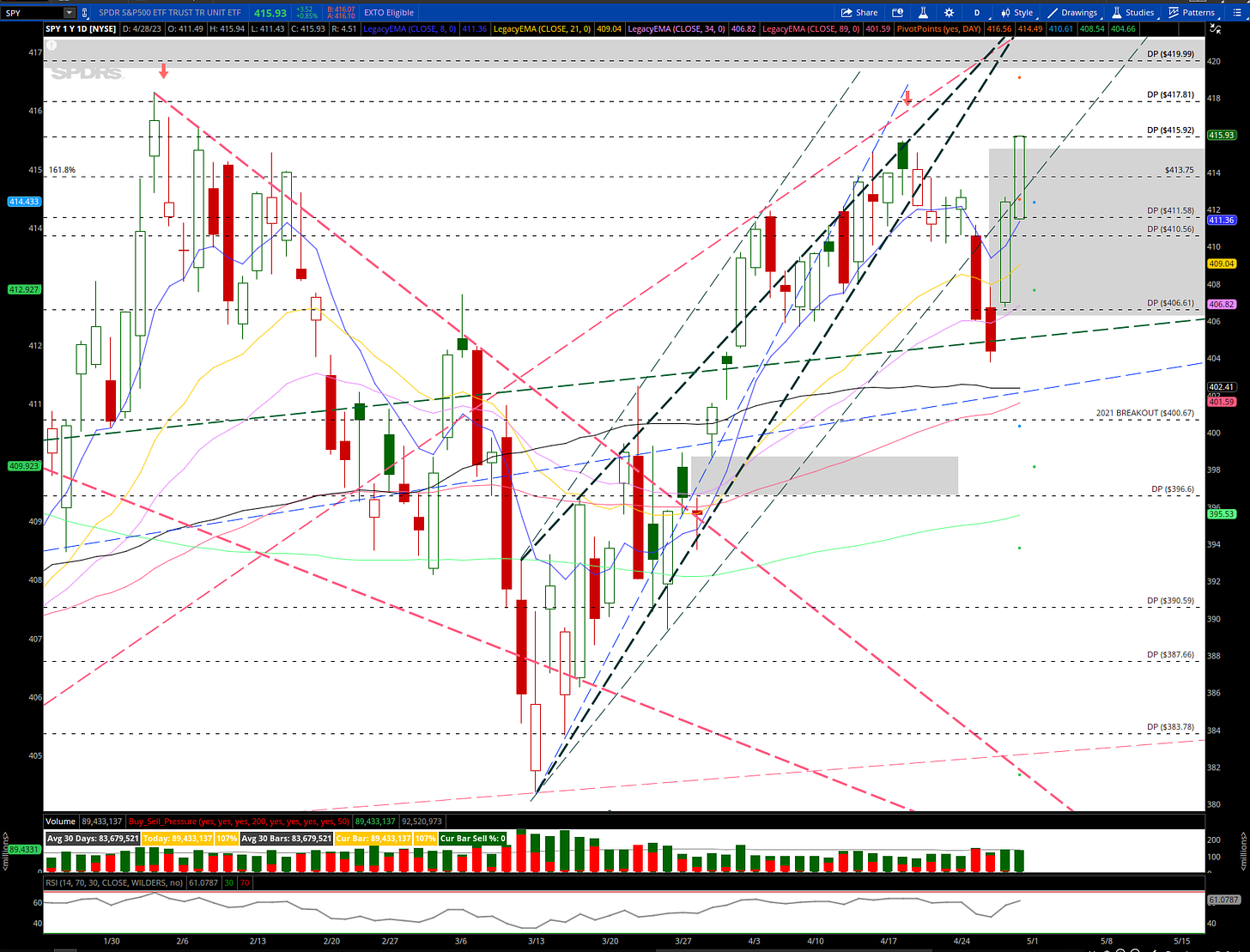

Last weekend I mentioned the importance of the DP level at 409.22, and this was the battle zone level of the week. When we broke below it, we had a nice $5 flush. When we broke above it, we had a nice $5 rip. The volatility is expanding in that we had some big range days on a break of that level. We also got a DP print at 412.55 which appeared to be a large sell, but the dip was bought up and we closed above it sharply on Friday. On Friday we closed right at the dp level 415.92. That capped the session and is a major resistance point.

Technically speaking there are two patterns on SPY 0.00%↑ here.. there is the large C&H which supports a move to $445 on SPY 0.00%↑ if it were to fulfill. I personally am not in the camp that we will see that move just yet, and i expect that pattern to fail:

The other pattern is a broadening wedge, which may be the fail point if we were to continue up next week:

I think we are on the brink of a major turning point here and the moves will become more violent as we have been chopping for the entire month of April.

The monthly chart shows a 1 year consolidation between 360 and 420, and April is closing right at that resistance line. It was also on low volume, not what you want to see on the brink of a “breakout.”

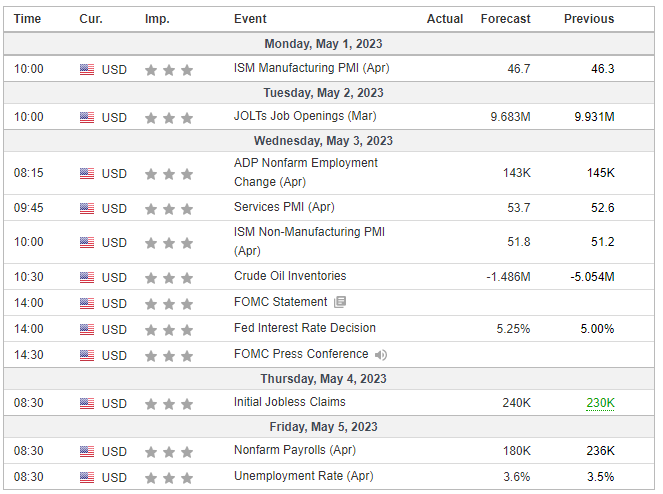

Here are the high volatility events for next week:

Notably May 3rd will be very volatile, and a dangerous day for microtrading. These FOMC days are full of fake moves, traps and stop hunting. AAPL ER is set for the day after FOMC (May 4th) making that likely to be a very volatile week. Small accounts should be extra careful, and if dancing with options, you should give yourself enough time for the trade to work as markets will likely be moving fast in both directions before the real move.

We had some great moves last week including longs on AMZN 0.00%↑ , shorts on TSLA 0.00%↑ (and the bounce).

For this upcoming week I will be watching the following setups and levels:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.