 and we closed at 4405. The majority of the week was spent at 4400 and was an inside candle to the prior week.

It’s important to note that Friday was a battle for control, and it does lean in favor of the bulls. SPX had a well-developed head & shoulders, and while it hasn’t technically failed yet, it was a day for it to go to the neckline, but bears dropped the ball and they lost 4400 which has been the battleground level all week. Bulls now have a shot again on Monday to invalidate the H&S as long as above 4400.

Both Fear & Greed and AAII survey show bullish levels decreasing and bearish sentiment increasing. If you are a bear awaiting the firedown of a H&S to 4170-4200, these sentiment levels with the close we had is not really what you want to see.

On the flip side, September is normally a bearish month and a lot of the October and December flows have continued to be very bearish.

A reminder of the VIX seasonality:

And here is the VIX so far this year:

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPX Analysis:

Key Levels: 4335 & 4439

There is just chop between those two levels as we have spent 2 weeks now trading in that range. One end of the range must give in to allow the next large leg.

Bullish Trajectory: If bulls reclaim 4439, we can retest the 50sma at 4459.56 which will likely give way since it’s the 2nd time and make way to 4471 to put in a higher high and setup a double bottom while invalidating the H&S. Above 4471 there is room to 4494-4503 which is the absolute maximum it can go without bears putting in their last stance battle. Above 4503 the bear case is dead.

Bearish Trajectory: If bears create a new low (below 4335) then the H&S fires down into 4318 and 4284 and then as long as they maintain below 4335, can target the gap fill at 4232.

Weekly chart shows an inside bar and further consolidation in this downtrending channel. We have not yet retested the original channel breakdown (orange one) since we fell out.

Monthly chart shows a possible cup & handle forming. If we go down to 4232, and we BOUNCE, it's possible we see a rally into 5300 next. Bears will need to take us below 4155 and hold that for a real sell.

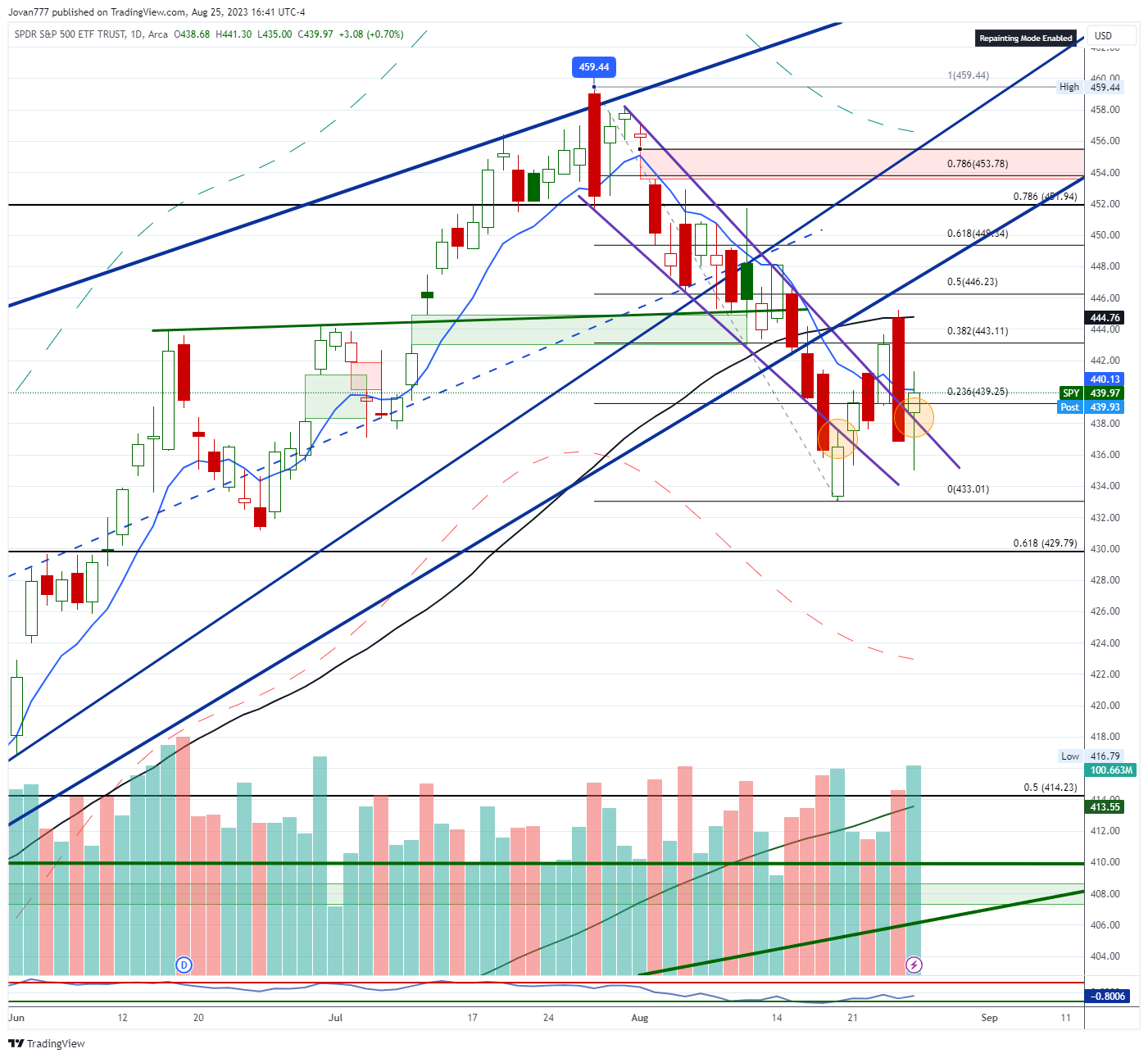

SPY 0.00%↑

Daily chart shows a failed breakdown from this falling wedge followed by a failed breakout - a retest - and then closing the week at breakout after retest. Bulls win technically speaking as long as they hold this on Monday.

Key level for the week is 439.25. As long as this holds bulls are in control.

Bull case: Above 439.25 sets up move to 443.11 and then retest the 50sma at 444.76 which likely gives way the 2nd time and can target 446.23 next. Above 446.23 is q squeeze to 449.34 which is the last chance for bears before a bigger squeeze to 451.94 and gap fill at 455.49.

Bear case: Below 438 bears can invalidate the bull’s win today and have one more shot to make a lower low. If they can take us below 433.01 then there is a bear case to fire the h&s to 429.79 and 422.23-424.

NVDA 0.00%↑

Breakout from this downtrending channel with a retest and it held, TWICE. So that 451 area is now major support and as long as that holds bulls have a good chance at taking this back to ATH.

Key level for the week is 451.17. This is the absolute minimum bulls need to hold to maintain the breakout.

Bull case: Above 451.17 can retest 464.24 then 480.88 and have a shot at 528.94. There is supporting flow for this move.

Bear case: Below 451.17 would be a failed breakout and can see drops to 442, 432.82, 421.46 and retest of recent lows around 403.11.

Key level for the week: 362

Bull case: Above 362 can retest 8ema at 364and then 367.42. If 367.42 clears would target a 50sma backtest to 370.56. If 50sma is taken out this can move to 371.35 and then try to make a higher high around 375-376

Bear case : Below 360bears in full control and can retest Friday lows at 354.71 which if taken out would support a move to 349.71. If 349.71 falls it will be a fast drop to 340-345.

TSLA 0.00%↑

Key level: 240

Bull case: Above 240 can retest fib at 245.57 then fib at 255.83 and 50sma 257.42.

Bear case: Below 232 can retest 221.26 and fill gap at 217.58 then retest lows at 212.36

BA 0.00%↑

Technical breakout retest and held on weekly - want to see it back above 225 for continuation.

Weekly breakout as long as above 225 to targets 240 and 267.51

/GCQ23 (GOLD)

Out of compression and back to 50sma for the retest - need to see it back above it for breakout continuation.

BABA 0.00%↑

Breakout so far has failed. Need to see over $94 again to become interested again. Consolidation until then.

XLE 0.00%↑

Breakout is in progress. 8ema has crossed over the 50sma. The 50sma continues to curl up and is headed to converge with the 200sma (daily chart) which will decide the next large move. This is likely to continue higher as long as it holds $84 to target $90 and $94

Might finally be out of compression - I would like to see it above 76.23 and then watch reaction around 80.43 and 82.56. Can play the move to the 50sma here for a quick scalp / daytrade or can watch and see if we get a few closes above the 50sma at 82.56 for a breakout back to 88.45 and 98.38 +

MSFT 0.00%↑

Bull case: Over #324.58 target 332.65 and 334 again and watch for reaction there.

Bear Case: Under 32.51 retest recent lows around 311.55.

AAPL 0.00%↑

Bull case: Over 178.16 target 182-182.94, if level is reclaimed, target the 50sma at 186.66.

Bear case: Below 176 retest recent lows at 171.96 and longer-term fib at 170.36

RBLX 0.00%↑

Watching this downtrend break, large gap fill play. Flow caught my eye on this as there was alot of $27C for SEP.

I think we can start to stage the gap fill play here if 29.07 is reclaimed to target 33.12 then 35.63.

Void below $26.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan