Week of May 13th, 2024

Did bears the drop the ball? Low volume melt up takes SPX back over 5200.

Hi everyone!

This past week I must admit I underestimated the extent of the rally as I had been expecting a chance to enter longs on a dip or a failed breakdown. We got neither as we just gapped up and kept going all week. This is usually risky to chase and not my favorite type of trade, but we did get a retest of 515.85 from above on Wednesday which held and gave us a good long entry for the rest of the week. I did give 5179 as the turn level on SPX and 515.85 as the shift in point of control. Above that level we could not be bearish and in the discord, we took advantage of some long setups.

Last week I mentioned in our analysis of SPX:

“As long as above 5110 bulls have potential to continue this failed breakdown into 5145-5179”

We started the week near 5419 on a gap up and then pushed over 5179 into 5199 before a pullback to 5160 (retest of 5179 from above) which held and we pushed higher into 5239 and breaking the downtrend line on daily.

I will keep mentioning this because the risks are currently elevated: Crucial for the upcoming weeks: "Buy the Dip" (BTD) strategy remains viable as long as crucial support levels hold. However, if support crumbles, it triggers the initiation of a short trade, and this short position should be maintained until a resistance level is successfully reclaimed. This underscores the importance of adaptability. Reminder that this goes both ways and shorting the rip does not work when resistance levels are reclaimed like we saw last week. So, make sure to remove bias and focus on just the levels in your trading.

SPX Analysis:

Key Levels: 5198 & 5264

Bullish Trajectory: It is hard to suggest a direct long here at 5222 as the long trigger was since the 5166 FBD on Wednesday. However, it is possible to take a chase long here as long as 5198 holds to continue higher into 5264 and fresh new ATH. If going long here, would keep a very tight stop as this is a breakout long, and any failure here could cause a complete unravel and huge selloff.

Bear Trajectory: A breakout is being attempted by the bulls. The only bear scenario would be a failed breakout, which would need to see a sell under 5198 and preferably under 5160 to trigger a large sell leg. Under 5160 would trigger a sell leg into 5072.

Summary:

Bulls in control above 5179 and in breakout above 5198. There is a gap below at 5072 now which will only be tested on a failed breakout scenario and may act as support the first time around. As long as above 5198 we are in breakout mode and continue up into new ATH likely. Breakout fails below 5198.

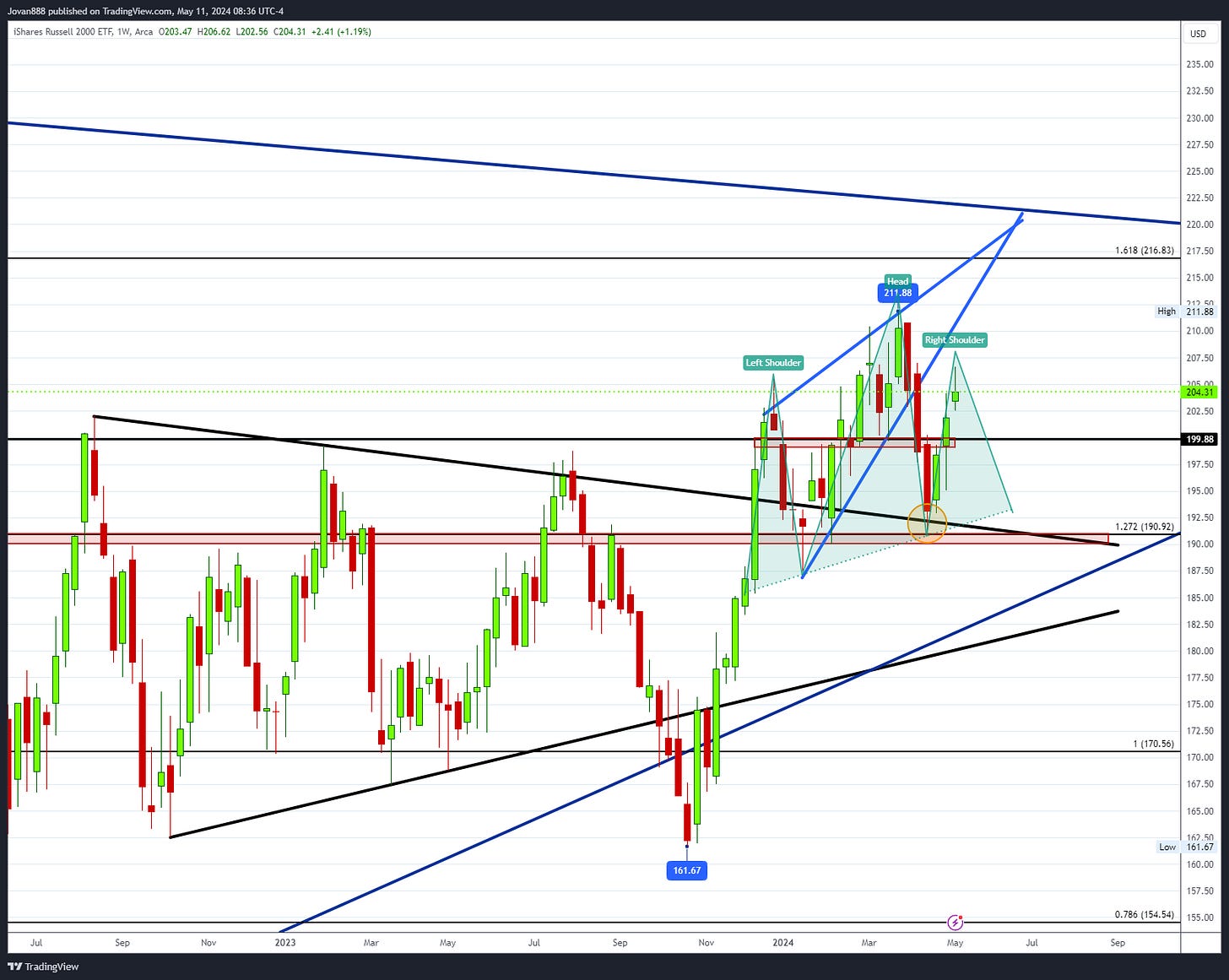

IWM 0.00%↑

Moment of truth here for $IWM, above 199.88 is good but not out of the woods for bulls as if we stall here at 205 it turns into a H&S.

Bulls need to push next week higher into 210+ area to invalidate the potential bearish setup.

QQQ 0.00%↑

QQQ is bullish above 436. Above 436 is 441 and above 441 is 447 and ATH around the corner.

No bear case here unless it goes back below 436. Gap below at 427.81 would act as support the first time around in the event we do sell below 436 next week.

In the event of a large, outsized move outside the levels given here for CPI, I will send out an extra newsletter with levels for the rest of the week if that happens.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS on Stocks, Options, Crypto & Futures.

FUTURES TRADING:

There is a current wave of futures trading with prop firms so I will start to post levels for ES instead of SPX as well as NQ but this will go out on the weekly newsletter on Sundays.

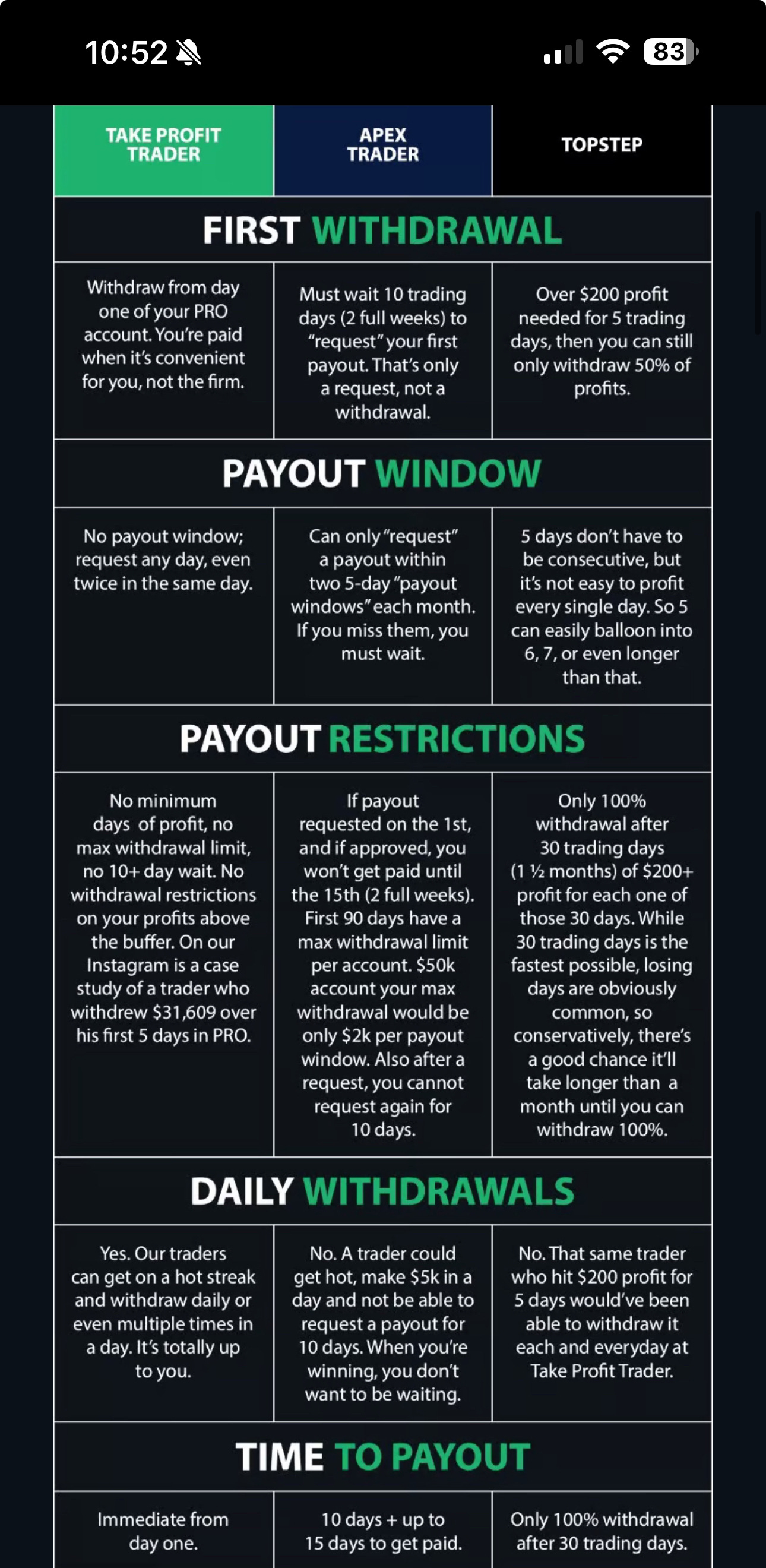

Here’s my feedback on TPT (TakeProfitTrader) USE CODE JR28

Initial cost with the 40% off and NO activation fee sale: Promo code: JR28

50k account $102 When you pass, no activation fees due = total cost $102

Why use a prop firm?

Discover the optimal approach to maximizing your capital while minimizing risk, all while gaining invaluable trading experience. Rather than committing substantial sums to an account in hopes of mastering trading, consider a more efficient and cost-effective strategy. With a nominal fee ranging from $75 to $250, you can gain access to an account furnished with capital, enabling you to generate profits without exposing yourself to significant risks.

While conventional methods like paper trading exist, they often fall short as they lack the emotional engagement and real consequences inherent in actual trading scenarios. Proprietary trading firms offer a compelling alternative, providing a challenging yet supportive environment to hone your skills. Should setbacks occur, the repercussions are manageable, with a mere $100 reset fee, far less severe than the potential loss of an entire account.

Beyond the educational benefits, this approach offers unparalleled leverage, allowing you to amplify your trading power at a fraction of the usual cost. With this strategy, you can navigate the complexities of trading with confidence and prudence, positioning yourself for long-term success in the markets.

What's harder about it vs other prop firms:

-> Challenge is a bit tougher because the daily loss limit is smaller ($1100)

-> "resets" are more expensive, so this is going to be hard for folks who are not consistent. I suggest using MNQ vs NQ and try not to take too much risk until you pass

What's better about it vs other prop firms:

-> Once you pass the test and move to a pro account if you mess up you don't have to go back to the test (you can reset the real account up to 3 times)

-> You can take a payout on day1, and whenever, every day if you want to and its approved rapidly and paid via PayPal or direct deposit

-> Even if you blow up the account, if the balance was above the buffer zone (or even within it) you can request a payment. So if you went up to 53-55k for example and then you blew it up cause you exceeded the traildown, but lets say it closed at 52500, you could still get a payment for the difference over 50k

In this discord if you are interested, we are giving guided trades for futures like this:

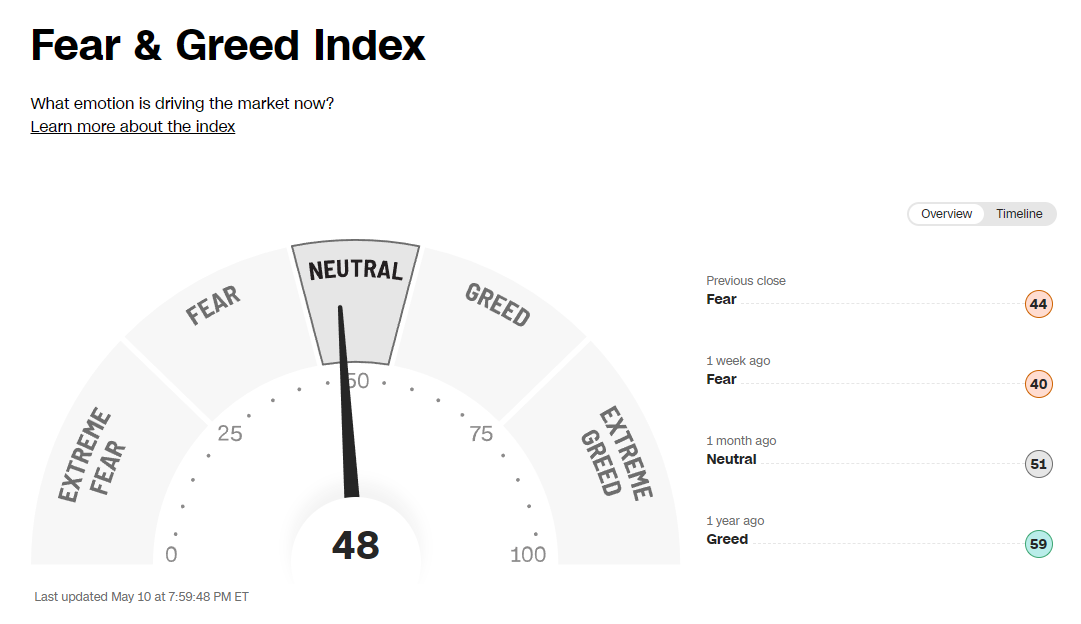

Sentiment Check

Here is the economic calendar for next week:

A separate newsletter will be sent tomorrow with the setups I am watching for next week to paid subscribers.

Have a wonderful weekend!

Wishing you a successful and profitable trading week ahead!

Best regards,

Jovan