Hi everyone!

This past week we got our 4th consecutive green week in a row with SPX now up over 11% in less than 30 days. The range for this past week was 4510 to 4568 and we closed the week just below that very important line on the weekly chart (see image above). This past week SPX also filled the gap back from August 1st at 4567.

Last week I mentioned “If we continue to base above 4487, we likely push higher into 4534 (78.6 fib) and make an attempt at the September high (4541) and above there an attempt to fill the gap above at 4572.” We got exactly that with 0 activity below our 4487 level.

While the move can seem extreme due to the speed of it, and the lack of pullbacks, it is important to zoom out and look at the bigger picture. SPX bounced decisively off the bottom of the pennant and since a breakdown did not occur (failed breakdown) price rapidly went back to the top of the pennant to try for an upside breakout. You will notice in the photo below that the range has been narrowing and will continue to do so for as long as it stays in this pennant. If it rejects at the top of the pennant now in the upcoming weeks, it’s possible to stay consolidating in a narrowing range for several months.

Anyone looking at this can definitely see a potential cup & handle pattern here, which is likely leading to the most epic bull trap I’ve seen in years. However, I want to avoid any predictive behavior as a trader our job is simply to identify level to level setups, snipe an entry and exit with a profit.

It should be noted clearly however that bulls are very clearly in control above 4250. We could sell 200pts and the bulls still have the edge.

SPX Analysis:

Key Levels: 4514 & 4594

Extreme risk at current levels for new longs.

Bulls continue to hold control as long as SPX is over 4248 and have the edge meaning that dips likely get bought. Bears will need to reclaim 4248 in order to regain control.

Bullish Trajectory: High risk for new longs at 4560 SPX. However, can try to buy dip at 4514 with a tight stop (8ema backtest). If 4514 holds can see an attempt at 4594-4604 area. 4607 is the recent high from July and at this area we are likely to experience a larger pullback.

Bear Trajectory: There is no bear case above 4248. However, a fail of 4514 (and then 4487) would trigger a short to backtest the breakout and gap fill at 4414. In an extremely bullish pullback scenario we would not make it to 4414 and may find support at 4450. If we do get below 4414 and 4394 can be taken out, then we can head lower to 4355 & 4311 and 4266. 4250-4266 would need to fall in order to take control back from the bulls.

Summary:

Possible range between 4514-4594. If we break below 4514 and then 4487, we could see a deeper pullback towards 4456 and 4414-4424. I cannot play chase the long here with such conditions and poor structure below.

TRADE ALERTS:

For those of you not in the Discord (www.jr28trading.com) I highly encourage it as we cover a lot of the setups given here but we also alert LIVE trade ENTRIES and EXITS.

Last week was a great example of the benefits of being in the discord.

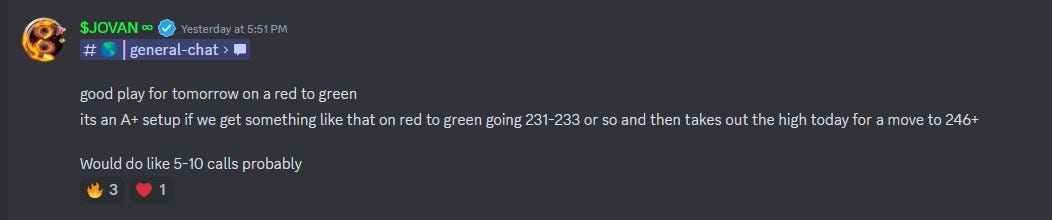

We gave an A+ setup for the next day, with specifics so that anyone could easily execute:

And here was the price action the next day with the exact scenario playing out perfectly:

Those calls were easily a 400-500% intraday winner!

**Please note that prices for the DISCORD will be going up as of November 28th, so if you would like to lock in the current special price of $44/mo please do it before then as we cannot adjust it after November 28th, no exceptions, thank you.

Sentiment Check:

AAII: Extremely Bullish (& well below historical averages for the bearish sentiment)

Fear & Greed: Greed now for 2 consecutive weeks.

*Hedge Fund positioning in mega-cap tech is at record highs

Comments:

AAII sentiment speaks for itself. We had peak bearishness (50.3%) at 4100 SPX and now we have peak bullishness at 4570 SPX. There is certainly more room on both AAII and Fear & Greed but we should be mindful of how quickly this shift took place and be cautious if you are bullish.

Here is the economic calendar for next week:

For this upcoming week I will be watching the following setups and levels:

Keep reading with a 7-day free trial

Subscribe to JR28 TRADING SUBSTACK to keep reading this post and get 7 days of free access to the full post archives.