Hi everyone!

Last week SPX put in it’s 4 consecutive red week for a total decline of over 5%, something it hasn’t done since last December. This marks the worst month for SPX of 2023. Last week I gave 4393 on $SPX as the pivot and point of control for this week. I mentioned “Bears remain firmly in control below 4393. A lower low was put in on Friday and the downtrend confirmed. We may see continued pullback into 4270 level where once tested, can produce a bounce the first time around. If the 4270 level is tested twice, and no meaningful bounce comes, then a larger sell to fill the gap at 4232." We started the week by attempting to take out 4335 which failed and led to a nasty 100pt rejection down into 4238 before finding some relief and closing the week at 4288.

Here’s the price action for last week:

A recap of the levels provided last week:

From last week’s newsletter:

Bear Trajectory: Bears remain firmly in control below 4393. A lower low was put in on Friday and the downtrend confirmed. We may see continued pullback into 4270 level where once tested, can produce a bounce the first time around. If the 4270 level is tested twice, and no meaningful bounce comes, then a larger sell to fill the gap at 4232 and drop to 4190-4208 area comes next.

Currently the path of least resistance continues to be down as we have sharply rejected the 50sma several times and the 8ema has crossed under the 50sma and is curling down. We have 2 bear gaps above serving as major resistance.

This is a clear DOWNTREND with lower highs and lower lows.

However, if you follow me on Twitter or you are in my Discord then you know that on Wednesday near the lows we got out of puts and switched to calls. From there we saw a rally back to 4335 before a rejection on Friday and trip back to 4280. Alot of the Friday selling IMO was bulls fumbling due to shutdown jitters which has now eased. However, if you look at Wednesday, Thursday, and Friday, each day was higher lows. I think that you can be cautiously bullish here for a leg up to a new lower high - as long as 4240 holds on SPX.

SPX Analysis:

Key Levels: 4240 & 4335

Bears are fully in control below 4393. Bulls need to take out 4335 for a short squeeze back to 4395. Because of the importance of this level, 4335 may be difficult to overcome and require several tries.

Bullish Trajectory: Hammer on Wednesday candle with confirmation the next day and higher lows the day after. I think if they can clear 4294 early in the week we can retest at 4335 where we may sell again one more time and build up energy to take it out. Once 4335 clears we can squeeze towards 4380-4395 before another sell reaction. Important to remember however that bears are currently in control and all longs are considered knife catches. For bulls to regain control they will need to start closing above 4393 again.

Bear Trajectory: Bears remain firmly in control below 4393, however they fumbled when they did not fill the gap from June at 4232. We went as low as 4238, for just 6 points it shows weakness there not to have taken it out. For bears to get sell pressure going again this week, they will need to take out 4238 to target the 200sma at 4199 and test some orderflow levels around 4156. For now it seems bears may have dropped the ball and we are going back up to put in a lower high.

We remain in “fear” on the Fear & Greed Index even after a small relief bounce attempt last week. We are no longer in oversold conditions in shorter timeframes. AAII survey shows declining bullishness and increasing bearishness with bear camp being overcrowded.

A reminder of the VIX seasonality: Possible deeper low in markets in October, but first week appears to be bullish for market.

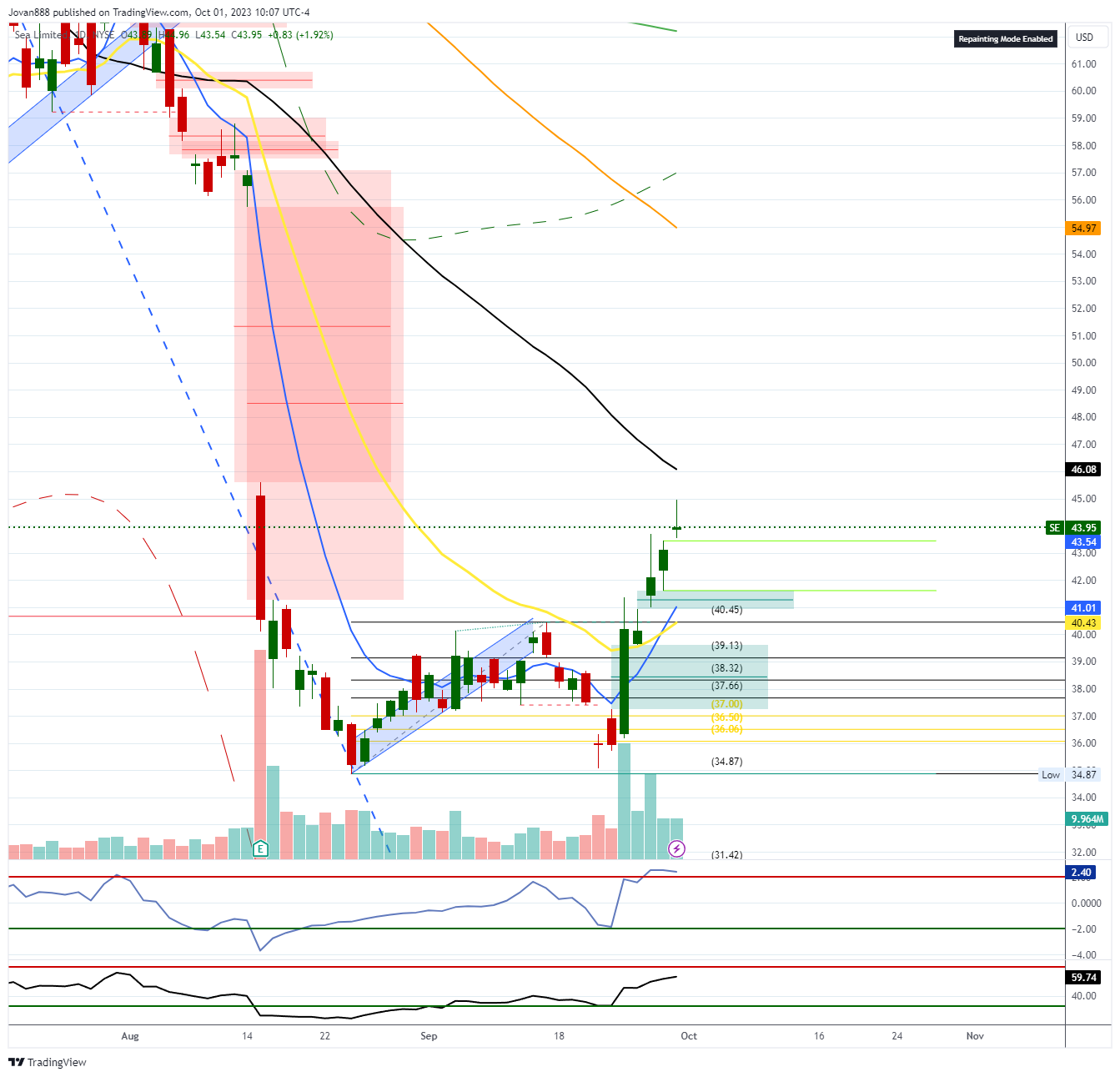

Here is the economic calendar for next week:

Note that Powell speaks Monday at 11am.

For this upcoming week I will be watching the following setups and levels:

SPY 0.00%↑

Clear downtrend in bigger picture with lower highs and lower lows, however we may be carving out a bottom there at 422 for a move back to 436-438 area (or higher) before continuing back down.

Bull case: Over 429.79 can see an attempt at 432-433 again before a sell reaction and then attempt higher into 436-438.

Bear case: Bears will need to hold price below 427 level for softness back to retest 424, if 424 falls then we will make new lows into 416-418 area (200sma) for a bounce the first time around. After a bounce, liquidity grab and rejection can continue lower into 414.23.

AAPL 0.00%↑

Falling wedge

SHORT under 169 targets 167.62, 165.89, 163-164

LONG over 174 targets 176.64, 177.42, 179.82, 181.19

NVDA 0.00%↑

Higher lows on NVDA and higher highs is still the trend.

This can possibly revisit 449 and 467-475 area first before it starts to sell

Bears should not be short while it’s above the red channel

As long as NVDA is over 432, the move is LONG to 445-449 then 460-475.

For a short, need to see NVDA under 420 for a retest of lows at 409 - 409 must fall for a move down into 390.

QQQ 0.00%↑

Lower low was put in last week however pattern is a bit different to SPY and this is slightly more bullish. (Failed breakdown and potential double bottom setup).

LONG above 361, target 362.36, 364.69, 367.24, 369.41, 370.32

SHORT below 355 target 349.71, 338.57

TSLA 0.00%↑

Eyes on 8ema/50sma interaction - very tight (blue and black lines)

Delivery # update coming this week.

Long over 253 to target 260, 270-272

Short under 237 to target 231.88, 226.62

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

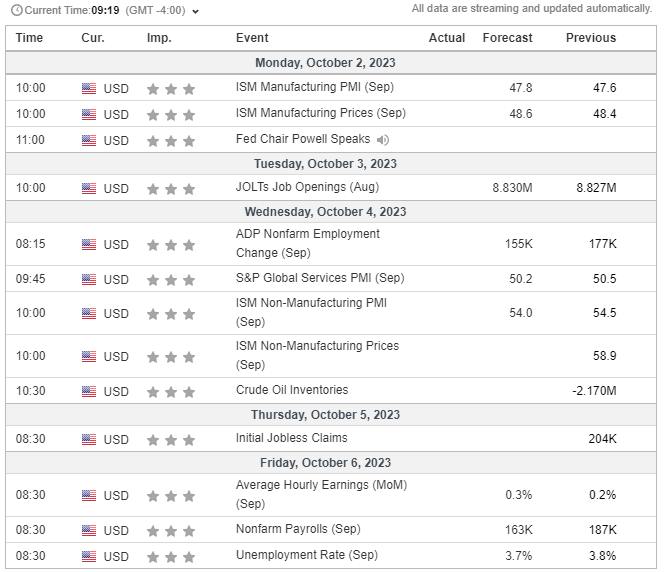

GOOGL 0.00%↑

Breakdown from rising wedge. Now attempting backtest at 137. 8ema/50sma tight together with 8ema still above the 50sma.

LONG over 133 for retest - to target 133.98, 136.95

SHORT under 129 target 126.68, 125.49, 124, 121.9

XLE 0.00%↑

88 could be supported for a move to 94-96.

META 0.00%↑

Setting up for a large 30pt move

If 300 remains supported this may head to 313-316 area next.

If 293.63 falls this will be a failed breakout and head to 280.

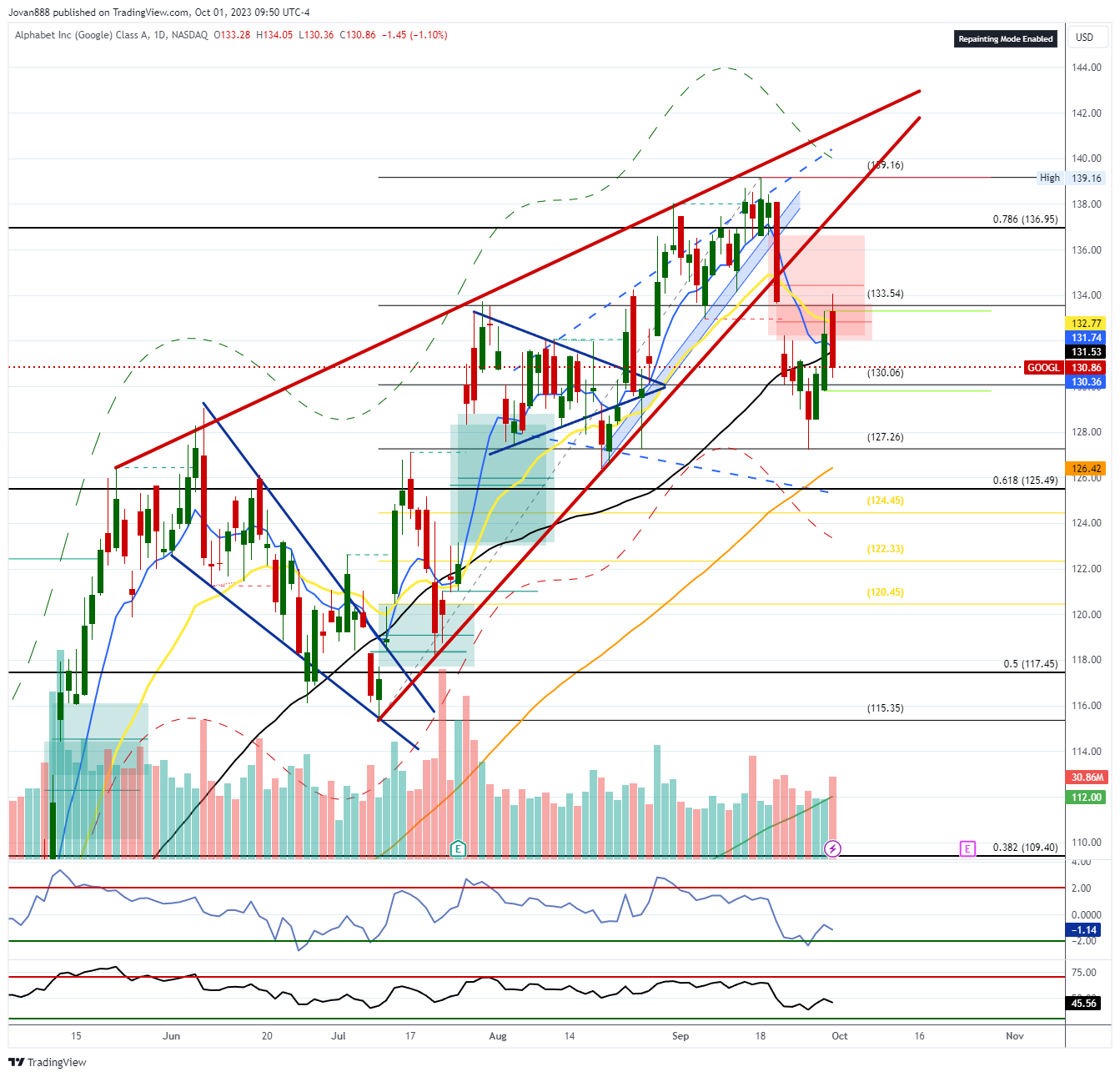

MSFT 0.00%↑

Possible failed breakdown - 320.14 will be the key level.

If 320.14 becomes support, we can target 322.75 and 327.08.

If 320.14 holds as resistance, we may head lower to 305.

AMZN 0.00%↑

Watching 130 level - if it clears, we can see a squeeze into 135.

Not too interested in a short unless 122 level falls - which would be a short trigger for a move down into 113.

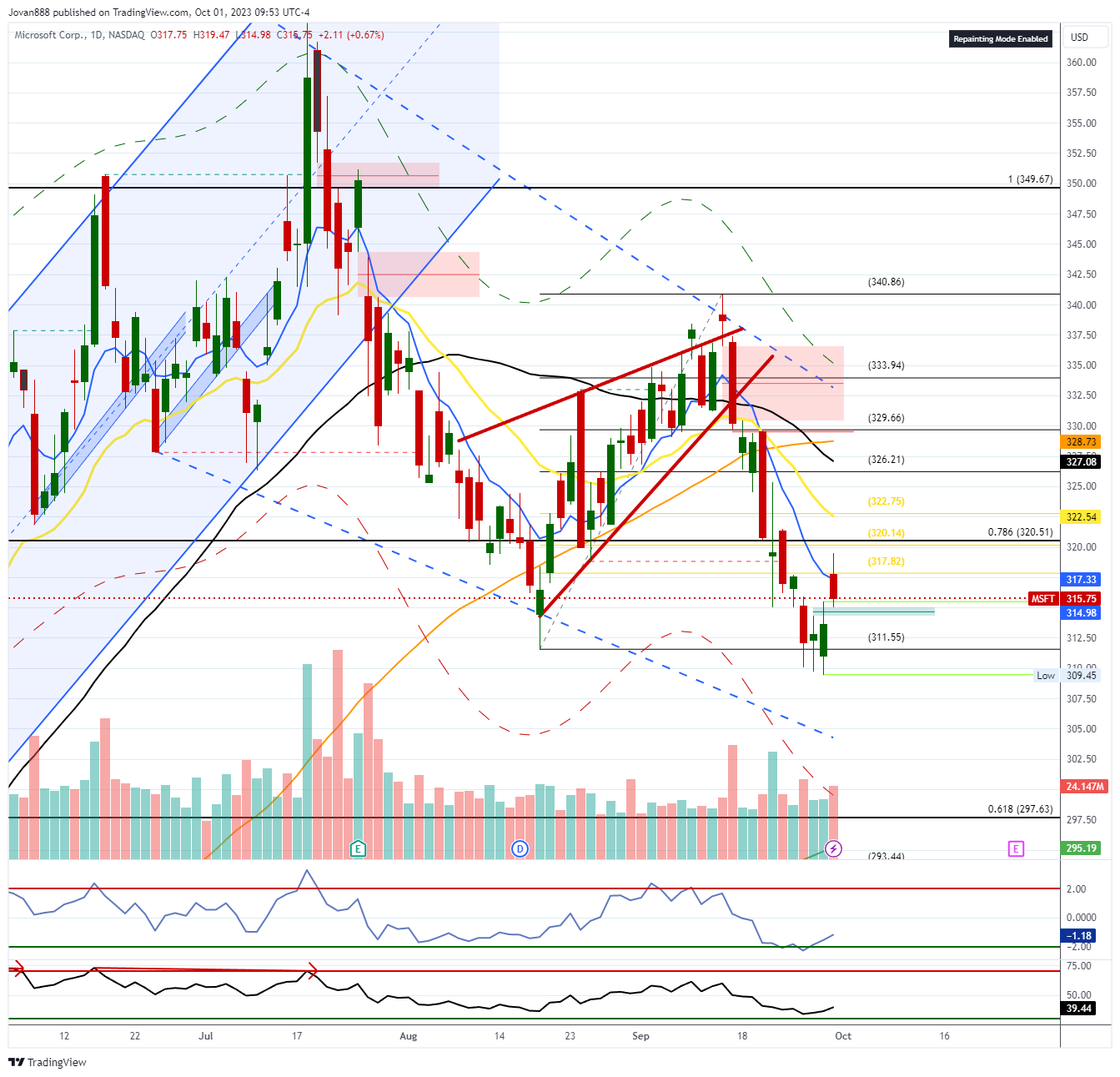

SE 0.00%↑

This one i posted back at $37, I think as long as $40 level holds on the next dip we can retest the 50sma at 46.08. After that we will need to base and build up some energy to setup for a move to 55

SHOP 0.00%↑

Watching $56 level, if it clears, we can long to target 59-61 area

GS 0.00%↑

Still on the radar for a large move when this breaks out of consolidation

For a downside trigger, looking at the fail of 315 which would be a short trigger for a mvoe to 292.

BABA 0.00%↑

Also still watching this on longer timeframes - this consolidation is setting up for an 80$ move, i think once we clear 100 again we will run towards 117, then 129 then 156-160.

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

IF YOU HAVE CHART REQUESTS OR QUESTIONS PLEASE LEAVE A COMMENT, THANK YOU!

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan