Hi everyone!

This past week we got our 7th consecutive green week in a row in what has clearly been a lockout rally and kept anyone waiting on a dip sidelined or forced to FOMO in at the highs. Some individual names such as MSFT 0.00%↑ saw their largest trade since inception - 9.2B printed in the closing auction. Last week’s range for SPX was 4593 to 4738.

Last week I mentioned “A pullback for a higher low is near however you can try chase longs as long as we are above SPX 4586 to target 4614-4624 zone. Above 4624 can target 4648, 4666.” The theme continues to be the same, the trend is long, and BTD continues to have better odds until a support fails. We did not trade below my 4586 level the entire week and it led to range expansion blowing past my 4666 level and continuing up to 4738.

Something I have mentioned time and time again is that in bullish trends bearish patterns tend to fail and in bearish trends bullish patterns tend to fail. Here we can see a rising wedge (bearish pattern) that is breaking out to the upside which is indicating that there is no shortage of demand or buyers and the strength persists, for now. I warned about this wedge last week “if we breakout of the pattern to the upside, the bearish pattern is invalidated and there is no reason to short.”

SPX Analysis:

Key Levels: 4734 & 4694

Extreme risk at current levels for new longs.

Bulls continue to hold control (BTD) as long as SPX is over 4534 and that means that BTD has a much higher success rate than STR. If below 4534 there is possibility of failed breakout which can unravel into a deep sell.

In the past 2 days SPX has put in another bull pennant with a measured move that either targets all time highs directly or fails and does a retest of 4607 first.

Bullish Trajectory: High risk for new longs as this breakout reaches its mature stages. If taking longs be prepared for a multi-day sell to come at some point suddenly and don’t get stuck buying every dip. Can try chase longs over 4734 to target 4742 and then attempt to take out the ATH. Be very tight with the stops and be prepared for fails.

Bear Trajectory: A break of 4694 likely leads to a retest of the FOMC breakout at 4655. If 4655 falls then this turns into a failed breakout and can continue down to 4607.

Summary:

Watch for which direction the pennant breaks and then play level to level move.

IWM 0.00%↑

IWM visiting this 200 level for the 4th time after a liquidity grab / failed breakdown it may have the juice this time. Watching this 190-193 zone if it holds for a push into 203 and 212.

QQQ 0.00%↑

A perfect backtest and S/R flip of its breakout that held, and recent new highs, only $3 away from ATH.

TLT 0.00%↑

We grabbed the bottom of this at 82 and it has reached our $100 target. As long as the red box holds on any dips, we should continue to 105 and 114 next.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

We had some great calls last week in TSLA 0.00%↑ , NVDA 0.00%↑ , SMCI 0.00%↑, PYPL 0.00%↑, U 0.00%↑ , $ENPH, OXY 0.00%↑ , SNAP 0.00%↑ , PENN 0.00%↑ and others.

Sentiment Check:

Comments:

Getting close to pullback as bullish sentiment nears the July high levels and bearish sentiment is at record lows.

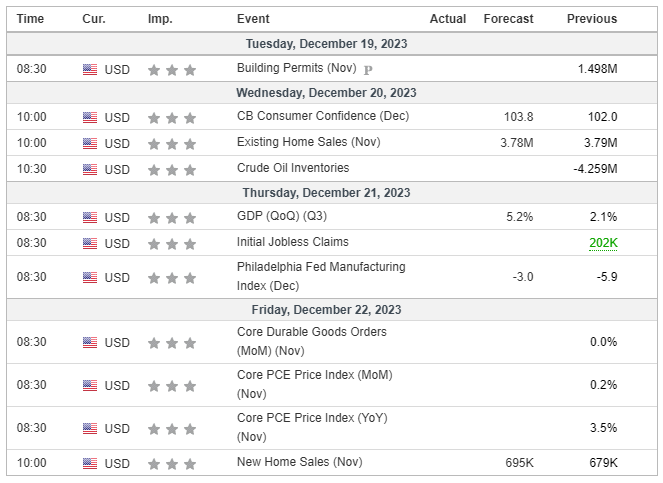

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.