Hi everyone!

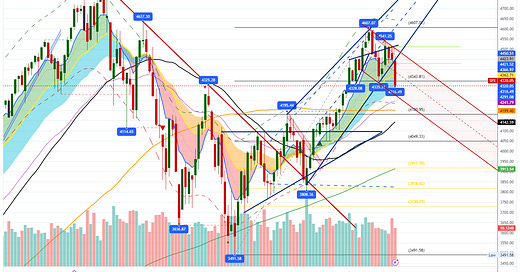

After 2 consecutive inside weeks, $SPX finally broke range last week firing down and breaking out of a rising wedge on the weekly to the downside. Last week I gave 4471 on $SPX as the pivot and point of control for this week. I mentioned “Bears remain in control below 4471. Below 4471 bears can push us down into 4438, 4413, 4395, 4379 and 4363. Even then this would be a higher low and we would need to take out 4335 for any further downside into 4280 and gap at 4232." I highlighted “SPX is definitely building energy for a large move. Currently the path of least resistance appears down as we have sharply rejected the 50sma several times and the 8ema has crossed under the 50sma and is curling down.” The range for this week was 4466 to 4316 and we closed near the lows at 4320.

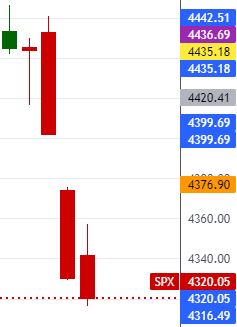

Here’s the price action for last week:

A recap of the levels provided last week:

From last week’s newsletter:

Bear Trajectory: Bears remain in control below 4471. Below 4471 bears can push us down into 4438, 4413, 4395, 4379 and 4363. Even then this would be a higher low and we would need to take out 4335 for any further downside into 4280 and gap at 4232.

It is clear that the trend has changed as we now have put in lower highs and lower lows and we are in a clear downtrend.

SPX Analysis:

Key Levels: 4270 & 4393

Bears are fully in control below 4393. 4270 may be supported the first time around for a significant bounce back to 4379 if tested. 4393 may cap relief rally attempts.

Bullish Trajectory: Bears are currently in control and all longs are considered knife catches. For bulls to regain control they will need to start closing above 4393 again. However, since we are oversold on many short-term timeframes, a relief bounce is possible, and a squeeze can occur when bulls reclaim a resistance. At this point the nearest one is 4335, if bulls can reclaim 4335 level, we can see a squeeze back to 4379 and possibly 4395.

Bear Trajectory: Bears remain firmly in control below 4393. A lower low was put in on Friday and the downtrend confirmed. We may see continued pullback into 4270 level where once tested, can produce a bounce the first time around. If the 4270 level is tested twice, and no meaningful bounce comes, then a larger sell to fill the gap at 4232 and drop to 4190-4208 area comes next.

Currently the path of least resistance continues to be down as we have sharply rejected the 50sma several times and the 8ema has crossed under the 50sma and is curling down. We have 2 bear gaps above serving as major resistance.

We are now in “fear” on the Fear & Greed Index while in oversold conditions, however AAII surveys show we still have some room on the bear side.

A reminder of the VIX seasonality:

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

SPY 0.00%↑

Multiple bearish patterns at work here on SPY. A rising wedge broke down and then consolidated in a bear flag which then broke down to the bottom of the pennant which is now in the process of breaking down.

Bull case: All longs currently are knife catches as bears are currently in control. We are in oversold conditions (doesn’t mean we can’t stay oversold longer) but be aware of short squeeze relief rallies that could occur if a resistance level is reclaimed. 433.01 reclaim is a potential squeeze trigger to target 436.78 and 437.43 and as high as 439.06 is possible.

Bear case: Bears are firmly in control below 439.06. There is a major fib below us at 429.79. Bears will likely need to gap down below this, tap the bottom of the channel around 427 and watch for a sizeable bounce there which can lead to a retest of the pennant around 433-435. If 427 hits and no bounce comes, a larger sell to 424, 420.24 and 418.11 is in order.

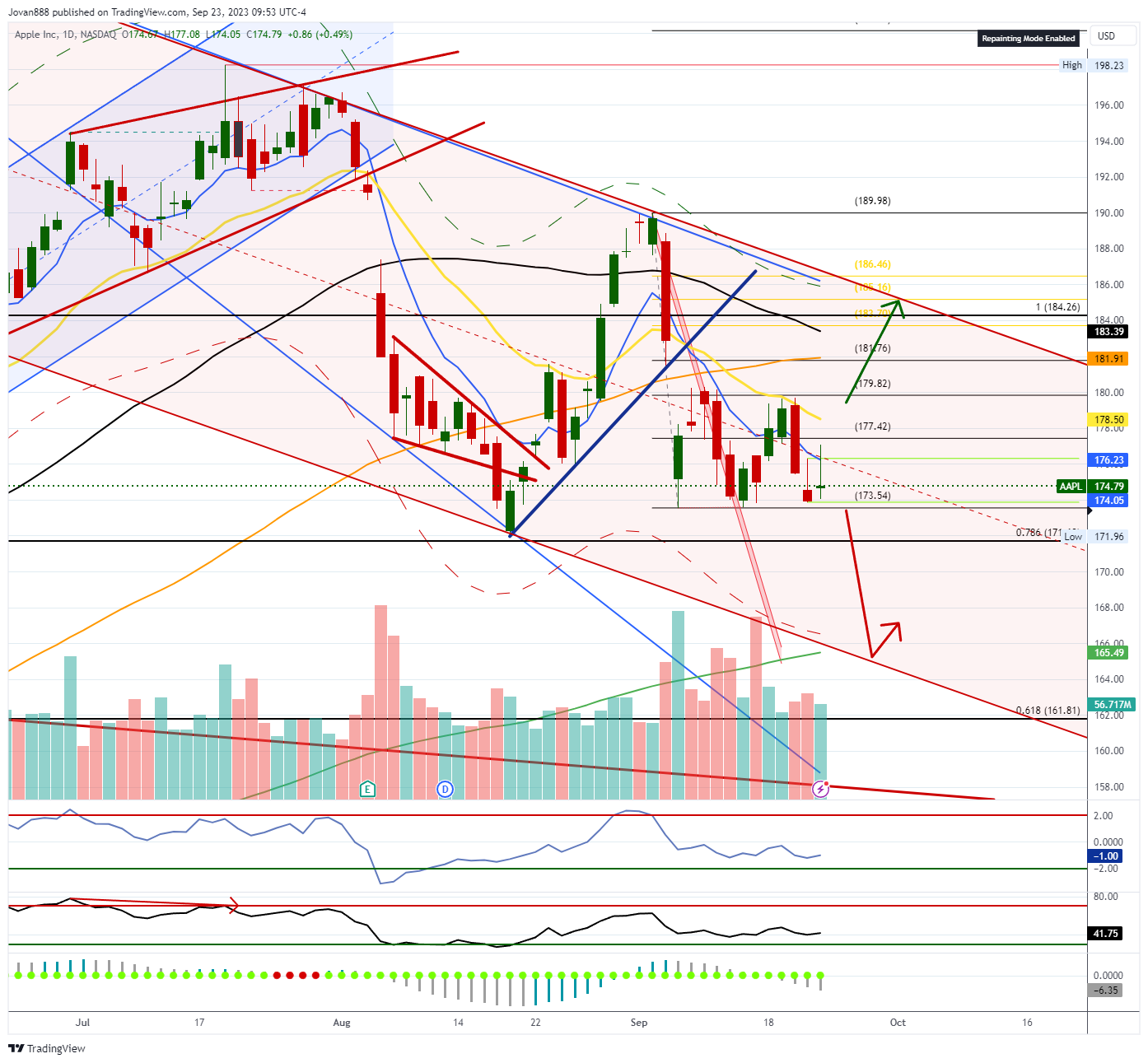

AAPL 0.00%↑

SHORT under 173 targets 171.96, 165.49, 164

LONG over 180 targets 181.76, 183.39, 184.26, 185.16

NVDA 0.00%↑

310P flow came in for NOV 17. This is more than 100$ from current trading price and something to watch out for.

SHORT below 412, target 403, 395.30 (gap fill). Below 395 is 341.59 and the gap at 318.28 which lines up with the 200sma at 314.97

QQQ 0.00%↑

Rejected the 100D SMA and lagging SPY as it has not put in a lower low yet.

SHORT below 357 target 354.71, 349.71, 338.57

LONG above 361, target 362.36, 364.69

TSLA 0.00%↑

Eyes on 8ema/50sma interaction - if 8ema (blue line) crosses under the 50sma (black line) then we are going back to 232.

Long over 253 to target 278

Short under 238-242 to target 231.88, 226.62

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

GOOGL 0.00%↑

Breakdown from rising wedge. Similar to $TSLA, watch for the 8ema/50sma interaction.

SHORT under 129 target 126.68, 125.49, 124, 121.99

LONG over 132 for retest - to target 133.98, 136. (reshort area is 136 on rejection there)

XLE 0.00%↑

88 could be supported for a move to 94.

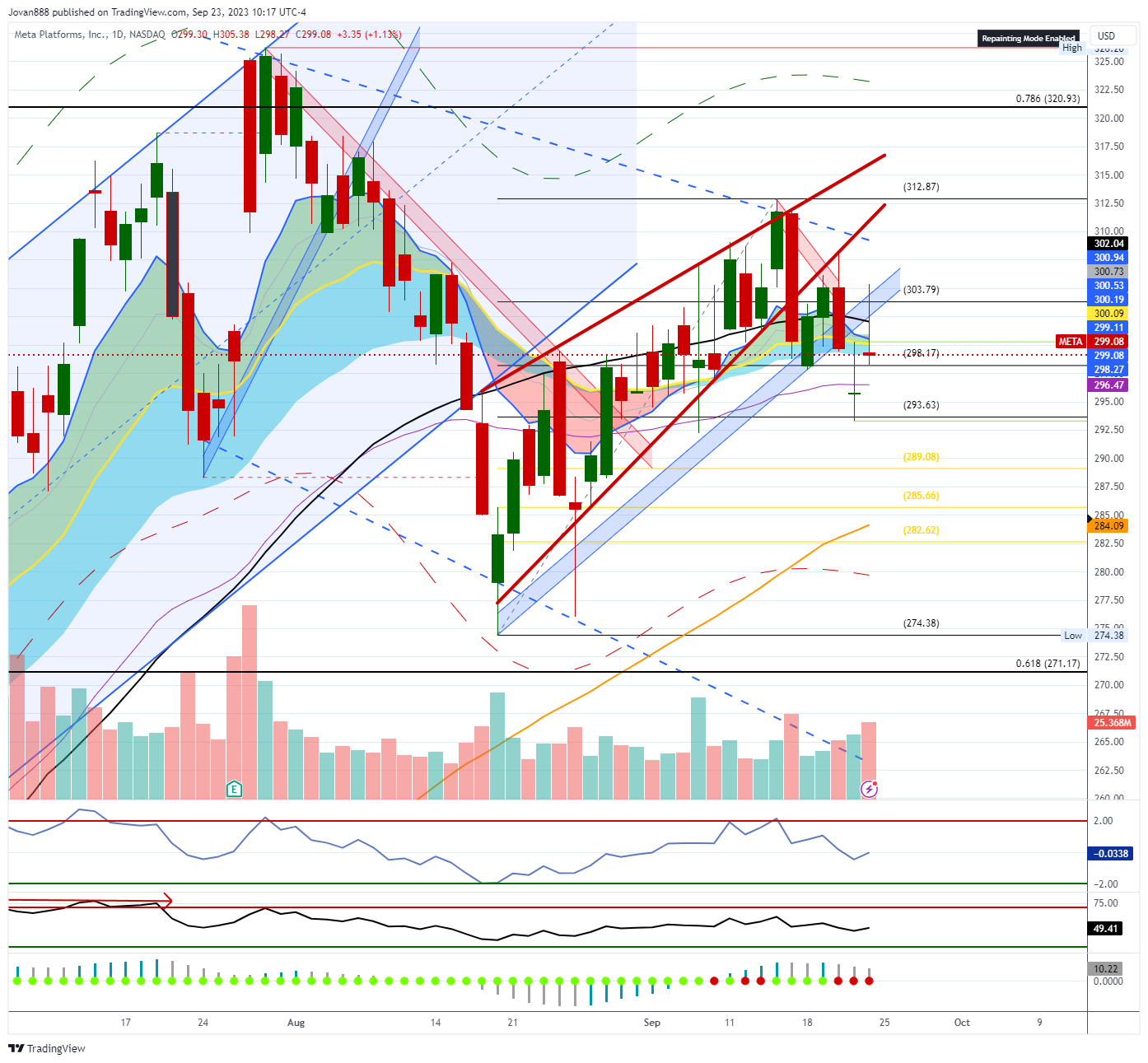

META 0.00%↑

Rising wedge breakdown with retest and confirmation.

Strong SHORT under 300 to target 293.63, 289.08, 285.66, 284.09.

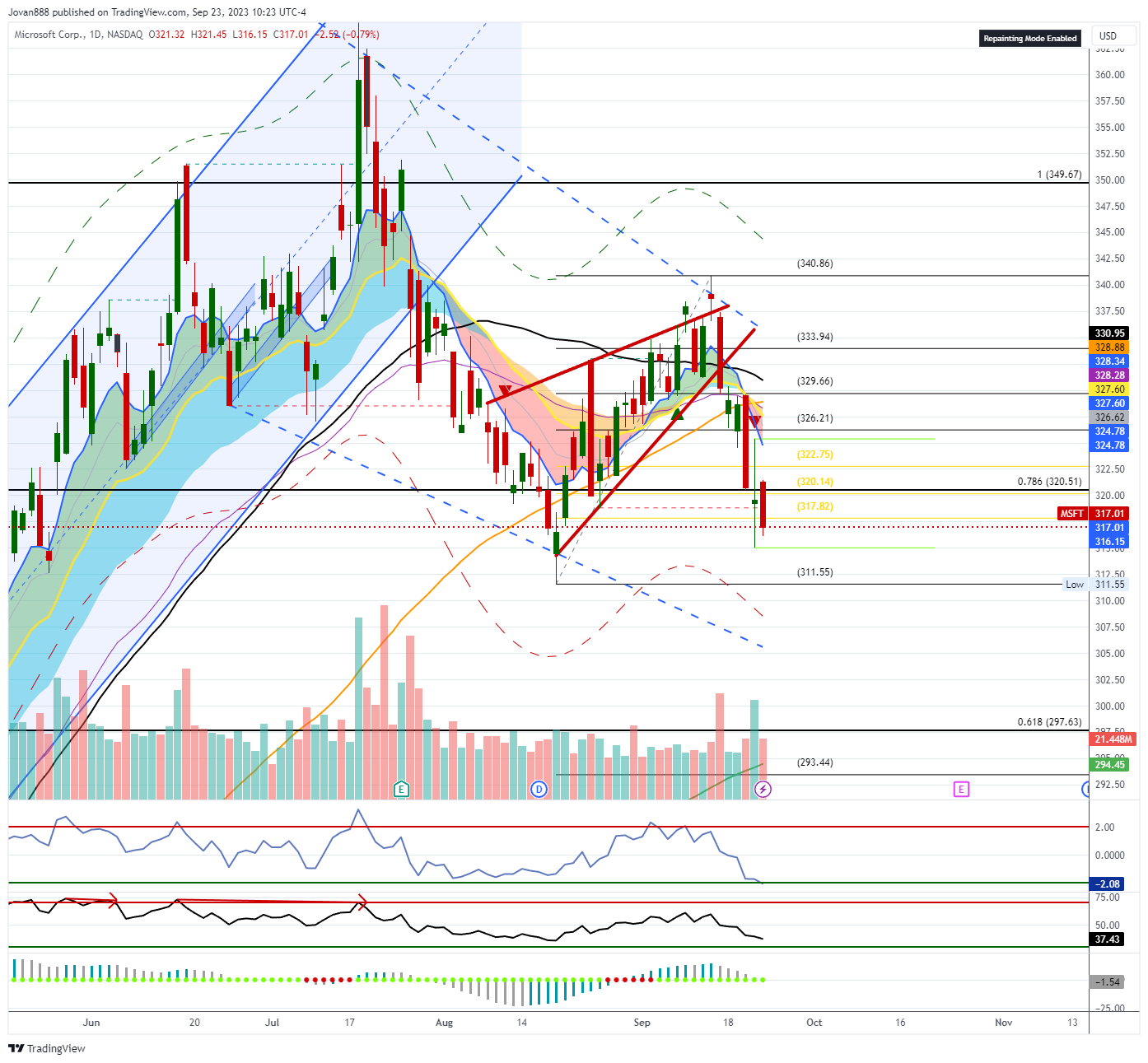

MSFT 0.00%↑

Breakdown continues - under 315 sees next drop to 311 then 305.

AMZN 0.00%↑

127 Support, 135 R

if 127 holds can see support come in for move back to 135.

If 127 falls next is 124 and 122.

FOR A LIMITED TIME: OUR DISCORD MEMBERSHIP IS $44/MO OR $440 FOR THE ANNUAL. YOU CAN JOIN HERE: JR88 DISCORD Membership Plans

IF YOU HAVE CHART REQUESTS OR QUESTIONS PLEASE LEAVE A COMMENT, THANK YOU!

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards, Jovan