Hi everyone!

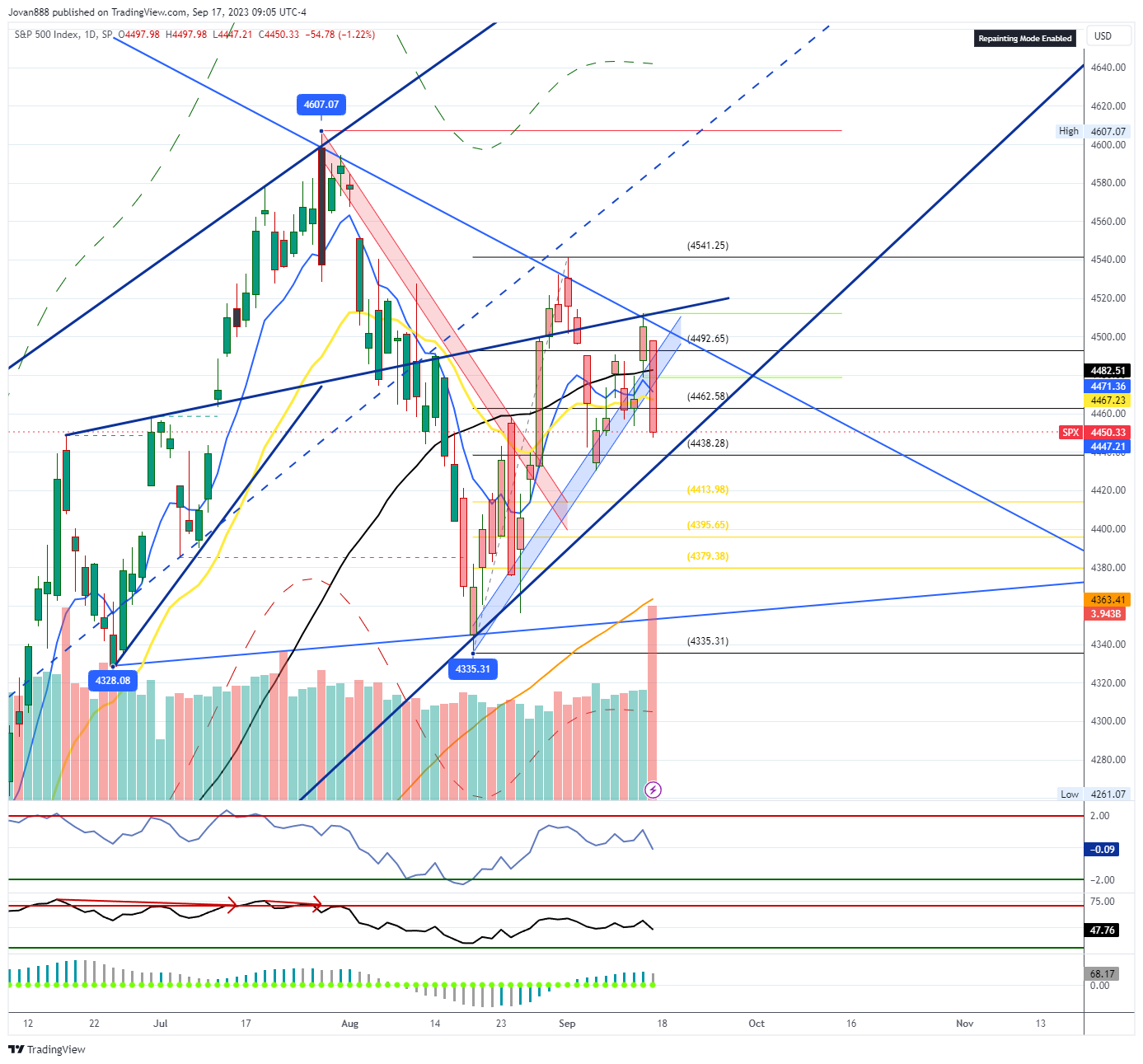

$SPX again with an inside week, now marking a double inside and 14 weeks of consolidation in this 4343 to 4607 range. Last week I gave 4471 on $SPX as the pivot and point of control for this week. I mentioned “Bulls will need to take out 4471 to retest 4503. That will be the bear’s last stand and likely some major dips there. They need to take out 4503 to reclaim control and shift momentum back to the upside" which is EXACTLY what we saw as we got as high as 4511 on $SPX before the bears came in for their final stand and shot us down to close the week near the lows. The range for this week was 4511 to 4447 and was an inside week to the prior.

So far $SPX continues to consolidate in a pennant putting in lower highs and higher lows thus far ahead of FOMC.

Here’s the price action for last week:

A recap of the levels provided last week:

From last week’s newsletter:

Key Level: 4471

Bullish Trajectory: Bulls will need to take out 4471 to retest 4503. That will be the bear’s last stand and likely some major dips there. They need to take out 4503 to reclaim control and shift momentum back to the upside to then target 4542, 4567, 4607 and 4637-50.

Bullish but pullback first - Trajectory: Below 4471 pullback can continue to 4439, 4414-4420 and 4393. As long as this holds - we can set a higher low and then continue building for more upside.

Bear Trajectory: Bears remain in control below 4471. They need to push us below 4430 again to target 4414-4420 and 4393. 4393 must fall for further downside into 4356 and 4335. The 100D SMA is at 4346.78, so that will need to be taken out for sell into 4241 and 4170. I’d expect that 100D SMA if we get there to be a good knife catch spot for a bounce on the first test. Same for 4393-4400 area.

SPX is building up energy for a large move. Folks it is incredibly important to remain patient and to be trading in small size until we have a clear break from range. While everyone is now focused on this pennant like last month they were focused on the H&S, there is a potential for extended consolidation here which can chop up many accounts in the process.

SPX Analysis:

Key Levels: 4430 & 4514

Expect more chop in between these levels with traps for both sides.

4462 will be the immediate POC, it’s possible we can retest this early in the week and reject for a move down to 4424-4430. Also possible we can head lower into 4424-4430 and find support for a move back to 4462 and possibly 4471. Watch out for failed breakdowns within the chop zone.

Bullish Trajectory: Bears are currently in control and all longs are considered knife catches. For bulls to regain control they will need to start closing above 4480 again and then try take out 4514 to test 4541. If 4541 is taken out we can see an attempt to fill the gap at 4567 which may continue to be major R as long as we close below it.

Bullish but pullback first - Trajectory: Below 4471 pullback can continue towards the pennant bottom around 4438 now with an overshoot of 4430. As long as bulls hold there - there is a possibility of going back towards 4480-4494.

Bear Trajectory: Bears remain in control below 4471. Below 4471 bears can push us down into 4438, 4413, 4395, 4379 and 4363. Even then this would be a higher low and we would need to take out 4335 for any further downside into 4280 and gap at 4232.

SPX is definitely building energy for a large move. Currently the path of least resistance appears down as we have sharply rejected the 50sma several times and the 8ema has crossed under the 50sma and is curling down. For the bullish scenario right away without dipping ahead of FOMC, bulls would need to get back above the 50sma asap. The 8ema currently sits at 4471 and the 50sma at 4482.

We have gone back to “neutral” on the F&I essentially giving us the “reset” we needed after the parabolic rally we had in the summer. Now we can setup the next large leg with plenty of room.

AAII sentiment also came down significantly vs the prior week and this can mean we have plenty of upside room. Important to consider this and not be too biased. Last week was a bit easier as we had 42% bullish while we were consolidating in a bear flag. This time around - it’s pretty even near the lower end of the pennant.

A reminder of the VIX seasonality:

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPY 0.00%↑

Key level for the week is 443 and 450 the top and bottom for the immediate pennant.

Expect traps in both directions. The 8ema sits at 446.56 and the 50sma at 447.35.

Bull case: All longs currently are knife catches as bears are currently in control. Bull will need to get back above 447 to regain upside momentum and try 450+ again where they would regain control there to try 451.94 and 453.67. Gap at 455.49 is above and will be major resistance.

Bear case: Below 443 bear flag can fire down into 440.90, 439.06 and overshoot of 437.43. Would watch out for bull’s last stand there as that will be the last line of defense before a test of recent lows at 433 which can be the start of a $20+ sell.

Note: This is a bearish pattern formed after a breakdown of a prior bearish pattern. A rising wedge that broke to the downside followed by a bear flag that had a bull trap and now is testing the bear flag trigger.

The green scenario would be a failed breakdown (bear flag failed to break down)

The red scenario would be the breakdown with bear flag trigger.

AAPL 0.00%↑

Bear setup (loss of 172 level):

AAPL will need to lose 172 for further downside into 164.74 and possibly 160.49

Bull setup (inability to lose 172 level):

Possible falling wedge / double bottom (weekly) setting up for a move back to 182.94-185.16

NVDA 0.00%↑

8ema/50sma reaction on watch. If 8ema (blue line) cross under 50sma (blackline) can see sell to 424-432 before a bounce. If 424 is lost - bigger sell into 405 (100dsma)

No longs for me unless we are over 460.

Bear case: Continue shorts into 432, 424 targets. Monitor for break of 424 zone for flush into 405 (100dsma)

Bull case: If 460 is reclaimed can target 464.63, 470, 479 again.

QQQ 0.00%↑

Unlike SPY, QQQ has the 8ema above the 50sma so it is lagging on the sell and could change this week.

Bear case:

Below 367 is a bearish setup for a move down into 364, 362, 360 and 100sma at 358.66

Bull case:

Above 376 can see 380 again. Above 380 would be a major upside breakout into 387, 394, 400+

TSLA 0.00%↑

Key level: 258.15

I think as long as 258.15 holds on any dips, this will try 280 again. Major spot here on weekly.

No bear case unless we are closing below 256 - at which point we can sell back into 226-231.

SNOW 0.00%↑

Watching same pennant and weekly squeeze

Needs over 165 for next move to 176.32. Over 180 can push into 191.84

MRNA 0.00%↑

Possible breakout here if it gets over 118.07 to target 120-124 and then 132.

GOOGL 0.00%↑

Relative strength as rest of market pulled back. Looking like we will test 140 however this is in a rising wedge so urge caution as pullback likely to follow after hitting 140-142 area.

XLE 0.00%↑

Keep running stops up - breakout fully active above $84, looking for 94-95

META 0.00%↑

BIG 2 WEEKS AHEAD FOR META

Moment of truth if this bear flag fires down or invalidates.

Under 300 target 294, 289 ,285, 280 ,274

Over 306 bear flag failure, longs to 314, 320, 326

MSFT 0.00%↑

Watching 8ema/50sma cross reaction. 100dsma below at 327.61.

If holds below 330 we can retest 326.70.

Bull case: Above 335 can target 346

Bear case: Below 326.70 can target 320.51

PENN 0.00%↑

Failed breakdown and reclaim of 22 level. As long as 22 holds can see retest of 24.48. Needs to get over 25 for accelerated upside into 28.

AMZN 0.00%↑

21ema needs to continue to hold (138.41) for continued upside into 147.69

If 21 ema falls - can see retest of 134.40 area which absolutely needs to hold otherwise uptrend breaks and we pullback to 127.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan