Hi everyone!

This past week I warned that we likely had to go higher in order to go lower. We got a nice green week to snap a 3-week losing streak thanks to positive ER reactions on MSFT 0.00%↑ & GOOGL 0.00%↑. As mentioned last week the conviction sell below 5179 marks the return of volatility and that predictable repetitive price action that we’ve had for several months now has come to an end. I have been warning the past several weeks that we were nearing the point where the “BTD” routine would stop working and it was time to quickly adapt to a new trend. Many went home very bullish on Friday, and many are calling for the bottom to be in. It’s important to note that in most corrections the majority are convinced a bottom is in before another deep leg down. For me it is simple, we are below 5179 and as long as we are below 5179 rallies are likely to be sold.

Last week I mentioned in our analysis of SPX:

“ We may need to go higher to go lower. If a failed breakdown setup appears where 5056 is reclaimed, then we can scalp longs towards 5110 & 5179.”

We started the week near 4990, attempted to break lower but failed and we rallied into 5056 setting up a beautiful, failed breakdown and rally into 5110.

I will keep mentioning this because the risks are currently elevated: Crucial for the upcoming weeks: "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, and this short position should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. For those accustomed to habitually buying every dip, swift pivoting is essential when support levels start to erode. Failing to do so might result in surrendering hard-earned gains by persistently attempting to buy dips amidst a multi-day, multi-support downturn.

SPX Analysis:

Key Levels: 5056 & 5110

Potential bear flag formation setup

Bullish Trajectory: As long as above 5056 bulls have potential to continue this failed breakdown into 5110 and 5150, 5179. Major resistance at 5179 and bulls not in the clear unless 5179 is taken out.

Bear Trajectory: Bears can maintain pressure below 5056. If this bear flag is valid, we should see a dip next week back to retest 5056. Below 5056 we can target 4983, 4924 & 4821.

Summary:

Bears in control below 5056. Bulls in control above 5179. Expecting a retest of 5056 next week, if it does not hold, a sell off leg into 4818 begins. If 5056 holds we could get a throwover trap into 5150-5179. A throwover trap is typical in these corrective phases as they would convince everyone that the bottom is in before a rug pull. Stay cautious next week.

IWM 0.00%↑

Last week at the orange circle below I mentioned that this was a critical spot and I expected the bulls to hold it otherwise the consequences of losing that level would be severe.

We got a nice bounce from that spot into my red box and POC of 199-200. This 199-200 will be the decision point for next week. If it is reclaimed, then bulls can put in a failed breakdown here and take us towards the gap at 205. If rejected at 199-200 we could retest recent low at 190.

QQQ 0.00%↑

Again mentioned last week that I expected a fight by bulls at this spot (orange circle) and indeed we got a huge bounce from there. It appears we are attempting to put in a failed breakdown of 427 to retest 436.

If 427 were to fall again on FOMC week we could retest the low again near 412. If 427 holds we can retest 436 and likely get rejected there.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

On the subscriber only newsletter:

We covered amazing setups and gave clear LONG or SHORT recommendations on each ticker.

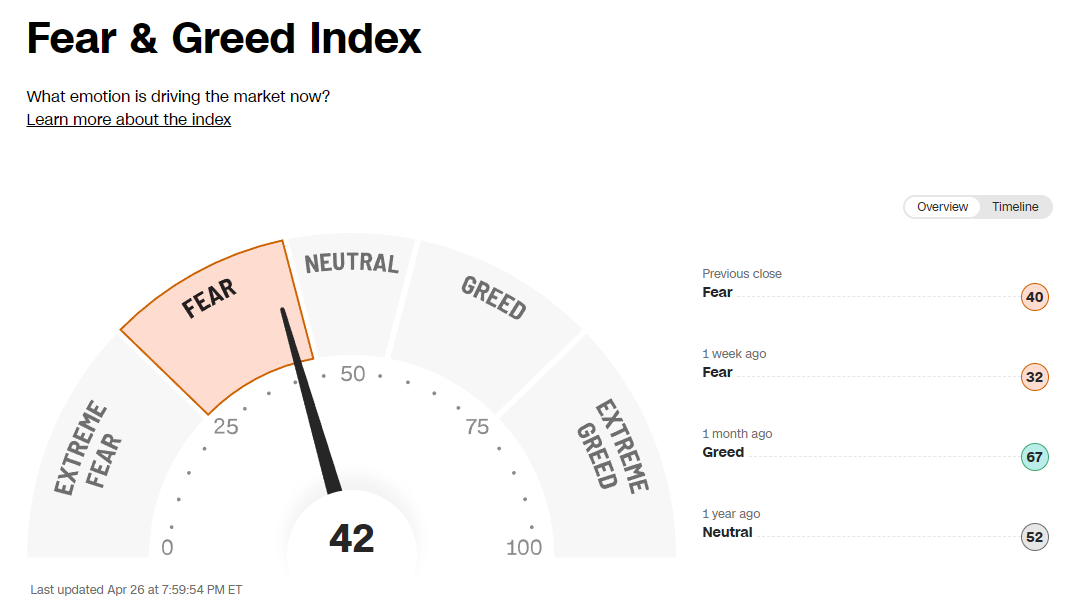

Sentiment Check

Here is the economic calendar for next week:

AMZN 0.00%↑ to report earnings Tuesday AMC

AAPL 0.00%↑ to report earnings Thursday AMC

A separate newsletter will be sent tomorrow with the setups I am watching for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan