(RESEND) Week of October 30th, 2023

SPX breaks through 200dsma towards 4100, end of month bounce time?

Resend of newsletter to update some links & post an update.

Please note our new discord signup link is https://whop.com/jr88trading/

Please also note that in the past we have made the newsletter public in the middle of the week - that will be discontinued. We have done this now for several months and have demonstrated our consistency so at this time we will be leaving the private sections for paid subscribers only.

Currently the price for the newsletter is only $10.88/mo, as you can see, we have made many phenomenal calls here including bottom ticks on NFLX, AMZN & TSLA as well as top ticks in NFLX, TSLA in just the past 2 weeks alone. This price will change for new members in the future (existing subscriptions will not be affected). We may start to push out more frequent updates at that time.

Hi everyone!

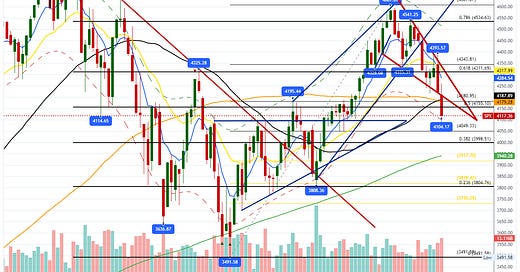

In the prior newsletter I mapped out two paths for this week putting this chart:

And here is how the week played out:

It was a very volatile week that started with an attempted recapture of the 200dsma, but after 2 sessions struggling to find buyers (price consolidating in a bear flag), bulls lost the battle and bears took us to new lows shaving off 300 points off the SPX in just 2 weeks.

On the last newsletter I mentioned “Below 4240 likely to see continuation into 4155-4180 which should see a sizeable bounce before continuing lower. If we flush through 4155 with no support this can be a crash leg into 3800-4000. IMO, it would be better if we bounced at 4155-4180 to then trap more liquidity before heading lower.”

You can see here the price action and how 4240 being defended by the bears led to the large sell off:

The range for last week was 4259-4103.

This is a clear DOWNTREND with lower highs and lower lows. SPX just hit correction territory this past week and you can see how the entire summer of gains has now been wiped out.

Something to keep an eye on now that we are so close is the unfilled gap from March:

Remember to follow me on Twitter @jovanroche or join our discord JR88 DISCORD for live updates.

SPX Analysis:

Key Levels: 4180 & 4085

Bears remain in control under 4340. Below this level expect rips to be sold and continued volatility. Since this is so far away from current level, it’s important to remember the trend is DOWN and rallies are likely to get sold.

That being said we just had a BREAKDOWN from a wedge and IMO it likely gets retested to reset oversold conditions.

Bullish Trajectory: Bulls need to take back a major resistance, now 4180-4200 to get a relief rally going back into 4240 and 4269.

Bear Trajectory: Bears need to hold price down below 4180 to avoid a relief rally and potential move back up to 4269. As long as SPX is below 4180 it is likely that bears can continue to push us lower into 4095 and possibly 4050. Be aware that there is very high risk of short squeeze and 4100 is not the area to be initiating NEW shorts. We are extremely oversold and late bears can get trapped.

Summary:

Below 4180 can see continued pressure towards 4085-95, 4050-67, 3998, 3979 (gap fill)

Above 4180-4200 can see a short squeeze relief rally into 4240 (200dsma) and 4269 (21 ema and fibs)

In the event of extreme volatility the next immediate levels below 3979 are 3917, 3818 and 3730

For those of you not in the Discord (www.jr88trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

Some good calls from last week:

TSLA - I was very specific here giving 200-205 as an area to try longs to target 224.

We alerted these in the discord:

And while we did not reach our 240 target yet we did get as high as 222 where we saw our calls go from 1.31 to 3.25+

Next, we have MSFT 0.00%↑ to which I mentioned if 325 held we would test 342.

While I did not play this one specifically due to ER risk, we were able to take a short at this 342-344 level:

And we managed to flip those for 3X!

This is where the value in the discord comes in and I hope you will consider joining us if you haven’t already :)

We also gave a bunch of setups from last week such as AMZN 0.00%↑ & GDX 0.00%↑

For example on AMZN we mentioned there was a magnet to the 120 level, and this was BEFORE ER

Later in the week we discovered that this morphed into a falling wedge and alerted it on twitter and the discord for an ER play https://x.com/jovanroche/status/1717296825445523490?s=20

There are plenty of other setups and targets that were posted that were on point last week, but you can go through the past newsletters and see for yourself :).

Many other great setups not shared here were available on Twitter & Discord as they came up. If you like my work please follow me on twitter / subscribe to discord / share. Thanks!

Last week I mentioned that the VIX was at a decision point - and highlight the 8ema and 50sma imminent convergence. We got that crossover this week

$22 will continue to be key on the VIX. If we get rejected there then there is an imminent relief for the markets. If we break over 22 and push, then markets may be in for a crash leg. Note that last week despite the large moves in SPX, there was no dramatic acceleration in the VIX yet.

Last week I pointed out a major red flag on AAII for me as there was decreasing bearishness on a decline which is implying that retail is assuming we can’t go lower. This was before even reaching “extreme fear.”

However last week we did get our move into “extreme fear”, and we saw a return to bearishness on the AAII. Bullish levels are now below 30% and I think this may be an indicator of an imminent squeeze.

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPY 0.00%↑

Clear downtrend in bigger picture with lower highs and lower lows. Decisive break of the 200dsma. Yet to be retested from below.

Bull case: Bulls need to take back 413.03 to setup a relief rally and retest that 420.18 level. If over 420.18 next target is 200dsma at 423. If 200dsma is reclaimed, can see large squeeze back to 425.44-428.54

Bear case: Bears will need to keep price suppressed below 413.03 for another direct leg down. If they lose 413.03 they may get squeezed for a retest of the 420.18 level. If they can keep price below 413.03 then they can push us down into 405 and 396-397.

AAPL 0.00%↑

If you are short from 183 as we had posted then just continue to tighten stops. We hit our goal of the 200dsma and broke below.

167.62 KEY LEVEL

→ Above this target 171.55-173.24

→ Below this target 161.81, 158.52

NVDA 0.00%↑

Obvious importance of this 400-405 level.

Above this 400-405 level we could see a retest of 429-435.

Below this 400-405 level we likely target the 200dsma below at 349.75.

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.