Hi everyone! Happy Friday!

In our previous newsletter, I highlighted the significance of $SPX level 4545 mentioned that if the bulls managed to maintain this level, we could see a notable upward movement towards 4637. While it did appear a pullback was imminent, once that 4545 level was taken by the bulls, it was a straight shoot up into SPX 4607 before a hard rejection into 4528 that same day. Then on Friday we gapped over that same 4545 level and continued to climb back up closing the week at 4582.

Key Levels: 4545 will be the key level for the week.

Bullish Trajectory: If the bulls can successfully surpass and maintain a hold above the 4545 level, it sets the stage for another potential short squeeze and a retest of the highs at 4580. If somehow it does surpass 4580 it can run to March 2022 highs at 4637.

The range for the week was the same as Thursday’s range 4528 to 4607.

We had a bunch of break outs and moves as well that were noted here on the newsletter such as:

BA 0.00%↑

BA signal has been a long since 204 with 225 as a breakout trigger. This week it rallied over 225 and rapidly went up to 240 direct. This breakout is on increasing volume and has plenty of room ahead towards next target of 267.51

GOOGL 0.00%↑

127 was the level needed for breakout and once it got over it, it ran direct to 134. It's been stuck below 127 for several months and the breakout is on increasing volume so it is unlikely to give up that 127 level for now. Breakout likely to continue towards 136.95 and 140

BABA 0.00%↑

BABA has JUST poked it’s head up over that triangle resistance and is my #1 watch next week for continuation towards 104 and then the gap fill at 116.81. The volume is increasing and rsi is bullish, as well as some 103c and 107c supportive flow. Looking for continuation next week.

In the discord community we also caught the breakout on TLRY 0.00%↑ and some 100% lottos on AMC 0.00%↑. For more information on the discord community, you can visit: https://jmoptiontrading.com/collections/membership-plans.

TLRY 0.00%↑

We are observing a large multi month wedge upside test - keeping this on watch for the upcoming months to stage a large breakout. Next immediate target upon a break from the wedge is that 50SMA on weekly at 2.81 followed by R at 3.74

AMC 0.00%↑

We are seeing a similar pattern in AMC. We had a breakout this week and rejected at the 50SMA on the weekly. We are now retesting the wedge. Assuming it holds, this would spark the next leg up in August to target the 50sma again, followed by R at $10.

Going to reiterate the following message over and over again as we are in a euphoric stage right now and most of you will disagree, which is why it needs to be said:

Throughout our communications, we have consistently expressed our viewpoint that the current market rally should be approached with caution, as we believe it to be a bear market rally driven by factors that do not align with fundamental and macroeconomic realities. However, it's essential to note that this perspective doesn't imply that one cannot engage in upside trades, such as the 440C on SPY or the $380C on QQQ, or the 190C on IWM (all things we have called in the Discord), for example. Rather, it serves as a reminder to remain mindful of market sentiment and emotions, as market dynamics can swiftly shift when the majority becomes overly comfortable, often leading to inconvenient outcomes.

For day traders, the focus primarily revolves around short-term trends and may not require extensive consideration of the broader, long-term picture. However, it remains crucial to exercise diligence and adaptability in response to evolving market conditions.

Previously, when the market stood at 3850, we outlined a trajectory that anticipated a rise to 4500 by summer, followed by a subsequent reversion and decline in the latter half of the year. It appears that the market has adhered to this projected path thus far. Initially, many doubted the feasibility of reaching 4500 or all-time highs at 3850. However, the prevailing sentiment has now shifted, with the majority expecting all time high levels and dismissing the possibility of a significant market drop due to the perceived "seasonal bullishness" of the remaining year. This prevailing sentiment of unwavering optimism can be seen as a classic case of complacency.

It is important to remain vigilant and aware of these market dynamics, as they have the potential to impact trading decisions and risk management strategies.

A reminder of VIX seasonality:

Bullish sentiment continues to stay high & we remain in extreme greed week after week.

WHAT TO LOOK OUT FOR THIS UPCOMING WEEK:

Economic Calendar (High Volatility Events):

For this upcoming week I will be watching the following setups and levels:

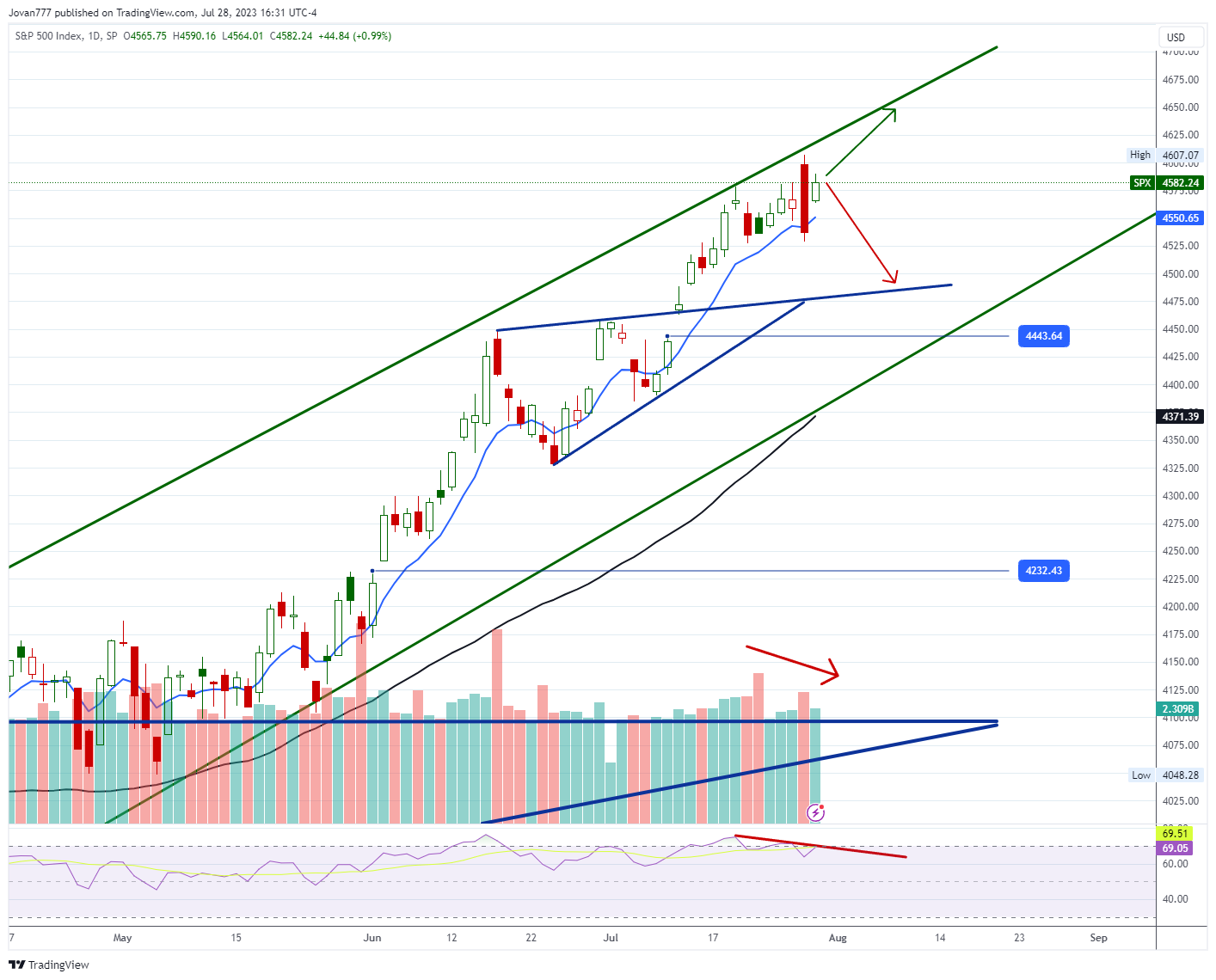

SPX Analysis:

The SPX is persistently displaying a strong bullish trend in the current wave. However, it has started to show initial signs of weakness and facing major resistance. There are bearish divergences on daily and volume is not increasing on the rally days.

Key Levels: 4582 will be the key level for the week.

Bullish Trajectory: If bulls hold above 4582 it can run to March 2022 highs at 4637 and if it passes then 4650.

Bearish Trajectory: If bears hold below 4582 it will drop to 4545-4550 key level. If that does not hold then a drop to 4494-4500 is expected.

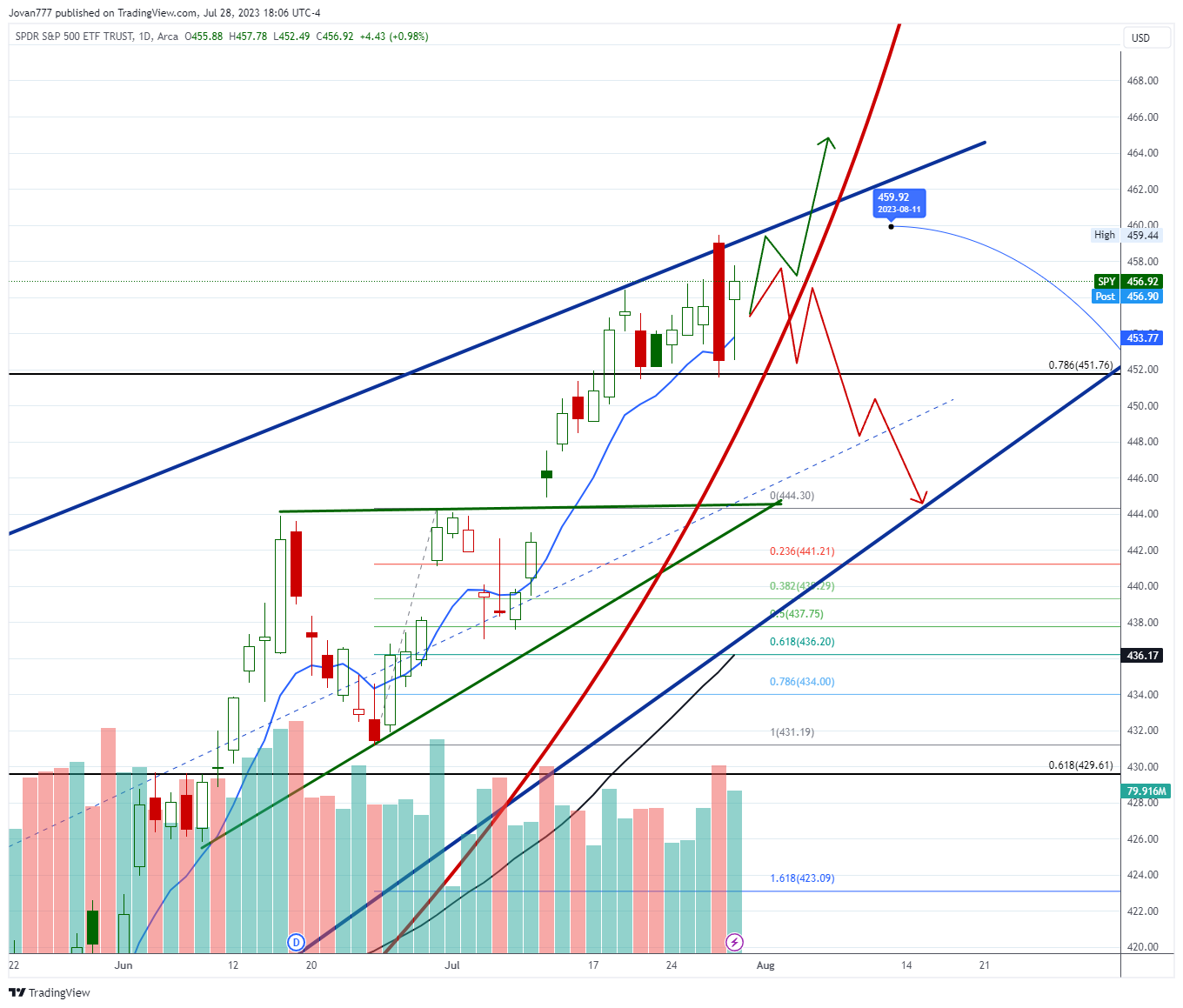

SPY 0.00%↑

Key level for the week is 457

Bull case: Above 457 can see retest of recent highs at 459.44 followed by 464 if taken out.

Bear case: Below 457 can see retest of recent lows at 451.55 followed by 448.49 and 442.97 (gap fill)

QQQ 0.00%↑

Key level for the week is: 383.92

Bull case: If holding above 383.92 a retest of the highs at 387 is likely with a possible overshoot towards 394.

Bear case: If holding below 383.92, then a retest of 375.66 is likely and likely to fall which would then target 370 and 365.98 as the 50sma catches up

Note: Lots of tech stocks are similar in that they are falling out of their channels (MSFT) or falling out of wedges (TSLA / NFLX).

TSLA 0.00%↑

Key level: 269

Bull case: Above 269 can target 276.91 and then stage a gap fill move to 289.51

Bear case: Below 269 can target 254 then test the 50sma (similar to NFLX), and if that doesn’t hold, 240 before staging a gap fill move to 235.23

Note: Flow leans to the bullish side

GOOGL 0.00%↑

Weekly breakout as long as above 125.49 to targets 136.95 and 140. Flow leans bullish into $140C.

Key level remains 125.49.

AMZN 0.00%↑

Weekly breakout as long as above 122.39 to targets 135.04 and 144. Flow leans bullish into $140C.

BA 0.00%↑

Weekly breakout as long as above 225 to targets 240 and 267.51.

/GCQ23 (GOLD)

Breakout on daily & weekly as long as above 1945 to targets 2004 and 2044.

Chart valid for GDX 0.00%↑ GLD 0.00%↑ NEM 0.00%↑

BABA 0.00%↑

Possible weekly breakout has started - pending confirmation next week. As long as it holds above $94 (firm LIS) breakout likely to succeed to target 105 then setup for gap fill at 116.81 and then 120. Void below $94. Can short below $94 to target 89.

JD 0.00%↑

Aside from running together with BABA which is on the verge of a large breakout shared in a prior idea, JD here is breaking out from this multi-month wedge with multiple gaps above. If above $42 there is room for a run towards gap fills 44.82 and 51.71 with the red line above being major resistance. My LIS is $37.

XLE 0.00%↑

Energy is breaking out and the 8ema is set to cross the 50sma soon which can lead to a large move. As long as above $79 this has run towards 87.32 and 90.57 next.

Holding in this channel so far despite losing the $100 level. Still a higher low vs Feb

As long as channel holds, should move back towards 102.28

8ema and 50sma are trending lower and set to cross. Can spark huge move in markets.

TLRY 0.00%↑

Massive multi-month wedge on weekly to watch. Breakout over $2.40 would target the 50SMA at 2.88 before a pullback and retest then continuation into 3.74 to 5.

NVDA 0.00%↑

NVDA continues to hold this channel - watching for a break of the channel to take a short to target 50SMA. Nothing for now.

MSFT 0.00%↑

Important watch for next week It broke out of the channel and retested, while holding the 50sma. Either this runs back to 346+ next week or falls to 320. Did not see alot of flow for this one, but if it comes in Monday, will join in.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan

No $TSLA coverage this week?