Week of December 11th, 2023

6 green weeks in a row for SPX and July highs taken out. CPI & FOMC ahead.

Hi everyone!

This past week we got our 6th consecutive green week in a row and SPX has officially closed at 2-year highs. The range for this past week was 4546-4609.

Last week I mentioned “A pullback for a higher low is near however you can try chase longs as long as we are above SPX 4569 to target 4614-4624 zone.” It was a very choppy weak with that 4546 being a magnet(ES 4556) for 2 weeks now but being defended every single time. Once we S/R flipped my 4569 level it was used as a launchpad to target new highs at 4609.

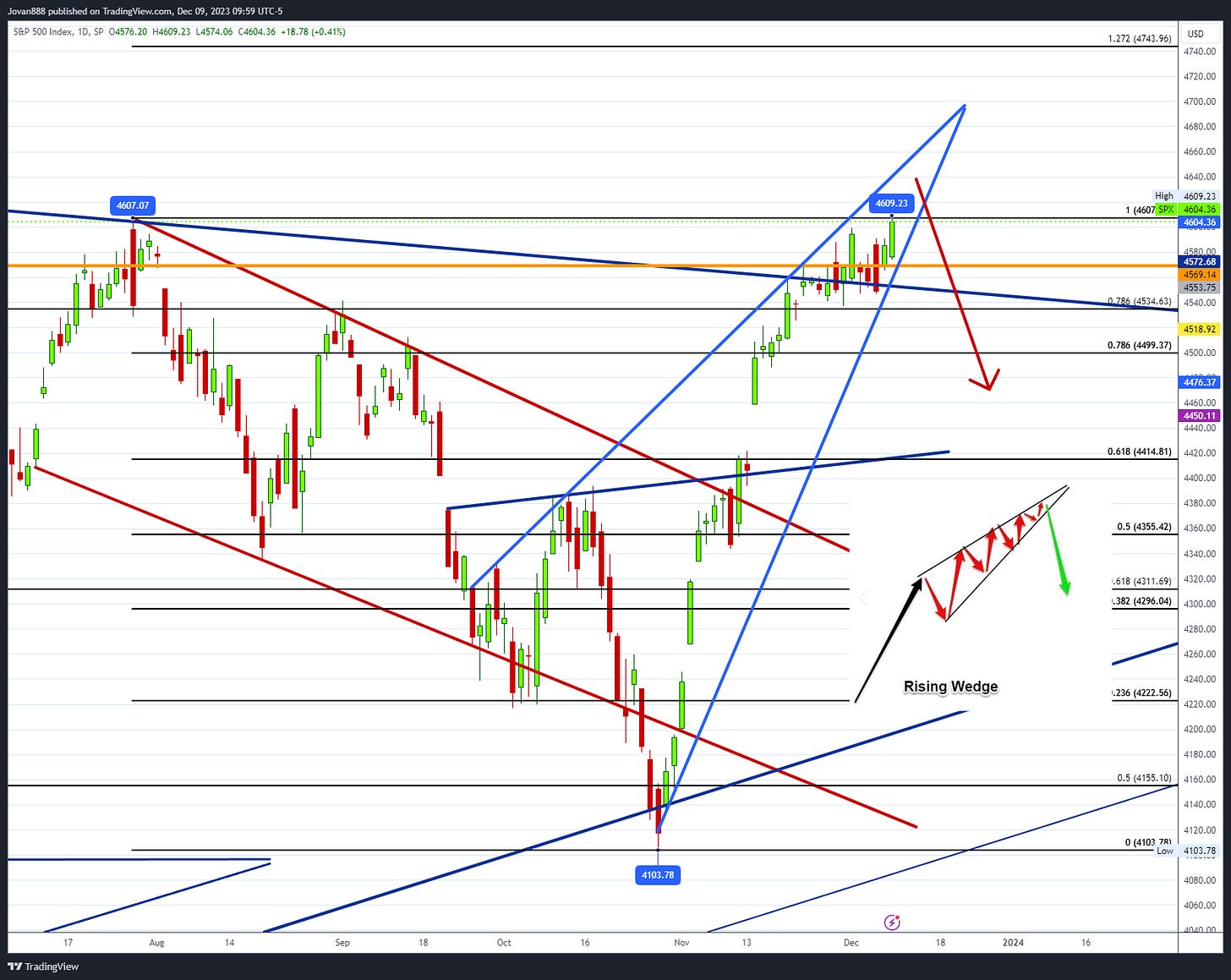

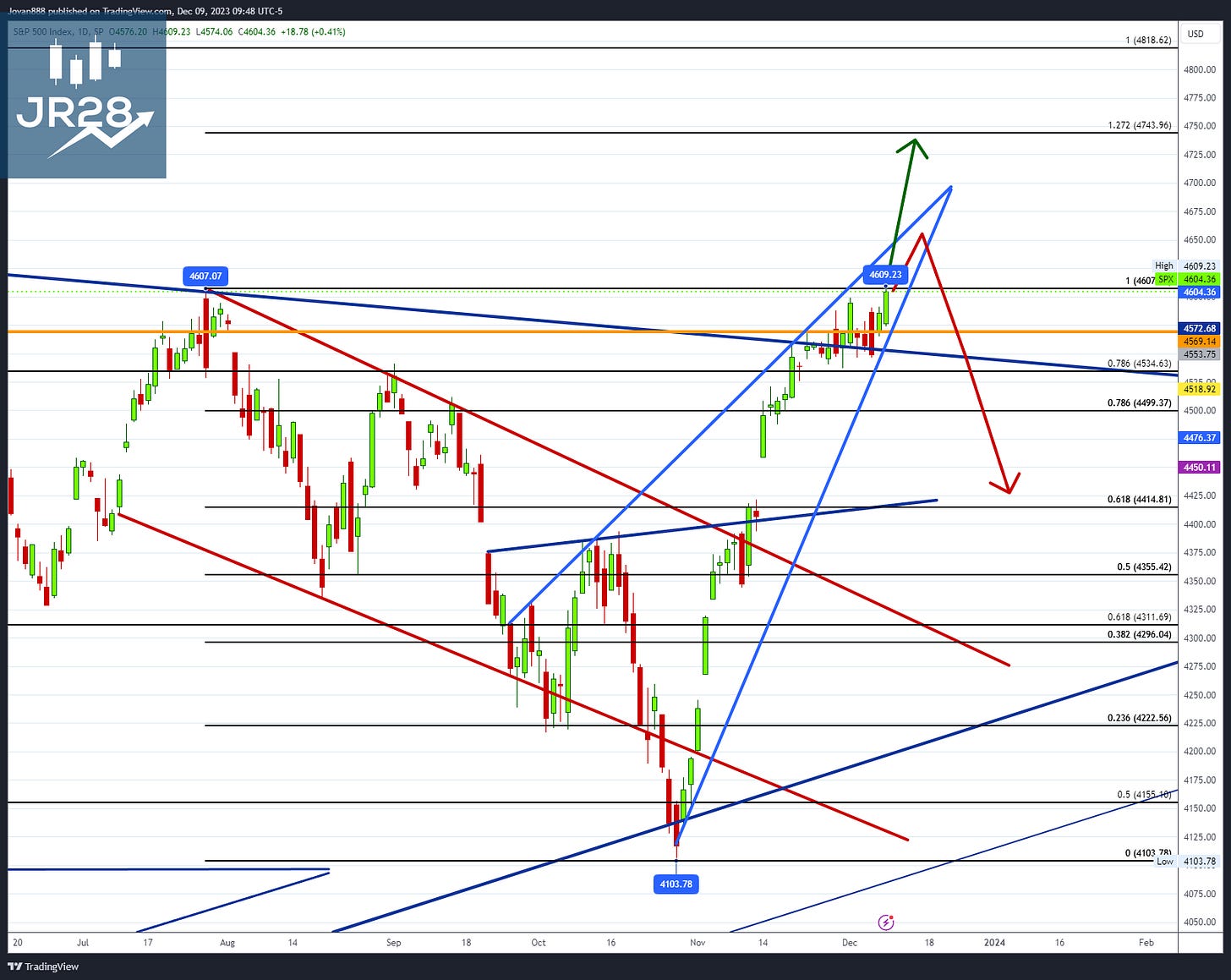

The technical structure for anyone looking at this chart is obviously overwhelmingly bullish with the island top invalidated, a cup & handle and higher highs. However, in the immediate short term there is a rising wedge that has been forming on this run from 4100 to 4610:

However, something I have said time and time again is that in bull markets bearish patterns tend to fail and in bear markets bullish patterns tend to fail. If the pattern triggers, then a short signal is activated which will be a sell for a higher low. However, if we breakout of the pattern to the upside, the bearish pattern is invalidated and there is no reason to short.

It should be noted clearly however that bulls are very clearly in control above 4250. We could sell 300pts and the bulls still have the edge.

SPX Analysis:

Key Levels: 4586

Extreme risk at current levels for new longs.

Bulls continue to hold control (BTD) as long as SPX is over 4248 and have the edge meaning that dips likely get bought. Bears will need to reclaim 4248 in order to regain control.

Bullish Trajectory: High risk for new longs at 4610 SPX. 4607 is the July high and 4637 is the April 2022 high. SPX broke out of a megaphone and downtrend channel on November 10th which has a measured move of 4594-4648. A pullback for a higher low is near however you can try chase longs as long as we are above SPX 4586 to target 4614-4624 zone. Above 4624 can target 4648, 4666.

Bear Trajectory: There is no bear case above 4248. However, we are due for at least a higher low and a short setup is if we have a failed breakout. We broke out on Friday at 4586 and if this level is retested and it fails, that is the start of a short towards 4569, 4546 (again) and 4534. 4535 needs to fall for a multi-day sell which would then target 4499, 4487, 4469. Below 4469 selling would accelerate to fill the gap at 4414-4420.

Summary:

4586 pivot level (breakout retest). If retested and held, continuation up to 4614-4624, 4648. If retested and breaks through, start of a short to retest 4546 (again), if 4546 fails the final test is 4534 where if that breaks then we finally get a multi-day sell towards 4460’s.

IWM 0.00%↑

IWM broke the 200d sma decisively and has been bull flagging above it getting ready for the next leg.

QQQ 0.00%↑

A perfect backtest and S/R flip of its breakout that held, however it has yet to put in a new high like SPY.

TLT 0.00%↑

We grabbed the bottom of this at 82 and it has been nonstop as it carves out a bottom. It is now at a very important stop and if it clears this red box then a sharp move up to 100-105 is likely.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

Sentiment Check:

AAII: Bullish sentiment decreased last week even though we made higher highs.

Fear & Greed: Greed now for 4 consecutive weeks w/ slowing momentum.

*Hedge Fund positioning in mega-cap tech is at record highs

Comments:

AAII & Fear & Greed are both suggesting that there is still room to the upside at 4610 as bearish sentiment increased at the highs.

Here is the economic calendar for next week:

CPI TUESDAY, FOMC WEDNESDAY

For this upcoming week I will be watching the following setups and levels:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.