Hi everyone!

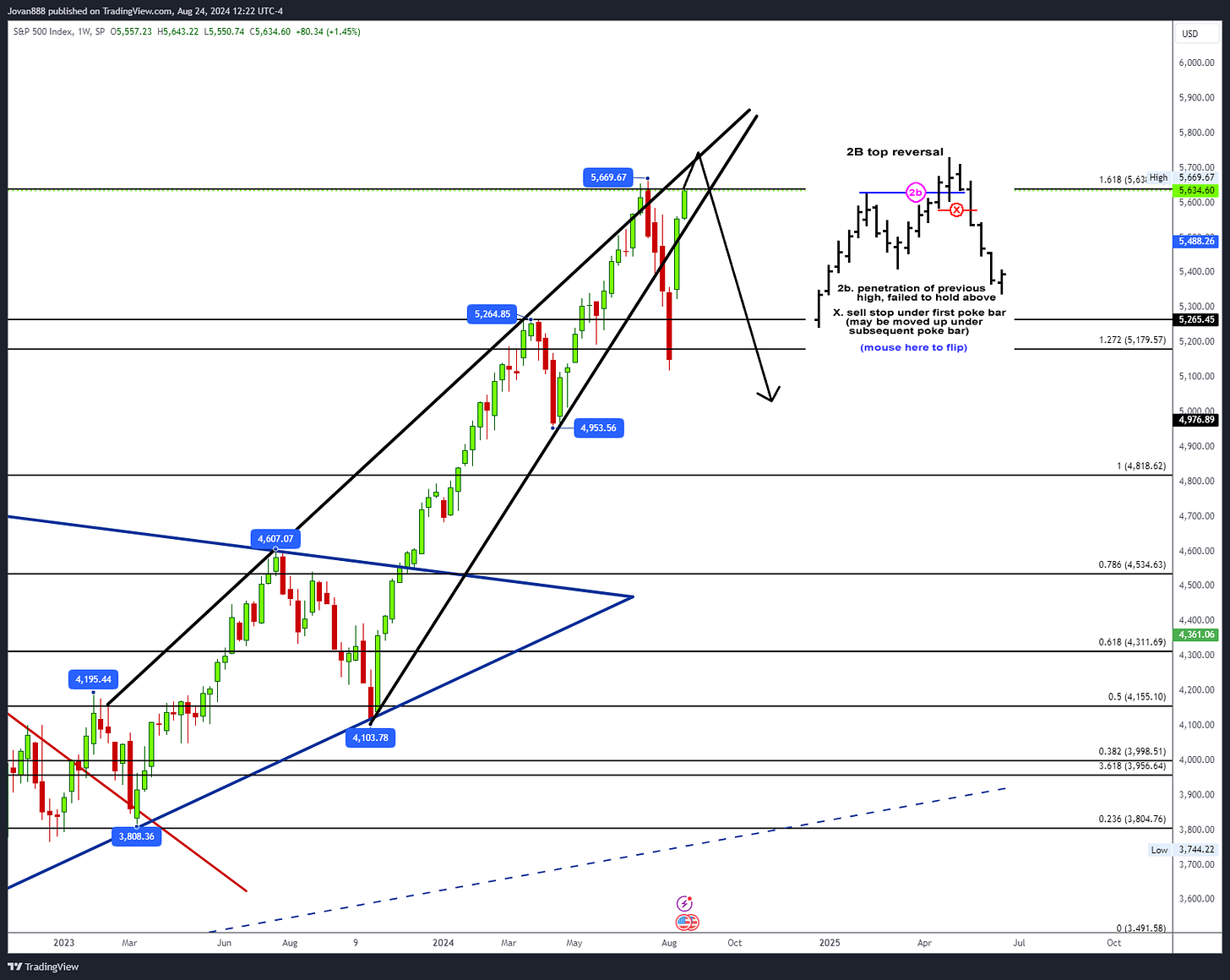

August was a month of dramatic reversals for the SPX. After bottoming out in early August, the index staged a swift V-shaped recovery, rebounding close to its all-time highs. This comeback erased a sharp 10% decline in just three weeks, marking one of the most volatile periods in recent memory. The VIX mirrored this turbulence, soaring to 65.73 before crashing down to 14.46, all within the same month. Volatility made a striking return, with wild swings in both directions as we near the end of a rising wedge pattern that has been forming since 2023. Notably, August saw a 532-point range in the SPX, the most significant move since September 2022.

The weekly chart reveals that the SPX has essentially retested the rising wedge it previously broke out of and has now re-entered. This sets up two possible scenarios: either an explosive move to the upside, targeting 6000, or a swift decline towards 4818 on a rejection. We saw a failed breakout in July when the SPX attempted to move above the wedge, followed by a failed breakdown in August when it attempted to move below. Now that the index is back inside the wedge, the next move—whichever direction it takes—will be decisive.

I want to point out that this could be setting up a classic 2B Top / Failed breakout scenario so we should remain cautious but aware of the possible scenarios and be ready to adapt based on what comes next. This would be a very cruel bull trap if it happens but the idea is to be prepared if we get a sharp and swift rejection at these highs so you are not caught off guard. After this move up, the bulls should be moving stops up and letting it run as far as it goes.

I've mentioned this many times before, but the "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, which should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn. “The trend is your friend.”

SPX Analysis:

Key Levels: 5394 & 5551

SPX back inside the rising wedge on weekly chart.

Same exact levels from last week will apply.

Bullish Trajectory: The bias remains bullish to continue up in the wedge as long as we stay above 5551. If the bulls can hold that level on any dips, we could see a push toward all-time highs and a test of 5700-5740. However, this is a critical zone due to the risk of a failed breakout or a 2B top. In this area, I would initiate longs on failed breakdowns (like the one we had yesterday at 5581), utilizing trailing stops to let the trade run, but avoiding blind dip-buying.

Bear Trajectory: A potential easy short setup with minimal risk is to attempt to short just above ATH around 5720-5740 with stops about 10-20 pts higher. The risk is minimal due to the stop being so close (easy to know if wrong). The second setup would be on a break below 5551 which would target 5508, 5459 and 5394. Below 5394 it would start a waterfall into 4953.

Summary:

Bulls are currently in control over 5551. We have had consolidation for 10 days and likely to see a large move soon. Dips likely to be supported above this 5551 level. For the trend to shift, we would need to start seeing some closes below this level.

IWM 0.00%↑

All eyes on that 216.83 level, if we start to get a few closes above this, we can likely test 233-235 zone. Bulls have the upper hand above 200.

QQQ 0.00%↑

Nowhere near as strong as SPY has been on the recovery - but watching this island top gap above and the current bull flag. If it is to follow SPY, then this should fill to 493.

Gets very bearish below 472.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms, so I have been sharing a weekly newsletter for NQ for subscribers.

We’ve partnered with TPT (TakeProfitTrader)

Promo code: JR28

The new real cost of all TPT accounts is only $130 since the test fees are refunded when you make a withdrawal. So, my recommendation would be the 150k account because once you pass that, and it's pro, you can trade at whatever pace with a much larger room for error and still have the same cost as all the others ($130)

50k account: Cost with code JR28 : $85 (refunded after you pass and take your first withdrawal) + $130 activation = total cost $130.

100k account: Cost with code JR28 : $165 (refunded after you pass and take your first withdrawal) + $130 activation = total cost $130.

150K account: Cost with code JR28 : $180 (refunded after you pass and take your first withdrawal) + $130 activation = total cost $130.

jr28trader.com

A separate newsletter will be sent with individual trade setups for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan