Week of November 20th 2023

Holiday Week ahead (short week), SPX charging up for another 100pt move. NVDA ER 11/21

Hi everyone!

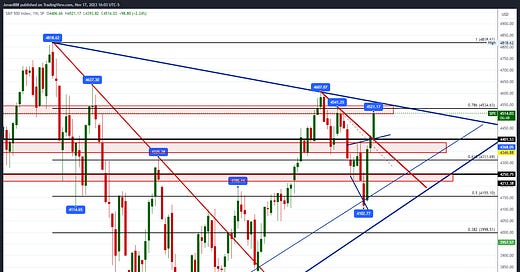

This past week we got another 100pt+ leg up on SPX and finished the week near the highs making another nice big green candle to the August/September highs. The range for the week was 4393 to 4521. SPX has now rallied 10.2%+ off the lows in 3 weeks. From Tuesday-Friday, SPX has been basing in yet another triangle consolidation meaning another large 80-120 pt leg is around the corner.

SPX has now left multiple gaps below and is stalling just below the island top gap from August 1 at 4572.

While the move can seem extreme due to the speed of it, and the lack of pullbacks, it is important to zoom out and look at the bigger picture. SPX bounced decisively off the bottom of the pennant and since a breakdown did not occur (failed breakdown) price rapidly went back to the top of the pennant to try for an upside breakout. You will notice in the photo below that the range has been narrowing and will continue to do so for as long as it stays in this pennant. If it rejects at the top of the pennant now in the upcoming weeks, it’s possible to stay consolidating in a narrowing range until May 2024.

This 4534-4550 level will obviously be of the upmost importance in the upcoming week as it will mark the difference between a larger squeeze into 4700 or a pullback to fill some gaps at 4420 and below. It should be noted clearly however that bulls are very clearly in control above 4250. We could sell 200pts and the bulls still have the edge. Given that we closed the week in another triangle consolidation, the breakout point of it next week will decide whether we go up direct into 4560+ or if we first pullback to backtest the CPI breakout and gap at 4420.

SPX Analysis:

Key Levels: 4487 & 4534

Bulls continue to hold control as long as SPX is over 4248 and have the edge meaning that dips likely get bought. Bears will need to reclaim 4248 in order to regain control.

Bullish Trajectory: 4487 key for next week. If we continue to base above 4487 we likely push higher into 4534 (78.6 fib) and make an attempt at the September high (4541) and above there an attempt fill the gap above at 4572. Above 4572 would lead to large a breakout into 4634 & 4700+.

Bear Trajectory: There is no bear case above 4248. However, a fail of 4487 would trigger a short to backtest the breakout and gap fill at 4414. In an extremely bullish pullback scenario we would not make it to 4414 and may find support at 4450. If we do get below 4414 and 4394 can be taken out, then we can head lower to 4355 & 4311 and 4266. 4250-4266 would need to fall in order to take control back from the bulls.

Summary:

4487 key level to hold for upside continuation. As long as that holds we can continue higher to 4534, 4541, 4572+. If 4487 falls, we can have our first pullback towards 4450, if that falls then retest breakout and cpi gap fill at 4414. Below 4414 is 4394 which may be heavily supported. 4394 falls then we would see 4355, 4296-4311, 4248-4266.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

Some of our calls from this past week:

TSLA $225C NOV 14 1.28 → 21+ (over 1400% return!!)

IWM $170C NOV 20 1.08 → 10+ (over 900% return!!)

ENPH $90C DEC 15 2.59 → 9

BA $210C DEC 15 2.40 → 5.05

**Please note that prices for the DISCORD will be going up as of November 28th, so if you would like to lock in the current special price of $44/mo please do it before then as we cannot adjust it after November 28th, no exceptions, thank you.

Sentiment Check:

AAII: Extremely Bullish

Fear & Greed: First time in Greed in over 30+ days

*Hedge Fund positioning in mega-cap tech is at record highs

Comments:

AAII sentiment speaks for itself. We had peak bearishness (50.3%) at 4100 SPX and now we have peak bullishness at 4520 SPX. There is certainly more room on both AAII and Fear & Greed but we should be mindful of how quickly this shift took place and be cautious if you are bullish.

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.