Hi everyone!

This past week SPX again hit new all-time highs before a quick sell off that ultimately resulted in closing the week exactly where it opened. SPX is now officially up 30% or 1238 points from the October 2023 lows. For comparison, the rally from October 2022 lows into summer 2023 highs was 31.95% and 1115 points. For the next few weeks/months that 5179 will continue to be our guide. If we were to fall back below that level, we could see a 2B top / failed breakout forming which would lead to the unravel in price to 4700’s that everyone was looking for beforehand.

Obviously, it is way too early and above 5179 bulls are in control for now, but it’s a good idea to keep potential scenarios in mind for perspective. Remember as traders it is not our job to predict, but rather react to price accordingly. Being prepared leads to better reactions and profitable trades.

End of month is approaching and so far, it appears we have a massive bullish engulfing candle for the month completely undoing last month’s sell off:

Last week I mentioned in our analysis of SPX:

“Ideally a failed breakdown of 5264 would be a decent relong”

We started the week near 5305 and then chopped every day until Thursday where we gapped up into new ATH and sold off to my 5264 level where we put in that failed breakdown and got the long back to 5305 finishing the week exactly where we started.

I will keep mentioning this because the risks are currently elevated: Crucial for the upcoming weeks: "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, and this short position should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. Reminder that this goes both ways and shorting the rip does not work when resistance levels are reclaimed like we saw last week. So, make sure to remove bias and focus on just the levels in your trading.

SPX Analysis:

Key Levels: 5264 & 5340

Bulls put in a failed breakdown at 5264 on Thursday so the move is long as long as above 5264. It will be weaker the 2nd time around so bulls will not want to give that level up or else we would see a retest of 5179 which is the point of control.

Bullish Trajectory: Continuation of the 5264 failed breakdown to continue higher to retest the 4324 & 5341. Bulls will need to take out 5341 for continuation higher into 5394.

Bear Trajectory: A breakout is being attempted by the bulls. The only bear scenario would be a failed breakout, which would need to see a sell under 5160-5179 to trigger a large sell leg. Under 5160 would trigger a sell leg into 5072. You could get a short scalp out of the breakaway gap at 5250 being filled which would likely take us to 5198 for a retest.

Summary:

Bulls in control above 5179 and in breakout above 5198. As long as 5198 holds the BTD routine likely continues to work. We are currently in a breakaway gap similar to the ones we saw early in the year which led to constant continuation higher so keep that in mind while that gap is open. Only bear case is below 5179 which would turn this into a large, failed breakout.

IWM 0.00%↑

Potential head & shoulders here if we fall back below 199 this week. Bulls need to reclaim 210 and push higher into 216 to invalidate this bearish setup.

QQQ 0.00%↑

QQQ nearly at the 472 target I gave back at the beginning of the year. Unlike IWM this one has been very strong and consistently putting in fresh highs.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms so I will start to post levels for ES instead of SPX as well as NQ but this will go out on the weekly newsletter on Sundays.

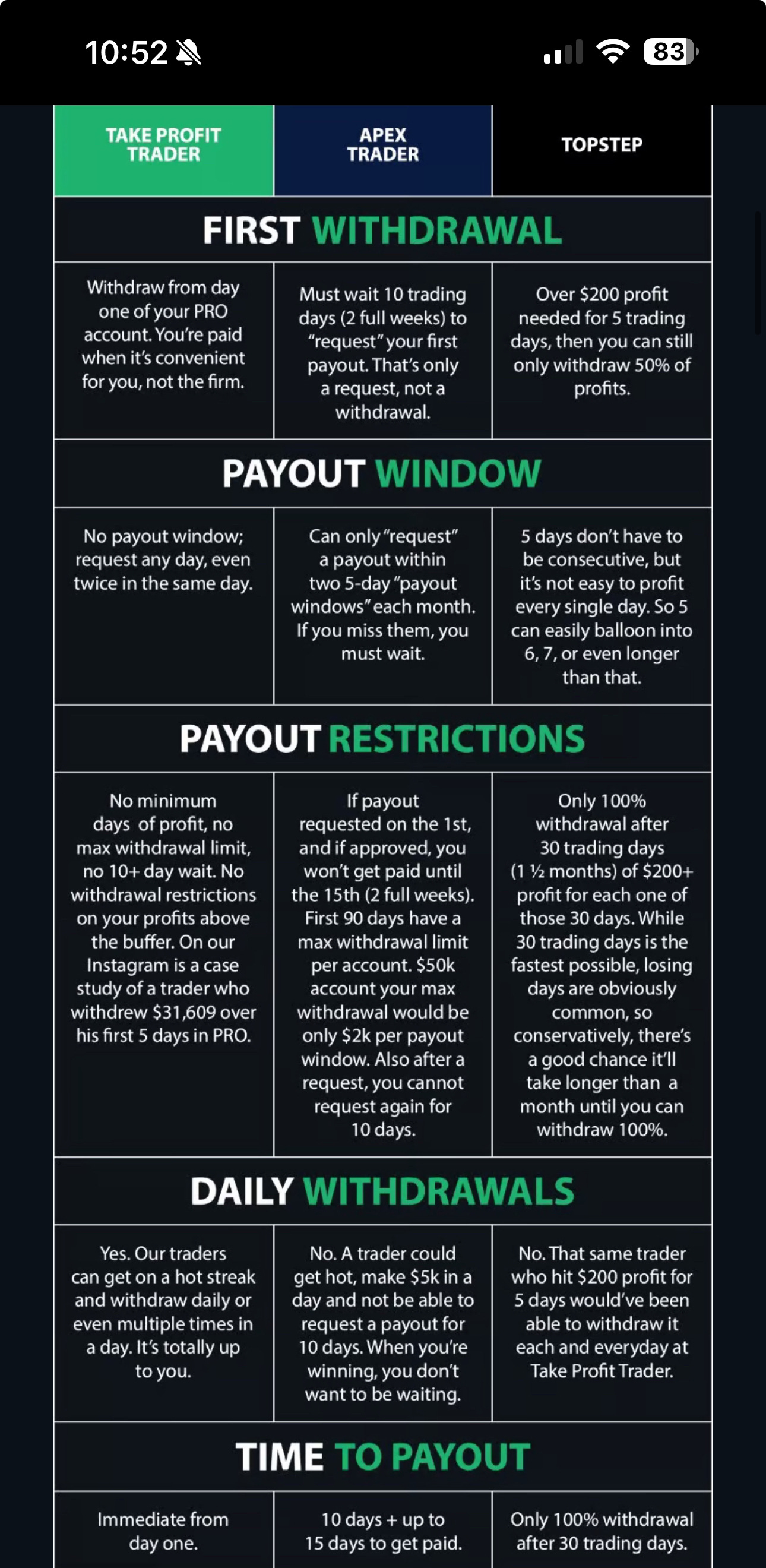

We’ve partnered with TPT (TakeProfitTrader) USE CODE JR28

Initial cost with the 40% off and NO activation fee sale: Promo code: JR28

50k account $102 When you pass, no activation fees due = total cost $102

jr28trader.com

In this discord if you are interested, we are giving guided trades for futures like this:

Sentiment Check

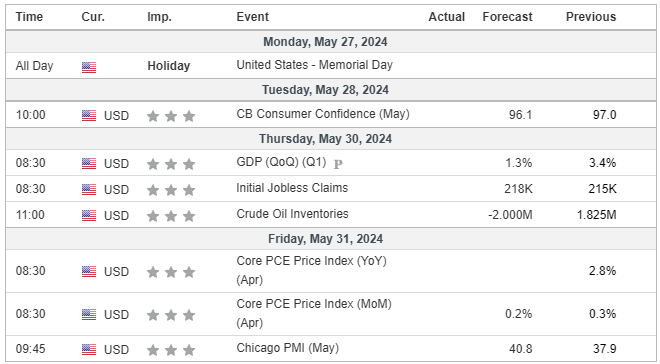

Here is the economic calendar for next week:

A separate newsletter will be sent tomorrow with the setups I am watching for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan