Week of April 22nd, 2024

Rising wedge breakdown leads to 3 consecutive red weeks. Big Tech to report earnings next week (TSLA, MSFT, GOOGL, META)

Hi everyone!

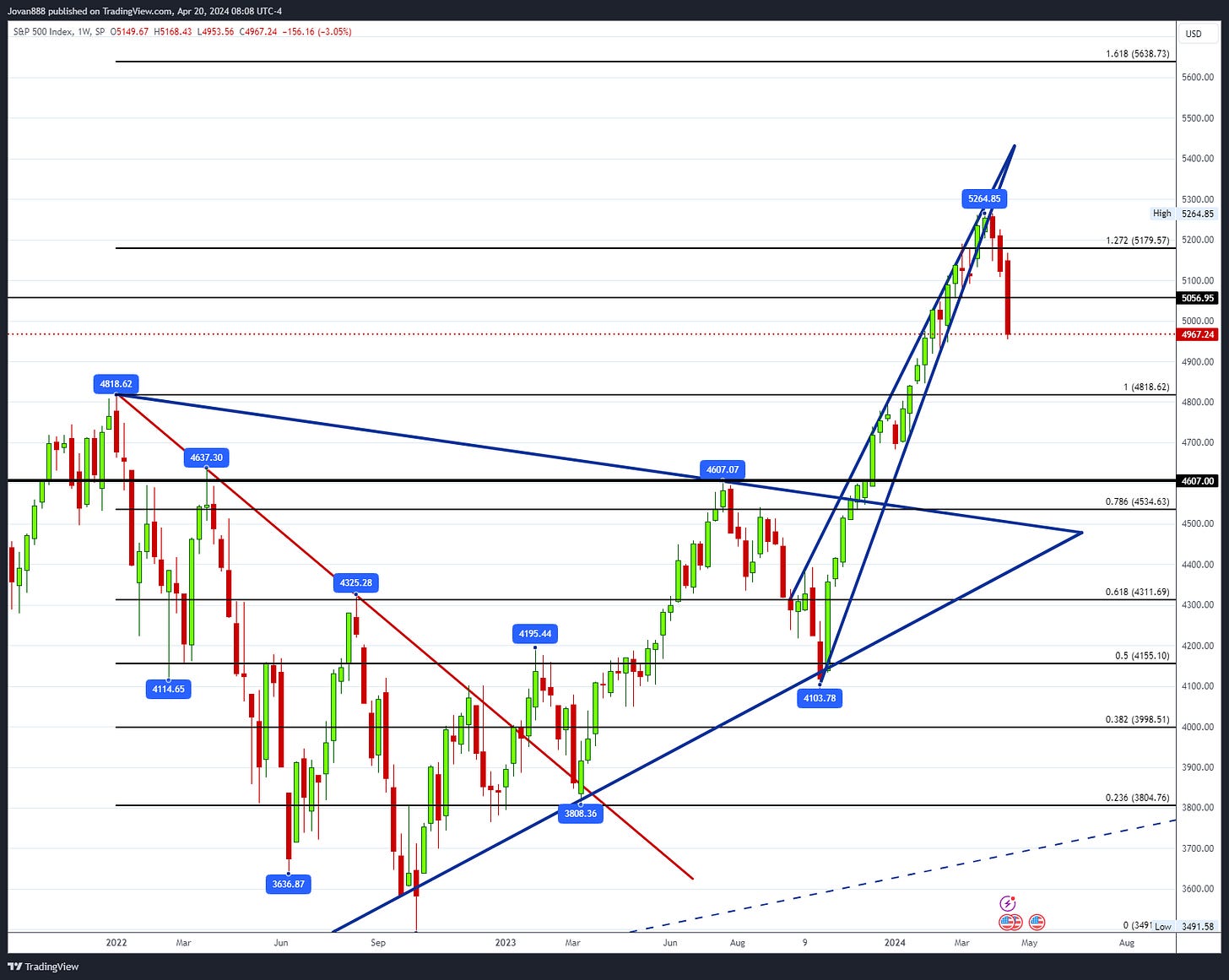

This past week we got some continued downside acceleration making it the 3rd consecutive red week and a decline of -5.91% since the breakdown from the wedge. As mentioned last week the conviction sell below 5179 marks the return of volatility and that predictable repetitive price action that we’ve had for several months now has come to an end. I have been warning the past several weeks that we were nearing the point where the “BTD” routine would stop working and it was time to quickly adapt to a new trend.

You will notice that my weekly analysis revolves around levels and price, not headlines or events, so while some will argue that it is the war tensions or cpi or other headlines, my plans are based on the idea that narrative follows price, and the price is based on reactions to certain levels. We got through all of our targets last week - in a very simple to understand way (bearish under 5179 to target 4983) and did not need to factor in macro complexities for our trade plan.

Last week I mentioned in our analysis of SPX:

“Bears can maintain pressure as long as below 5179 which could lead to a sell that breaks 5110 and targets 5056. If 5056 falls, then we start a sell leg to fill the gap at 4983 and head into 4800’s.”

We started the week near 5150, attempted to push to 5179, failed and then sold all the way down into 4953.

I will keep mentioning this because the risks are currently elevated: Crucial for the upcoming weeks: "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, and this short position should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn.

The 5179 fib extension was the key important zone to watch for this breakdown because it defined who was in control between bulls vs bears. For a bottom to be in a resistance must be reclaimed, in this case it will now shift to 5056. Bulls can relcaim control if above 5056, bears in control below 5056. By control - I mean the trend goes from buy the dips (bull) to short the rips (bear).

SPX Analysis:

Key Levels: 5056 & 5110

Bullish Trajectory: No bull case below 5056 other than knife catches and to watch for a failed breakdown setup. If a failed breakdown setup appears where 5056 is reclaimed, then we can scalp longs towards 5110 & 5179.

Bear Trajectory: Bears can maintain pressure as long as below 5056. Below 5056 we can target 4983, 4924 & 4821.

Summary:

Bears in control below 5056. We may need to go higher to go lower. So rallies to 5056 that are rejected, would be a good short back down to 4983 & 4924. Below 4924 is a big leg down into 4818-4821.

IWM 0.00%↑

Gave this 2B top setup weeks ago and it has played out perfectly taking us down into the 191 area. On this one the trend is also short the rips for now and that trend does not change UNLESS we are back over 200.

This is a critical area as a failure of 190 is a massive, failed breakout that can take us to 170 and below, so I would expect to see an attempt by bulls to hold this spot because the consequences of not holding this are severe.

QQQ 0.00%↑

Currently retesting the original 408-411 breakout zone. This is also a critical spot for QQQ as it defines whether this is a valid breakout or a failed breakout which leads to another 30pt sell. Would expect a fight by bulls at this spot but bears are in control below 427. If 408 falls the next levels below at 398 & 394.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

On the subscriber only newsletter:

We covered amazing setups and gave clear LONG or SHORT recommendations on each ticker.

Sentiment Check

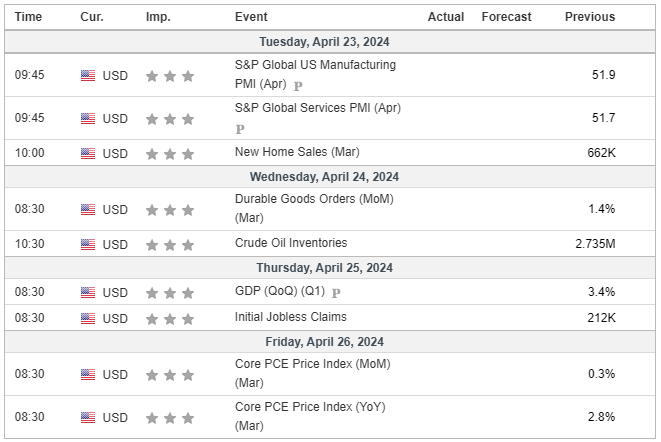

Here is the economic calendar for next week:

A separate newsletter will be sent tomorrow with the setups I am watching for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan