Hi everyone!

In the prior newsletter I mapped out two paths for this week putting this chart:

And here is how the week played out:

It was a very volatile week that started because of a failed breakout when bulls failed to close the gap at 4401. They missed it by $8 and just like I mentioned that getting close to the 200d sma but not touching it showed weak bearishness (leading to the subsequent rally), the inability to close the gap by $8 showed weak bullishness which lead to the decline.

On the last newsletter I mentioned “Below 4335 likely retest 4294-4304 area. If that falls then target 4240. 4240 must fall for a real sell down into 4169. Note: Just like coming close to but not tapping the 200sma demonstrated weakness from the bears, coming close to the gap at 4401 but not filling it demonstrated weakness from the bulls.” I also mentioned that I leaned bearish the next few weeks due to bulls not setting up properly for the move and getting ahead of themselves, making them vulnerable to traps.

We added energy to this move with the failed breakout that happened first - aka a bull trap - then we took the elevator down breaking multiple supports in 2 sessions ending the week at 4224.

Here’s the price action for last week:

The range for last week was 4223-4393.

This is a clear DOWNTREND with lower highs and lower lows. While we have not yet taken out the 4216 low from the start of October, we had a bearish engulfing this week from a failed breakout and bear flag breakdown. However, it is possibly a falling wedge structure in the last 3months of activity so continue to trade level to level.

Remember to follow me on Twitter @jovanroche or join our discord JR88 DISCORD for live updates.

SPX Analysis:

Key Levels: 4155-4180 & 4240

Bears remain in control under 4404. Below this level expect rips to be sold and continued volatility. For bulls to reclaim control they need a couple of closes over this 4395-4404 zone. Since this is so far away from current level, it’s important to remember the trend is DOWN and rips are likely to get sold.

Bullish Trajectory: Bulls need to take back a major resistance, now 4240 to get a relief rally going back into 4294 and 4335. 4180 is a level to watch for a dip buy reaction.

Bear Trajectory: Bears need to hold price down below 4240 to avoid a relief rally and potential move back up to 4335. As long as SPX is below 4240 it is likely that bears can continue to push us lower into 4180. Below 4180 would be 4155 and that is the final line for bulls because if bears get us below 4155 a large move to 3914-4000 would follow. It does seem that we have been setting up for a move down into 3818 at some point in the next few months.

Summary: Below 4240 likely to see continuation into 4155-4180 which should see a sizeable bounce before continuing lower. If we flush through 4155 with no support this can be a crash leg into 3800-4000. IMO, it would be better if we bounced at 4155-4180 to then trap more liquidity before heading lower.

Some good calls from last week:

NVDA short setup was golden since we mentioned it at 475, we hit all targets and exceeded them. This is where twitter and discord aid because we gave additional targets below 432.

We also nailed the bottom tick on NFLX 0.00%↑

Next.. We could not have asked for a more easy short in AAPL 0.00%↑ that went almost exactly to plan:

We also nailed longs on GLD 0.00%↑ , shorts on TSLA 0.00%↑ (we alerted 235P in discord for 1.60, that went well over 25.00 for a massive return).

Now let’s take a look at some red flags in the market…

$VIX - Look at that 8ema and 50sma convergence (blue line and black line). This is it, this is the moment, if a crash is coming it’s coming within a couple of weeks. This is THE spot for the VIX to either get slammed down or to breakout next into $25.50. If the VIX gets slammed down here at $22 - a retest of the megaphone is likely - which is at $19.50 and what happens there will decide the next move. If VIX falls back below 19.50 it’s like that we see a big rally next so this is the moment for VIX to breakout if we are to see a crash leg in SPX.

Total crash in TLT 0.00%↑ - this needs rescue and intervention, and the most likely salvation for this is that they will crash equities (mag 7) to save them.

Next we have $GLD… which is on a major breakout on the monthly.

We remain in “fear” on the Fear & Greed Index even after the green weekly close from last week. AAII is a major red flag for me as it shows decreasing bearishness on a decline which is implying that retail is assuming we can’t go lower. Notice we are not yet in “extreme fear” whereas we spent a good amount of time in “extreme greed” earlier this year.

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPY 0.00%↑

Clear downtrend in bigger picture with lower highs and lower lows. This is the 2nd visit to the 200dsma and no signs of putting in a low are in yet.

Bull case: Bulls need to reclaim 200dsma now at 422.30 to stage a relief rally back into 428. Over 428 can see continuation to 429.76 and 432.97.

Bear case: Bears will need to keep price suppressed below 200dsma to continue lower into that dotted blue trend line at 416 and possibly overshoot into 414.25 before a reactionary oversold bounce.

AAPL 0.00%↑

No changes since last week’s plan:

"“AAPL got ahead of itself and instead of forming a strong base at 178 it lunged for 183 where it failed and sold off back to 178.

This 178 will be important, if it holds here it now has an S/R flip and the 8ema crossing over the 50sma can lead to a move to 183.43 and 184.26 for the next major resistance area.

I think the move here is shorting 180-183 with a LIS of 185 to target the 200sma at 168.30.”

See below possible path (move to 200dsma)

NVDA 0.00%↑

I mentioned a short at 475 on this one and to keep moving stops down.

Now here is what you need to watch: So far, we have higher lows. But if NVDA can take out this low at 409 we can setup for a breakdown into 368 area.

Very large amount of OTM puts on NVDA for 300-350 strikes out to November and December.

Would suggest watching for a clear breakdown, usually that involves something like a sizeable bounce off support that then is rejected for a flush down (liquidity trap). Do not get trapped in this and watchout for a failed breakdown scenario

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

QQQ 0.00%↑

Watching for a retest of 360 level for the most bearish scenario would be a rejection there (liquidity trap for move lower). Also watching for a failed breakdown of the lows which would be the bullish scenario.

Bull: If we gap down directly to 350 we may see a failed breakdown / trap scenario to revisit 357-360.

Bear: If we retrace to 360 and reject, that would be the ideal short scenario to target 335-338.

349.71 needs to fall with conviction for a move lower to the 200dsma at 337

TSLA 0.00%↑

I know everyone is ITCHING to buy the dip but here we have a conviction breakdown that can target $160.

In the immediate short term, I think 200-205 area may be supported for a move back to 224-234

GOOGL 0.00%↑

This may have turned into a 2B top scenario here - I am watching reaction at 135, if that does not hold we may have more room down into 127-131 area. As long as that holds it can be a good candidate for leaps.

127 is a firm lis - that level must hold at all costs or its a setup short down to 116-118.

ROKU 0.00%↑

Earnings ahead - this one in this falling wedge pattern, I think if it can reclaim $63 it would be a decent RR for leap calls on this one as it sets up for a move to 74 at least and possibly 87.

LIS is $55

META 0.00%↑

302 is a MUST hold for bulls here, if 302 falls I’d be interested in a short to 290.

Over 313 is continuously bullish and sets up a run for 330 again.

MSFT 0.00%↑

Attempted breakout here and now in a megaphone - I think if it holds 325 it can test 342. If 325 falls it will fall back to 320 and 316.

AMZN 0.00%↑

Megaphone here - for now is weak and magnet to 120 is likely - however on good ER, could see test of upper portion of megaphone at 148

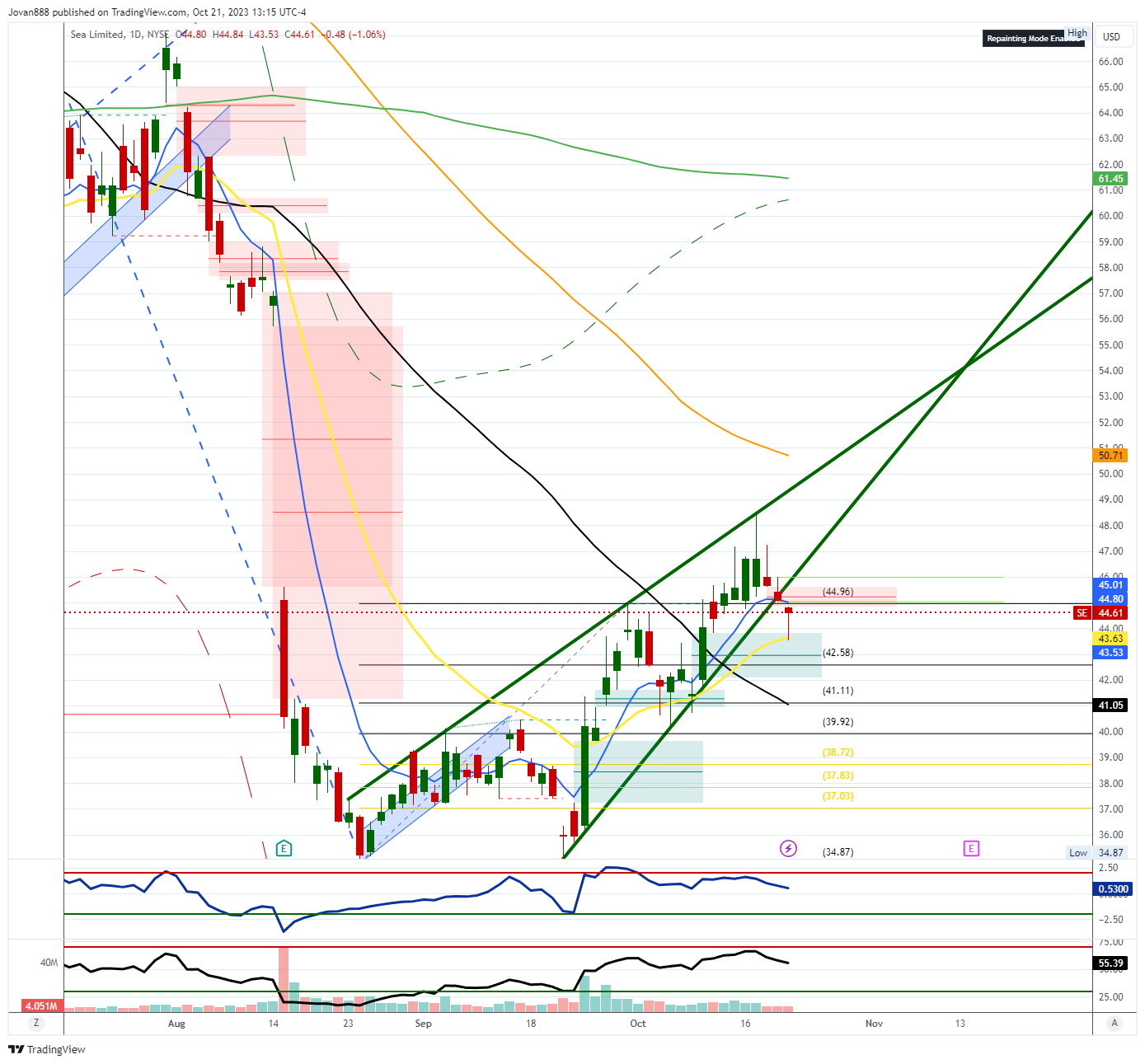

SE 0.00%↑

We caught this move for as much as we could from 37 to 48 but now this wedge has broken to the downside. It would need to hold 41 for continuation

GDX 0.00%↑

Now need to see a conviction move over $29.42 for a real breakout to $32 and above

GS 0.00%↑

Breakdown confirmed here, can see the start of a breakdown to 26

NFLX 0.00%↑

Last week we nailed the bottom tick giving 343.83 as the support and probable BTD zone for a move back to 385+.

Now we need to watch this 417 area which may cap rallies and present a reshort opportunity.

I would suggest also looking at some healthcare stocks now with open enrollment coming on 11-1. HUM 0.00%↑ UNH 0.00%↑ CVS 0.00%↑ among others… they are all having great setups.

Here are some ideas to watch out for in options flow:

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

IF YOU HAVE CHART REQUESTS OR QUESTIONS PLEASE LEAVE A COMMENT, THANK YOU!

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan