Hi everyone!

In the prior newsletter I mapped out two paths for this week putting this chart:

I mentioned very clearly that SPX “Bulls need to overcome resistance at 4335 to squeeze towards 4351, 4379 and 4395. High risk of rug pulls for bull below 4395 as trend can continue to be short the rips while below it.”

We did exactly that before selling off a good 60-70 points off that 4395 level. While we did not reach that in the cash session (4385 was the high) we did in the globex and it was very clearly an area where longer term sellers re-appeared causing some volatile moves from there.

I had anticipated an initial pullback to form an IHS, but we did not get that. That makes me lean bearish for the coming weeks. Going out too fast without the right setup beforehand leads to traps and bulls got a bit too excited and just lunged for 4395 without setting up for it first leading to what we saw this week. Now, there is a range carved out here from 4324 to 4380 and it appears to be a bull flag. This 4395 level will continue to be key for the upcoming week. It will continue to be the battle of 4300 and 4400 with the breach of one deciding the next leg. Despite the volatility in the last days of the week SPX did manage its 2nd consecutive green weekly close.

Here’s the price action for last week:

The range for last week was 4283-4385.

This is a clear DOWNTREND with lower highs and lower lows. However, it is possibly a falling wedge structure in the last 3months of activity so continue to trade level to level.

Remember to follow me on Twitter @jovanroche or join our discord JR88 DISCORD for live updates. We jumped in calls near the lows and we sold those on Friday before the close.

SPX Analysis:

Key Levels: 4240 & 4404

Bears remain in control under 4404. Below this level expect rips to be sold and continued volatility. For bulls to reclaim control they need a couple of closes over this 4395-4404 zone.

Bullish Trajectory: Bulls need to defend 4294 to keep the relief bounce alive again towards 4335 and 4395-4404. We closed the week just under that 4335 level again and this is something bulls need to take out ASAP to retest 4395. If 4395 clears there is a resistance cluster at 4404 with the 50d and 100d smas. Bulls need to get over this 4404 level to target 4446 major resistance area.

Summary: 4294 bull last line of defense, over that resistances are 4335, 4395, 4404, 4446.

Bear Trajectory: Although bears have come in at 4380 to defend and gotten some decent sells back to 4324, they are in defensive mode and for any real sell they need to take us below 4240 ASAP. Level to level though, if we remain below 4335 level we likely will test 4294-4304 area early in the week. If that falls then we are headed to 4230-4240. If 4240 is again tested and it holds, bears will be annihilated as it would be a higher low and a retest of 4380 again. Bears hate this 4240 level as they have had so many shots to take it out but could not.

Summary: Below 4335 likely retest 4294-4304 area. If that falls then target 4240. 4240 must fall for a real sell down into 4169.

Note: Just like coming close to but not tapping the 200sma demonstrated weakness from the bears, coming close to the gap at 4401 but not filling it demonstrated weakness from the bulls

Some good calls from last week:

I mentioned that if 445 held on NVDA we could long to 467-475. NVDA indeed hit exactly our 4$75 target before a sell off back to $460.

Next.. QQQ tapped our 372 target to perfection:

Star of the week… META 0.00%↑ we warned that after a few closes over 313 we could make our way to 326-333. We hit exactly 330 before a pullback back to 316

And we nailed GDX 0.00%↑ which exceeded our target for the week:

Something important we noticed this week was the shift in TLT 0.00%↑ vs the indices. TLT had 2 days where it gapped up over 1.5% overnight. This to me is telling as it shows that we may in for a real reversal on TLT and we are carving out the lows right now. TLT showing a triangle consolidation on the daily:

$VIX - in a broadening wedge since June - 8/50 on weekly getting closer implying a big move coming soon based on the reaction. It was up over 15% on Friday despite SPY only being down around 0.5%.

We remain in “fear” on the Fear & Greed Index even after the green weekly close from last week. AAII shows increasing bullishness back to 40%, a red flag to see so close to a major resistance level.

Here is the economic calendar for next week:

Powell on Thursday

For this upcoming week I will be watching the following setups and levels:

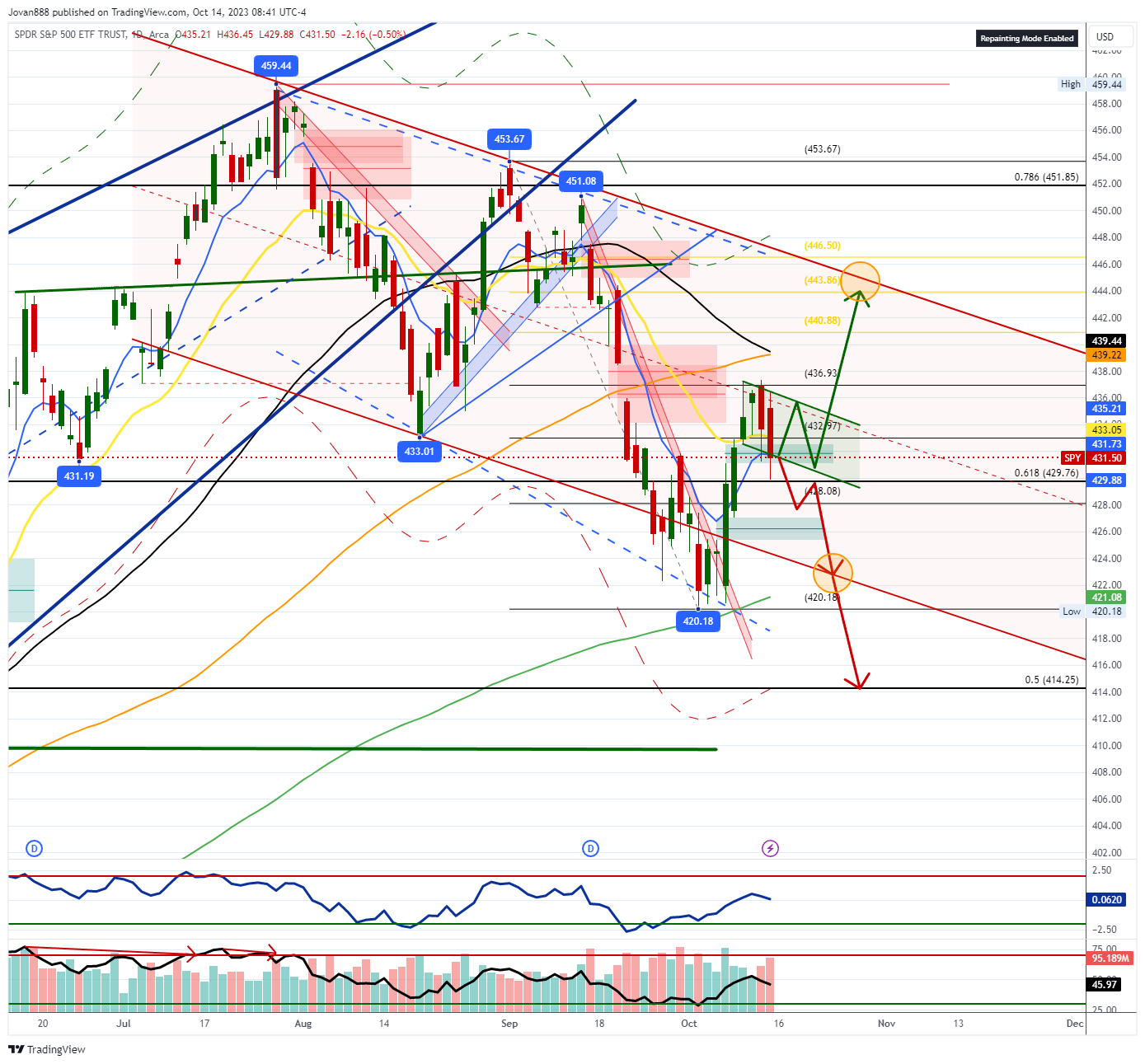

SPY 0.00%↑

Clear downtrend in bigger picture with lower highs and lower lows.

Bull case: Bulls last line of defense is 429.76, as long as that holds, we can continue back to 435-436 and setup for a move to 441 & 444 once 437 clears.

Bear case: Bears will need to take out 429.76 level for a move down to 428.08 then 426.24 then 423. At that point the 200sma would be very close and we likely tap it this time if we managed to get down there. If the 200sma falls, it’s a sell to 414 at a minimum.

AAPL 0.00%↑

AAPL got ahead of itself and instead of forming a strong base at 178 it lunged for 183 where it failed and sold off back to 178.

This 178 will be important, if it holds here it now has an S/R flip and the 8ema crossing over the 50sma can lead to a move to 183.43 and 184.26 for the next major resistance area.

I think the move here is shorting 180-183 with a LIS of 185 to target the 200sma at 168.30.

The long side would look like a couple of closes over 183.43 then we are looking at a move to 190.69+. However, I’m not too interested in trying that pathway yet. For me to consider long, I would want to see an IHS form around 176 and build energy.

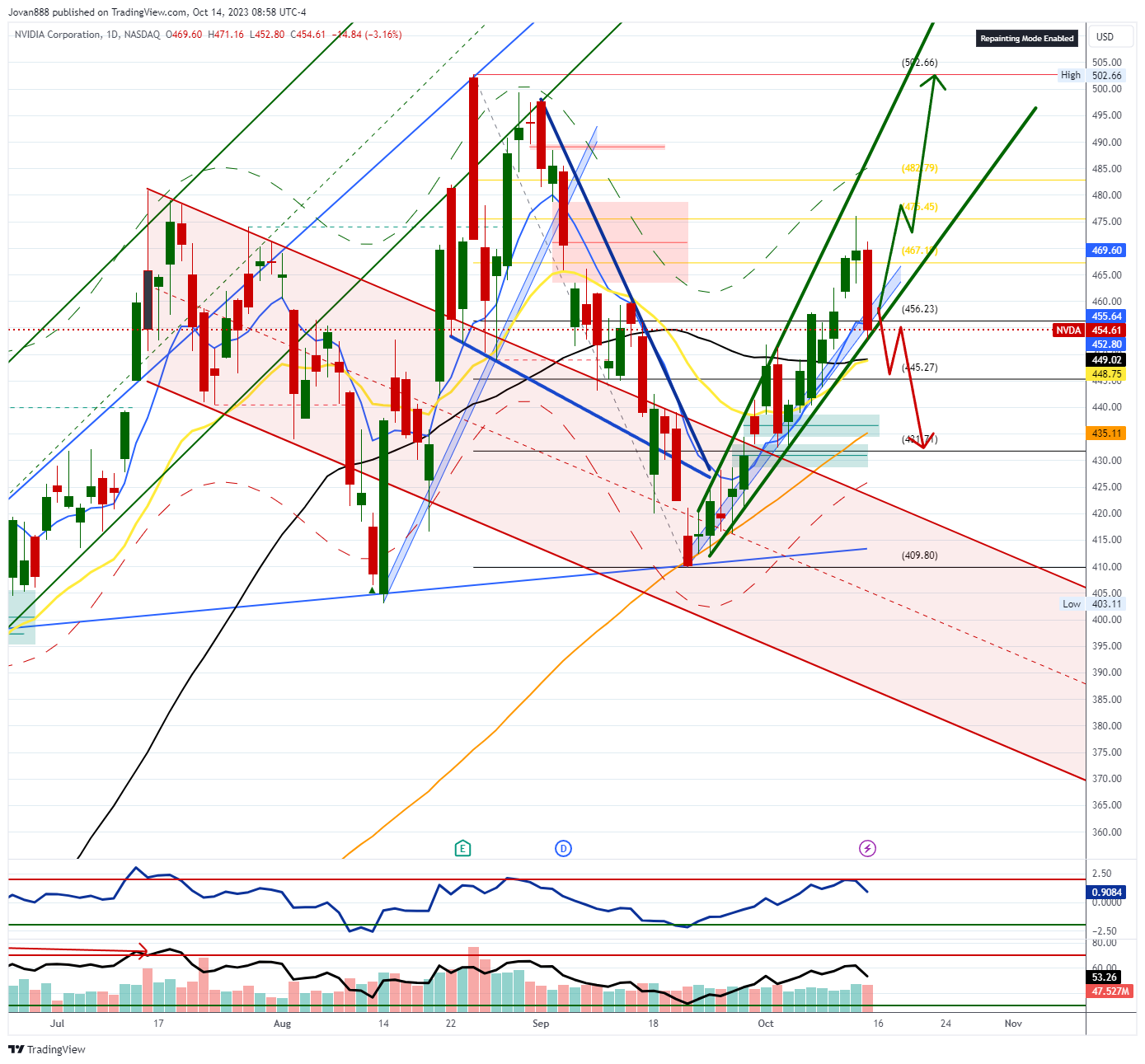

NVDA 0.00%↑

On last weekend newsletter i mentioned a short at 467-475 to target 456. If you are in that play still the move is simply to keep moving stops down now.

Otherwise here is the move:

Bull: If 456 holds, we could see a retest of 475 level which could give way to 482.79 and as high as 502-507.

Bear: If 456 falls we would see a retest of 50sma at 449 which could give way to 445 and lead to a backtest of 432-435 zone.

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

QQQ 0.00%↑

Bull: If 366 holds we can try 372 again. If 372 is taken out we could see an attempted breakout to 375.66 level. 375.66 goes and we have a massive breakout to 400+.

Bear: Below 366 can see sell to 362.62 and then 358.31.

No real bear case here unless 355 falls then it’s a retest of lows at 351 but bears will need to take out that 349.71 for any meaningful sell, at that point it would be to 338 level.

TSLA 0.00%↑

PENNANT structure here with higher lows and lower highs.

265.97 key level for bulls, it will need to break that for a move to 272-280 and test the bear gap at 289.52 and then 295. (upside breakout of pennant)

For bears, they will need to take out 242 level to target 230, 221.26 and then 200sma at 211.65

GOOGL 0.00%↑

Wedge breakdown failed - obvious strength. 135.66 area of interest.

Dips may be supported on this one, I noticed 150C flow out a couple of months

Interested in buying dips as long as 127 holds to target 151.55. (longer term)

AMC 0.00%↑

If $9 remains supported, can see move higher to target gap fill at 12.64

META 0.00%↑

Last week I mentioned that if 313 held then we can setup a move to 326-333. We then hit 330.54 before a selloff back to 313.

I will now watch this 309 level, If that remains supported we can continue back up to retest 330-333.

If 309 falls then we may have a failed breakout. First would be a retest of 302.19 and then 294.79.

MSFT 0.00%↑

Falling wedge building out in bigger picture, needs more time.

If it can clear 331.66 with volume, then we can breakout to 340 and 349.

If it gets below 320, we can explore the lower end of the wedge again near 308

AMZN 0.00%↑

First attempt at 135 and gap fill failed with a sharp rejection at the 50SMA.

140C flow ahead of ER.

128.43 now must hold to keep the gap fill move in play.

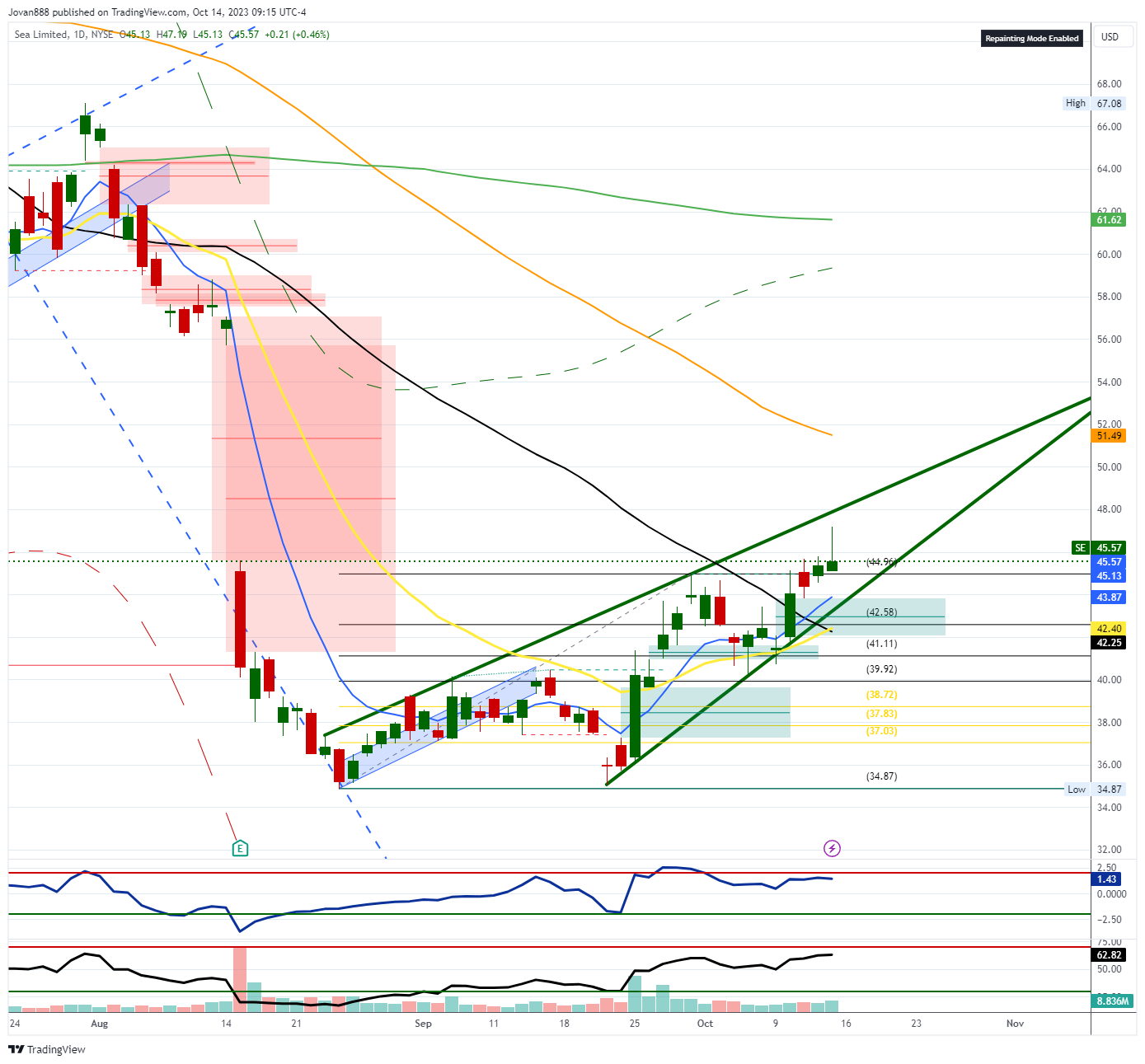

SE 0.00%↑

This one I posted back at $37, with a target $52.80. We hit 47 so far before a pullback and bearish candle.

$42 must hold on any further dips to keep this move to 52 intact.

This bullish (temporary) setup fails below $39

GDX 0.00%↑

Now need to see a move over $29.42 for a real breakout to $32 and above.

GS 0.00%↑

Possible breakdown here, we need to see if we can close below 320 this week, if we do, this may be the start of a breakdown towards 264 level

NFLX 0.00%↑

Watching 343.83 on NFLX to offer some support for a move back to 385. If 343 falls then we are headed lower into 285-289 zone.

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

IF YOU HAVE CHART REQUESTS OR QUESTIONS PLEASE LEAVE A COMMENT, THANK YOU!

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan